Diversity

2oskrKE

2oskrKE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

52<br />

Restructuring Trends<br />

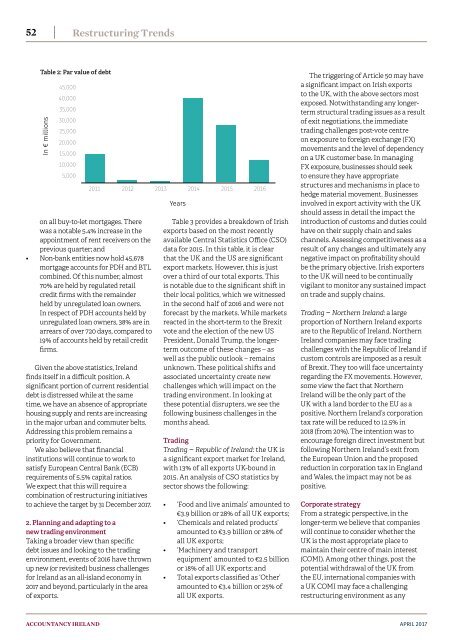

Table 2: Par value of debt<br />

In € millions<br />

45,000<br />

40,000<br />

35,000<br />

30,000<br />

25,000<br />

20,000<br />

15,000<br />

10,000<br />

5,000<br />

on all buy-to-let mortgages. There<br />

was a notable 5.4% increase in the<br />

appointment of rent receivers on the<br />

previous quarter; and<br />

• Non-bank entities now hold 45,678<br />

mortgage accounts for PDH and BTL<br />

combined. Of this number, almost<br />

70% are held by regulated retail<br />

credit firms with the remainder<br />

held by unregulated loan owners.<br />

In respect of PDH accounts held by<br />

unregulated loan owners, 38% are in<br />

arrears of over 720 days, compared to<br />

19% of accounts held by retail credit<br />

firms.<br />

Given the above statistics, Ireland<br />

finds itself in a difficult position. A<br />

significant portion of current residential<br />

debt is distressed while at the same<br />

time, we have an absence of appropriate<br />

housing supply and rents are increasing<br />

in the major urban and commuter belts.<br />

Addressing this problem remains a<br />

priority for Government.<br />

We also believe that financial<br />

institutions will continue to work to<br />

satisfy European Central Bank (ECB)<br />

requirements of 5.5% capital ratios.<br />

We expect that this will require a<br />

combination of restructuring initiatives<br />

to achieve the target by 31 December 2017.<br />

2. Planning and adapting to a<br />

new trading environment<br />

Taking a broader view than specific<br />

debt issues and looking to the trading<br />

environment, events of 2016 have thrown<br />

up new (or revisited) business challenges<br />

for Ireland as an all-island economy in<br />

2017 and beyond, particularly in the area<br />

of exports.<br />

2011 2012 2013 2014 2015 2016<br />

Years<br />

Table 3 provides a breakdown of Irish<br />

exports based on the most recently<br />

available Central Statistics Office (CSO)<br />

data for 2015. In this table, it is clear<br />

that the UK and the US are significant<br />

export markets. However, this is just<br />

over a third of our total exports. This<br />

is notable due to the significant shift in<br />

their local politics, which we witnessed<br />

in the second half of 2016 and were not<br />

forecast by the markets. While markets<br />

reacted in the short-term to the Brexit<br />

vote and the election of the new US<br />

President, Donald Trump, the longerterm<br />

outcome of these changes – as<br />

well as the public outlook – remains<br />

unknown. These political shifts and<br />

associated uncertainty create new<br />

challenges which will impact on the<br />

trading environment. In looking at<br />

these potential disrupters, we see the<br />

following business challenges in the<br />

months ahead.<br />

Trading<br />

Trading – Republic of Ireland: the UK is<br />

a significant export market for Ireland,<br />

with 13% of all exports UK-bound in<br />

2015. An analysis of CSO statistics by<br />

sector shows the following:<br />

• ‘Food and live animals’ amounted to<br />

€3.9 billion or 28% of all UK exports;<br />

• ‘Chemicals and related products’<br />

amounted to €3.9 billion or 28% of<br />

all UK exports;<br />

• ‘Machinery and transport<br />

equipment’ amounted to €2.5 billion<br />

or 18% of all UK exports; and<br />

• Total exports classified as ‘Other’<br />

amounted to €3.4 billion or 25% of<br />

all UK exports.<br />

The triggering of Article 50 may have<br />

a significant impact on Irish exports<br />

to the UK, with the above sectors most<br />

exposed. Notwithstanding any longerterm<br />

structural trading issues as a result<br />

of exit negotiations, the immediate<br />

trading challenges post-vote centre<br />

on exposure to foreign exchange (FX)<br />

movements and the level of dependency<br />

on a UK customer base. In managing<br />

FX exposure, businesses should seek<br />

to ensure they have appropriate<br />

structures and mechanisms in place to<br />

hedge material movement. Businesses<br />

involved in export activity with the UK<br />

should assess in detail the impact the<br />

introduction of customs and duties could<br />

have on their supply chain and sales<br />

channels. Assessing competitiveness as a<br />

result of any changes and ultimately any<br />

negative impact on profitability should<br />

be the primary objective. Irish exporters<br />

to the UK will need to be continually<br />

vigilant to monitor any sustained impact<br />

on trade and supply chains.<br />

Trading – Northern Ireland: a large<br />

proportion of Northern Ireland exports<br />

are to the Republic of Ireland. Northern<br />

Ireland companies may face trading<br />

challenges with the Republic of Ireland if<br />

custom controls are imposed as a result<br />

of Brexit. They too will face uncertainty<br />

regarding the FX movements. However,<br />

some view the fact that Northern<br />

Ireland will be the only part of the<br />

UK with a land border to the EU as a<br />

positive. Northern Ireland’s corporation<br />

tax rate will be reduced to 12.5% in<br />

2018 (from 20%). The intention was to<br />

encourage foreign direct investment but<br />

following Northern Ireland’s exit from<br />

the European Union and the proposed<br />

reduction in corporation tax in England<br />

and Wales, the impact may not be as<br />

positive.<br />

Corporate strategy<br />

From a strategic perspective, in the<br />

longer-term we believe that companies<br />

will continue to consider whether the<br />

UK is the most appropriate place to<br />

maintain their centre of main interest<br />

(COMI). Among other things, post the<br />

potential withdrawal of the UK from<br />

the EU, international companies with<br />

a UK COMI may face a challenging<br />

restructuring environment as any<br />

ACCOUNTANCY IRELAND<br />

APRIL 2017