ekonomikslmyunit3-150509141302-lva1-app6892

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

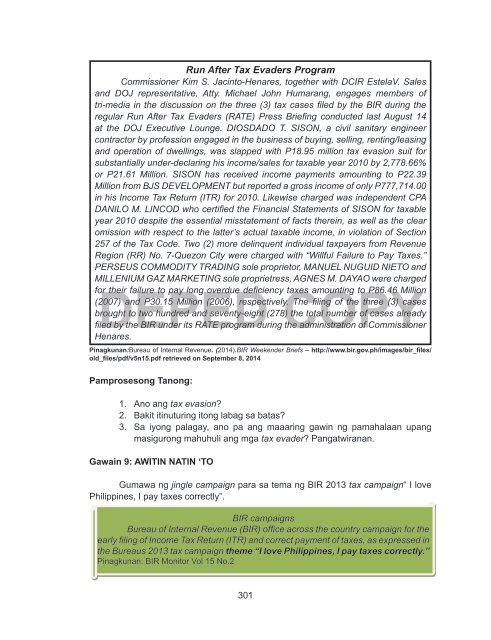

Run After Tax Evaders Program<br />

Commissioner Kim S. Jacinto-Henares, together with DCIR EstelaV. Sales<br />

and DOJ representative, Atty. Michael John Humarang, engages members of<br />

tri-media in the discussion on the three (3) tax cases filed by the BIR during the<br />

regular Run After Tax Evaders (RATE) Press Briefing conducted last August 14<br />

at the DOJ Executive Lounge. DIOSDADO T. SISON, a civil sanitary engineer<br />

contractor by profession engaged in the business of buying, selling, renting/leasing<br />

and operation of dwellings, was slapped with P18.95 million tax evasion suit for<br />

substantially under-declaring his income/sales for taxable year 2010 by 2,778.66%<br />

or P21.61 Million. SISON has received income payments amounting to P22.39<br />

Million from BJS DEVELOPMENT but reported a gross income of only P777,714.00<br />

in his Income Tax Return (ITR) for 2010. Likewise charged was independent CPA<br />

DANILO M. LINCOD who certified the Financial Statements of SISON for taxable<br />

year 2010 despite the essential misstatement of facts therein, as well as the clear<br />

omission with respect to the latter’s actual taxable income, in violation of Section<br />

257 of the Tax Code. Two (2) more delinquent individual taxpayers from Revenue<br />

Region (RR) No. 7-Quezon City were charged with “Willful Failure to Pay Taxes.”<br />

PERSEUS COMMODITY TRADING sole proprietor, MANUEL NUGUID NIETO and<br />

MILLENIUM GAZ MARKETING sole proprietress, AGNES M. DAYAO were charged<br />

for<br />

DEPED<br />

their failure to pay long overdue deficiency<br />

COPY<br />

taxes amounting to P86.46 Million<br />

(2007) and P30.15 Million (2006), respectively. The filing of the three (3) cases<br />

brought to two hundred and seventy-eight (278) the total number of cases already<br />

filed by the BIR under its RATE program during the administration of Commissioner<br />

Henares.<br />

Pinagkunan:Bureau of Internal Revenue. (2014).BIR Weekender Briefs – http://www.bir.gov.ph/images/bir_files/<br />

old_files/pdf/v5n15.pdf retrieved on September 8, 2014<br />

Pamprosesong Tanong:<br />

1. Ano ang tax evasion?<br />

2. Bakit itinuturing itong labag sa batas?<br />

3. Sa iyong palagay, ano pa ang maaaring gawin ng pamahalaan upang<br />

masigurong mahuhuli ang mga tax evader? Pangatwiranan.<br />

Gawain 9: AWITIN NATIN ‘TO<br />

Gumawa ng jingle campaign para sa tema ng BIR 2013 tax campaign“ I love<br />

Philippines, I pay taxes correctly”.<br />

BIR campaigns<br />

Bureau of Internal Revenue (BIR) office across the country campaign for the<br />

early filing of Income Tax Return (ITR) and correct payment of taxes, as expressed in<br />

the Bureaus 2013 tax campaign theme “I love Philippines, I pay taxes correctly.”<br />

Pinagkunan: BIR Monitor Vol 15 No.2<br />

301