Diversity

2oskrKE

2oskrKE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Tax<br />

59<br />

entrepreneurial and favouring higher<br />

self-employed earners at the expense<br />

of low-middle income earners<br />

etc. Following pressure from the<br />

press and their own backbenchers,<br />

the Government subsequently<br />

announced on 15 March that it would<br />

not proceed with the NIC changes. As<br />

a result, the only substantive change<br />

from a tax-raising perspective<br />

announced in the March 2017 Budget<br />

is the reduction in the Dividend<br />

Allowance from April 2018 to £2,000.<br />

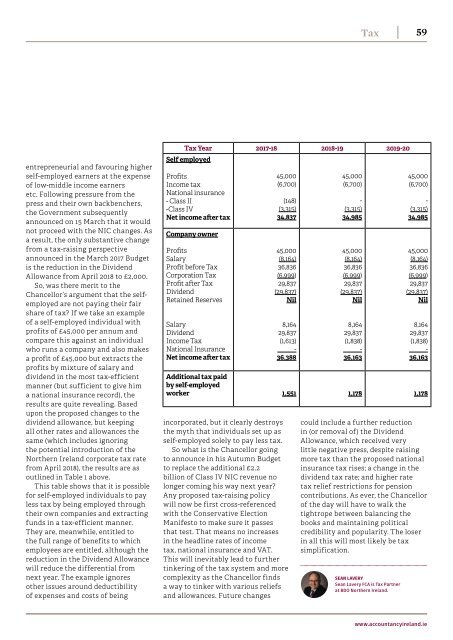

So, was there merit to the<br />

Chancellor’s argument that the selfemployed<br />

are not paying their fair<br />

share of tax? If we take an example<br />

of a self-employed individual with<br />

profits of £45,000 per annum and<br />

compare this against an individual<br />

who runs a company and also makes<br />

a profit of £45,000 but extracts the<br />

profits by mixture of salary and<br />

dividend in the most tax-efficient<br />

manner (but sufficient to give him<br />

a national insurance record), the<br />

results are quite revealing. Based<br />

upon the proposed changes to the<br />

dividend allowance, but keeping<br />

all other rates and allowances the<br />

same (which includes ignoring<br />

the potential introduction of the<br />

Northern Ireland corporate tax rate<br />

from April 2018), the results are as<br />

outlined in Table 1 above.<br />

This table shows that it is possible<br />

for self-employed individuals to pay<br />

less tax by being employed through<br />

their own companies and extracting<br />

funds in a tax-efficient manner.<br />

They are, meanwhile, entitled to<br />

the full range of benefits to which<br />

employees are entitled, although the<br />

reduction in the Dividend Allowance<br />

will reduce the differential from<br />

next year. The example ignores<br />

other issues around deductibility<br />

of expenses and costs of being<br />

Tax Year 2017-18 2018-19 2019-20<br />

Self employed<br />

Profits<br />

Income tax<br />

National insurance<br />

- Class II<br />

-Class IV<br />

Net income after tax<br />

Company owner<br />

Profits<br />

Salary<br />

Profit before Tax<br />

Corporation Tax<br />

Profit after Tax<br />

Dividend<br />

Retained Reserves<br />

Salary<br />

Dividend<br />

Income Tax<br />

National Insurance<br />

Net income after tax<br />

45,000<br />

(6,700)<br />

(148)<br />

(3,315)<br />

34,837<br />

45,000<br />

(8,164)<br />

36,836<br />

(6,999)<br />

29,837<br />

(29,837)<br />

Nil<br />

8,164<br />

29,837<br />

(1,613)<br />

-<br />

36,388<br />

incorporated, but it clearly destroys<br />

the myth that individuals set up as<br />

self-employed solely to pay less tax.<br />

So what is the Chancellor going<br />

to announce in his Autumn Budget<br />

to replace the additional £2.2<br />

billion of Class IV NIC revenue no<br />

longer coming his way next year?<br />

Any proposed tax-raising policy<br />

will now be first cross-referenced<br />

with the Conservative Election<br />

Manifesto to make sure it passes<br />

that test. That means no increases<br />

in the headline rates of income<br />

tax, national insurance and VAT.<br />

This will inevitably lead to further<br />

tinkering of the tax system and more<br />

complexity as the Chancellor finds<br />

a way to tinker with various reliefs<br />

and allowances. Future changes<br />

45,000<br />

(6,700)<br />

-<br />

(3,315)<br />

34,985<br />

45,000<br />

(8,164)<br />

36,836<br />

(6,999)<br />

29,837<br />

(29,837)<br />

Nil<br />

8,164<br />

29,837<br />

(1,838)<br />

-<br />

36,163<br />

could include a further reduction<br />

in (or removal of) the Dividend<br />

Allowance, which received very<br />

little negative press, despite raising<br />

more tax than the proposed national<br />

insurance tax rises; a change in the<br />

dividend tax rate; and higher rate<br />

tax relief restrictions for pension<br />

contributions. As ever, the Chancellor<br />

of the day will have to walk the<br />

tightrope between balancing the<br />

books and maintaining political<br />

credibility and popularity. The loser<br />

in all this will most likely be tax<br />

simplification.<br />

SEAN LAVERY<br />

Sean Lavery FCA is Tax Partner<br />

at BDO Northern Ireland.<br />

45,000<br />

(6,700)<br />

-<br />

(3,315)<br />

34,985<br />

45,000<br />

(8,164)<br />

36,836<br />

(6,999)<br />

29,837<br />

(29,837)<br />

Nil<br />

8,164<br />

29,837<br />

(1,838)<br />

-<br />

36,163<br />

Additional tax paid<br />

by self-employed<br />

worker 1,551 1,178 1,178<br />

www.accountancyireland.ie