Meeting everyday needs of people everywhere - Unilever

Meeting everyday needs of people everywhere - Unilever

Meeting everyday needs of people everywhere - Unilever

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

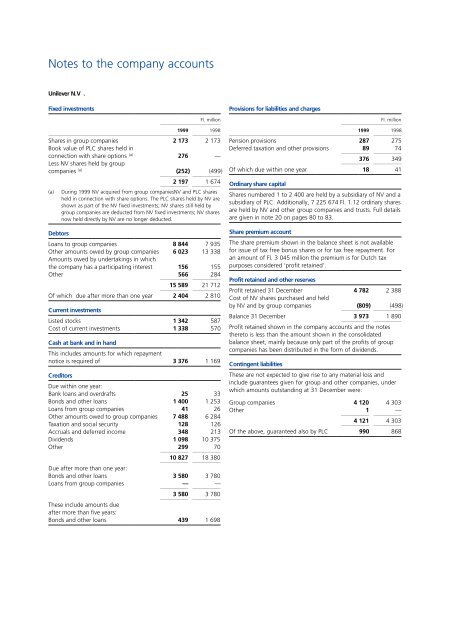

Notes to the company accounts<br />

<strong>Unilever</strong> N.V .<br />

Fixed investments<br />

00000000<br />

Fl. million<br />

051110<br />

1999 1998<br />

0000005 0111<br />

Shares in group companies 2 173 2 173<br />

Book value <strong>of</strong> PLC shares held in<br />

connection with share options (a) 276 —<br />

Less NV shares held by group<br />

companies (a) (252) (499)<br />

51115 0111<br />

2 197 1 674<br />

51115 0111<br />

(a) During 1999 NV acquired from group companiesNV and PLC shares<br />

held in connection with share options. The PLC shares held by NV are<br />

shown as part <strong>of</strong> the NV fixed investments; NV shares still held by<br />

group companies are deducted from NV fixed investments; NV shares<br />

now held directly by NV are no longer deducted.<br />

00000000<br />

Debtors<br />

00000000<br />

Loans to group companies 8 844 7 935<br />

Other amounts owed by group companies 6 023 13 338<br />

Amounts owed by undertakings in which<br />

the company has a participating interest 156 155<br />

Other 566 284<br />

51115 0111<br />

15 589 21 712<br />

51115 0111<br />

Of which due after more than one year 2 404 2 810<br />

00000000<br />

Current investments<br />

00000000<br />

Listed stocks 1 342 587<br />

Cost <strong>of</strong> current investments 1 338 570<br />

00000000<br />

Cash at bank and in hand<br />

00000000<br />

This includes amounts for which repayment<br />

notice is required <strong>of</strong> 3 376 1 169<br />

00000000<br />

Creditors<br />

00000000<br />

Due within one year:<br />

Bank loans and overdrafts 25 33<br />

Bonds and other loans 1 400 1 253<br />

Loans from group companies 41 26<br />

Other amounts owed to group companies 7 488 6 284<br />

Taxation and social security 128 126<br />

Accruals and deferred income 348 213<br />

Dividends 1 098 10 375<br />

Other 299 70<br />

51115 0111<br />

10 827 18 380<br />

51115 0111<br />

Due after more than one year:<br />

Bonds and other loans 3 580 3 780<br />

Loans from group companies — —<br />

51115 0111<br />

3 580 3 780<br />

51115 0111<br />

These include amounts due<br />

after more than five years:<br />

Bonds and other loans 439 1 698<br />

00000000<br />

Provisions for liabilities and charges<br />

00000000<br />

Fl. million<br />

051110<br />

1999 1998<br />

0000005 0111<br />

Pension provisions 287 275<br />

Deferred taxation and other provisions 89 74<br />

51115 0111<br />

376 349<br />

51115 0111<br />

Of which due within one year 18 41<br />

00000000<br />

Ordinary share capital<br />

00000000<br />

Shares numbered 1 to 2 400 are held by a subsidiary <strong>of</strong> NV and a<br />

subsidiary <strong>of</strong> PLC. Additionally, 7 225 674 Fl. 1.12 ordinary shares<br />

are held by NV and other group companies and trusts. Full details<br />

are given in note 20 on pages 80 to 83.<br />

00000000<br />

Share premium account<br />

00000000<br />

The share premium shown in the balance sheet is not available<br />

for issue <strong>of</strong> tax free bonus shares or for tax free repayment. For<br />

an amount <strong>of</strong> Fl. 3 045 million the premium is for Dutch tax<br />

purposes considered ‘pr<strong>of</strong>it retained’.<br />

00000000<br />

Pr<strong>of</strong>it retained and other reserves<br />

00000000<br />

Pr<strong>of</strong>it retained 31 December 4 782 2 388<br />

Cost <strong>of</strong> NV shares purchased and held<br />

by NV and by group companies (809) (498)<br />

51115 0111<br />

Balance 31 December 3 973 1 890<br />

51115 0111<br />

Pr<strong>of</strong>it retained shown in the company accounts and the notes<br />

thereto is less than the amount shown in the consolidated<br />

balance sheet, mainly because only part <strong>of</strong> the pr<strong>of</strong>its <strong>of</strong> group<br />

companies has been distributed in the form <strong>of</strong> dividends.<br />

00000000<br />

Contingent liabilities<br />

00000000<br />

These are not expected to give rise to any material loss and<br />

include guarantees given for group and other companies, under<br />

which amounts outstanding at 31 December were:<br />

Group companies 4 120 4 303<br />

Other 1 —<br />

51115 0111<br />

4 121 4 303<br />

51115 0111<br />

Of the above, guaranteed also by PLC 990 868<br />

00000000