Meeting everyday needs of people everywhere - Unilever

Meeting everyday needs of people everywhere - Unilever

Meeting everyday needs of people everywhere - Unilever

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Unilever</strong> Group Notes to the consolidated accounts<br />

29 Financial instruments (continued)<br />

00000000000000001111<br />

Currency exposures<br />

Group treasury manages the foreign exchange exposures that arise from the Group’s financing and investing activities in accordance<br />

with Group policies.<br />

The objectives <strong>of</strong> <strong>Unilever</strong>’s foreign exchange policies are to allow operating companies to manage foreign exchange exposures that<br />

arise from trading activities effectively within a framework <strong>of</strong> control that does not expose the Group to unnecessary foreign exchange<br />

risks. Operating companies are required to cover substantially all foreign exchange exposures arising from trading activities and each<br />

company operates within a specified maximum exposure limit. Business Groups monitor compliance with these policies. Compliance<br />

with the Group’s policies means that the net amount <strong>of</strong> monetary assets and liabilities at 31 December 1999 that are exposed to<br />

currency fluctuations is not material.<br />

00000000000000001111<br />

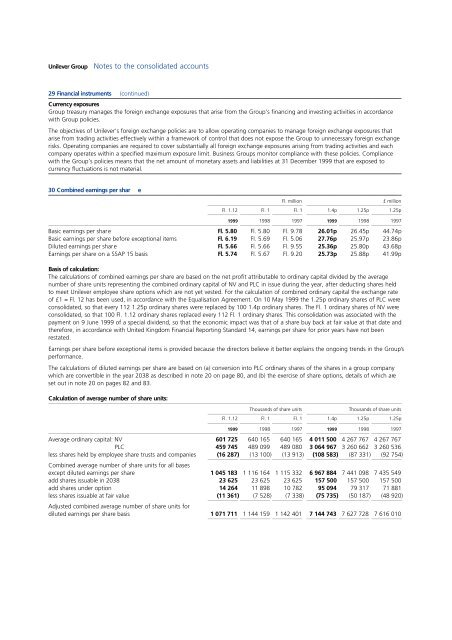

30 Combined earnings per shar e<br />

00000000000000001111<br />

Fl. million £ million<br />

01111101111101111 01111101111101111<br />

Fl. 1.12 Fl. 1 Fl. 1 1.4p 1.25p 1.25p<br />

01111 01111 01111 01111 01111 01111<br />

1999 1998 1997 1999 1998 1997<br />

0000000111101111 01111 01111 01111 01111 01111<br />

Basic earnings per share Fl. 5.80 Fl. 5.80 Fl. 9.78 26.01p 26.45p 44.74p<br />

Basic earnings per share before exceptional items Fl. 6.19 Fl. 5.69 Fl. 5.06 27.76p 25.97p 23.86p<br />

Diluted earnings per share Fl. 5.66 Fl. 5.66 Fl. 9.55 25.36p 25.80p 43.68p<br />

Earnings per share on a SSAP 15 basis Fl. 5.74 Fl. 5.67 Fl. 9.20 25.73p 25.88p 41.99p<br />

Basis <strong>of</strong> calculation:<br />

The calculations <strong>of</strong> combined earnings per share are based on the net pr<strong>of</strong>it attributable to ordinary capital divided by the average<br />

number <strong>of</strong> share units representing the combined ordinary capital <strong>of</strong> NV and PLC in issue during the year, after deducting shares held<br />

to meet <strong>Unilever</strong> employee share options which are not yet vested. For the calculation <strong>of</strong> combined ordinary capital the exchange rate<br />

<strong>of</strong> £1 = Fl. 12 has been used, in accordance with the Equalisation Agreement. On 10 May 1999 the 1.25p ordinary shares <strong>of</strong> PLC were<br />

consolidated, so that every 112 1.25p ordinary shares were replaced by 100 1.4p ordinary shares. The Fl. 1 ordinary shares <strong>of</strong> NV were<br />

consolidated, so that 100 Fl. 1.12 ordinary shares replaced every 112 Fl. 1 ordinary shares. This consolidation was associated with the<br />

payment on 9 June 1999 <strong>of</strong> a special dividend, so that the economic impact was that <strong>of</strong> a share buy back at fair value at that date and<br />

therefore, in accordance with United Kingdom Financial Reporting Standard 14, earnings per share for prior years have not been<br />

restated.<br />

Earnings per share before exceptional items is provided because the directors believe it better explains the ongoing trends in the Group’s<br />

performance.<br />

The calculations <strong>of</strong> diluted earnings per share are based on (a) conversion into PLC ordinary shares <strong>of</strong> the shares in a group company<br />

which are convertible in the year 2038 as described in note 20 on page 80, and (b) the exercise <strong>of</strong> share options, details <strong>of</strong> which are<br />

set out in note 20 on pages 82 and 83.<br />

Calculation <strong>of</strong> average number <strong>of</strong> share units:<br />

000000111111051111105111110511111051111105111<br />

Thousands <strong>of</strong> share units Thousands <strong>of</strong> share units<br />

01111101111101111 01111101111101111<br />

Fl. 1.12 Fl. 1 Fl. 1 1.4p 1.25p 1.25p<br />

01111 01111 01111 01111 01111 01111<br />

1999 1998 1997 1999 1998 1997<br />

0000000111101111 01111 01111 01111 01111 01111<br />

Average ordinary capital: NV 601 725 640 165 640 165 4 011 500 4 267 767 4 267 767<br />

PLC 459 745 489 099 489 080 3 064 967 3 260 662 3 260 536<br />

less shares held by employee share trusts and companies (16 287) (13 100) (13 913) (108 583) (87 331) (92 754)<br />

01111 01111 01111 01111 01111 01111<br />

Combined average number <strong>of</strong> share units for all bases<br />

except diluted earnings per share 1 045 183 1 116 164 1 115 332 6 967 884 7 441 098 7 435 549<br />

add shares issuable in 2038 23 625 23 625 23 625 157 500 157 500 157 500<br />

add shares under option 14 264 11 898 10 782 95 094 79 317 71 881<br />

less shares issuable at fair value (11 361) (7 528) (7 338) (75 735) (50 187) (48 920)<br />

01111 01111 01111 01111 01111 01111<br />

Adjusted combined average number <strong>of</strong> share units for<br />

diluted earnings per share basis 1 071 711 1 144 159 1 142 401 7 144 743 7 627 728 7 616 010<br />

01111 01111 01111 01111 01111 01111