Diversity

2oskrKE

2oskrKE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

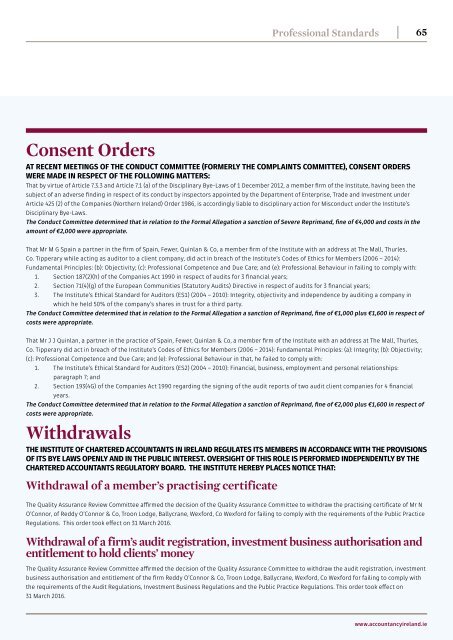

Professional Standards<br />

65<br />

Consent Orders<br />

AT RECENT MEETINGS OF THE CONDUCT COMMITTEE (FORMERLY THE COMPLAINTS COMMITTEE), CONSENT ORDERS<br />

WERE MADE IN RESPECT OF THE FOLLOWING MATTERS:<br />

That by virtue of Article 7.3.3 and Article 7.1 (a) of the Disciplinary Bye-Laws of 1 December 2012, a member firm of the Institute, having been the<br />

subject of an adverse finding in respect of its conduct by inspectors appointed by the Department of Enterprise, Trade and Investment under<br />

Article 425 (2) of the Companies (Northern Ireland) Order 1986, is accordingly liable to disciplinary action for Misconduct under the Institute’s<br />

Disciplinary Bye-Laws.<br />

The Conduct Committee determined that in relation to the Formal Allegation a sanction of Severe Reprimand, fine of €4,000 and costs in the<br />

amount of €2,000 were appropriate.<br />

That Mr M G Spain a partner in the firm of Spain, Fewer, Quinlan & Co, a member firm of the Institute with an address at The Mall, Thurles,<br />

Co. Tipperary while acting as auditor to a client company, did act in breach of the Institute’s Codes of Ethics for Members (2006 – 2014):<br />

Fundamental Principles: (b): Objectivity; (c): Professional Competence and Due Care; and (e): Professional Behaviour in failing to comply with:<br />

1. Section 187(2)(h) of the Companies Act 1990 in respect of audits for 3 financial years;<br />

2. Section 71(4)(g) of the European Communities (Statutory Audits) Directive in respect of audits for 3 financial years;<br />

3. The Institute’s Ethical Standard for Auditors (ES1) (2004 – 2010): Integrity, objectivity and independence by auditing a company in<br />

which he held 50% of the company’s shares in trust for a third party.<br />

The Conduct Committee determined that in relation to the Formal Allegation a sanction of Reprimand, fine of €1,000 plus €1,600 in respect of<br />

costs were appropriate.<br />

That Mr J J Quinlan, a partner in the practice of Spain, Fewer, Quinlan & Co, a member firm of the Institute with an address at The Mall, Thurles,<br />

Co. Tipperary did act in breach of the Institute’s Codes of Ethics for Members (2006 – 2014): Fundamental Principles: (a): Integrity; (b): Objectivity;<br />

(c): Professional Competence and Due Care; and (e): Professional Behaviour in that, he failed to comply with:<br />

1. The Institute’s Ethical Standard for Auditors (ES2) (2004 – 2010): Financial, business, employment and personal relationships:<br />

paragraph 7; and<br />

2. Section 193(4G) of the Companies Act 1990 regarding the signing of the audit reports of two audit client companies for 4 financial<br />

years.<br />

The Conduct Committee determined that in relation to the Formal Allegation a sanction of Reprimand, fine of €2,000 plus €1,600 in respect of<br />

costs were appropriate.<br />

Withdrawals<br />

THE INSTITUTE OF CHARTERED ACCOUNTANTS IN IRELAND REGULATES ITS MEMBERS IN ACCORDANCE WITH THE PROVISIONS<br />

OF ITS BYE LAWS OPENLY AND IN THE PUBLIC INTEREST. OVERSIGHT OF THIS ROLE IS PERFORMED INDEPENDENTLY BY THE<br />

CHARTERED ACCOUNTANTS REGULATORY BOARD. THE INSTITUTE HEREBY PLACES NOTICE THAT:<br />

Withdrawal of a member’s practising certificate<br />

The Quality Assurance Review Committee affirmed the decision of the Quality Assurance Committee to withdraw the practising certificate of Mr N<br />

O’Connor, of Reddy O’Connor & Co, Troon Lodge, Ballycrane, Wexford, Co Wexford for failing to comply with the requirements of the Public Practice<br />

Regulations. This order took effect on 31 March 2016.<br />

Withdrawal of a firm’s audit registration, investment business authorisation and<br />

entitlement to hold clients’ money<br />

The Quality Assurance Review Committee affirmed the decision of the Quality Assurance Committee to withdraw the audit registration, investment<br />

business authorisation and entitlement of the firm Reddy O’Connor & Co, Troon Lodge, Ballycrane, Wexford, Co Wexford for failing to comply with<br />

the requirements of the Audit Regulations, Investment Business Regulations and the Public Practice Regulations. This order took effect on<br />

31 March 2016.<br />

www.accountancyireland.ie