Diversity

2oskrKE

2oskrKE

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

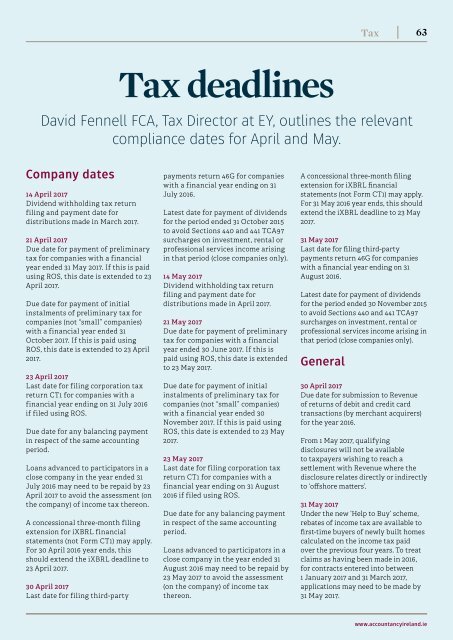

Tax<br />

63<br />

Tax deadlines<br />

David Fennell FCA, Tax Director at EY, outlines the relevant<br />

compliance dates for April and May.<br />

and tutors on the<br />

Company dates<br />

14 April 2017<br />

Dividend withholding tax return<br />

filing and payment date for<br />

distributions made in March 2017.<br />

21 April 2017<br />

Due date for payment of preliminary<br />

tax for companies with a financial<br />

year ended 31 May 2017. If this is paid<br />

using ROS, this date is extended to 23<br />

April 2017.<br />

Due date for payment of initial<br />

instalments of preliminary tax for<br />

companies (not “small” companies)<br />

with a financial year ended 31<br />

October 2017. If this is paid using<br />

ROS, this date is extended to 23 April<br />

2017.<br />

23 April 2017<br />

Last date for filing corporation tax<br />

return CT1 for companies with a<br />

financial year ending on 31 July 2016<br />

if filed using ROS.<br />

Due date for any balancing payment<br />

in respect of the same accounting<br />

period.<br />

Loans advanced to participators in a<br />

close company in the year ended 31<br />

July 2016 may need to be repaid by 23<br />

April 2017 to avoid the assessment (on<br />

the company) of income tax thereon.<br />

A concessional three-month filing<br />

extension for iXBRL financial<br />

statements (not Form CT1) may apply.<br />

For 30 April 2016 year ends, this<br />

should extend the iXBRL deadline to<br />

23 April 2017.<br />

30 April 2017<br />

Last date for filing third-party<br />

payments return 46G for companies<br />

with a financial year ending on 31<br />

July 2016.<br />

Latest date for payment of dividends<br />

for the period ended 31 October 2015<br />

to avoid Sections 440 and 441 TCA97<br />

surcharges on investment, rental or<br />

professional services income arising<br />

in that period (close companies only).<br />

14 May 2017<br />

Dividend withholding tax return<br />

filing and payment date for<br />

distributions made in April 2017.<br />

21 May 2017<br />

Due date for payment of preliminary<br />

tax for companies with a financial<br />

year ended 30 June 2017. If this is<br />

paid using ROS, this date is extended<br />

to 23 May 2017.<br />

Due date for payment of initial<br />

instalments of preliminary tax for<br />

companies (not “small” companies)<br />

with a financial year ended 30<br />

November 2017. If this is paid using<br />

ROS, this date is extended to 23 May<br />

2017.<br />

23 May 2017<br />

Last date for filing corporation tax<br />

return CT1 for companies with a<br />

financial year ending on 31 August<br />

2016 if filed using ROS.<br />

Due date for any balancing payment<br />

in respect of the same accounting<br />

period.<br />

Loans advanced to participators in a<br />

close company in the year ended 31<br />

August 2016 may need to be repaid by<br />

23 May 2017 to avoid the assessment<br />

(on the company) of income tax<br />

thereon.<br />

A concessional three-month filing<br />

extension for iXBRL financial<br />

statements (not Form CT1) may apply.<br />

For 31 May 2016 year ends, this should<br />

extend the iXBRL deadline to 23 May<br />

2017.<br />

31 May 2017<br />

Last date for filing third-party<br />

payments return 46G for companies<br />

with a financial year ending on 31<br />

August 2016.<br />

Latest date for payment of dividends<br />

for the period ended 30 November 2015<br />

to avoid Sections 440 and 441 TCA97<br />

surcharges on investment, rental or<br />

professional services income arising in<br />

that period (close companies only).<br />

General<br />

30 April 2017<br />

Due date for submission to Revenue<br />

of returns of debit and credit card<br />

transactions (by merchant acquirers)<br />

for the year 2016.<br />

From 1 May 2017, qualifying<br />

disclosures will not be available<br />

to taxpayers wishing to reach a<br />

settlement with Revenue where the<br />

disclosure relates directly or indirectly<br />

to ‘offshore matters’.<br />

31 May 2017<br />

Under the new ‘Help to Buy’ scheme,<br />

rebates of income tax are available to<br />

first-time buyers of newly built homes<br />

calculated on the income tax paid<br />

over the previous four years. To treat<br />

claims as having been made in 2016,<br />

for contracts entered into between<br />

1 January 2017 and 31 March 2017,<br />

applications may need to be made by<br />

31 May 2017.<br />

www.accountancyireland.ie