Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 1.15 — 15<br />

Private equity<br />

in emerging<br />

markets<br />

Markus Stierli<br />

Fundamental Micro Themes Research<br />

+41 44 334 88 57<br />

markus.stierli@credit-suisse.com<br />

Nikhil Gupta<br />

Fundamental Micro Themes Research<br />

+91 22 6607 3707<br />

nikhil.gupta.4@credit-suisse.com<br />

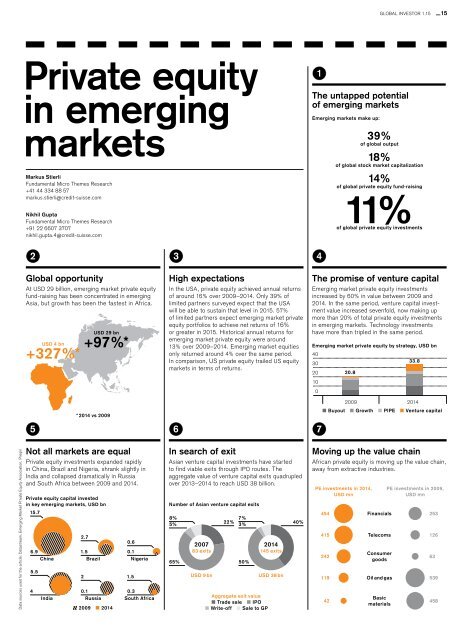

1<br />

The untapped potential<br />

of emerging markets<br />

Emerging markets make up:<br />

39%<br />

of global output<br />

18%<br />

of global stock market capitalization<br />

14%<br />

of global private equity fund-raising<br />

11%<br />

of global private equity investments<br />

2<br />

Global opportunity<br />

At USD 29 billion, emerging market private equity<br />

fund-raising has been concentrated in emerging<br />

Asia, but growth has been the fastest in Africa.<br />

USD 4 bn<br />

+327%*<br />

USD 29 bn<br />

+97%*<br />

3<br />

High expectations<br />

In the USA, private equity achieved annual returns<br />

of around 16% over 2009–2014. Only 39% of<br />

limited partners surveyed expect that the USA<br />

will be able to sustain that level in 2015. 57%<br />

of limited partners expect emerging market private<br />

equity portfolios to achieve net returns of 16%<br />

or greater in 2015. Historical annual returns for<br />

emerging market private equity were around<br />

13% over 2009–2014. Emerging market equities<br />

only returned around 4% over the same period.<br />

In comparison, US private equity trailed US equity<br />

markets in terms of returns.<br />

4<br />

The promise of venture capital<br />

Emerging market private equity investments<br />

increased by 60% in value between 2009 and<br />

2014. In the same period, venture capital investment<br />

value increased sevenfold, now making up<br />

more than 20% of total private equity investments<br />

in emerging markets. Technology investments<br />

have more than tripled in the same period.<br />

Emerging market private equity by strategy, USD bn<br />

40<br />

30<br />

20<br />

10<br />

0<br />

20.8<br />

33.8<br />

5<br />

* 2014 vs 2009<br />

6 7<br />

2009 2014<br />

Buyout Growth PIPE Venture capital<br />

Data sources used for the article: Datastream, Emerging Market Private Equity Association, Preqin<br />

Not all markets are equal<br />

Private equity investments expanded rapidly<br />

in China, Brazil and Nigeria, shrank slightly in<br />

India and collapsed dramatically in Russia<br />

and South Africa between 2009 and 2014.<br />

Private equity capital invested<br />

in key emerging markets, USD bn<br />

15.7<br />

6.9<br />

China<br />

5.5<br />

4<br />

India<br />

2.7<br />

1.5<br />

Brazil<br />

2<br />

0.1<br />

Russia<br />

2009 2014<br />

0.6<br />

0.1<br />

Nigeria<br />

1.5<br />

0.3<br />

South Africa<br />

In search of exit<br />

Asian venture capital investments have started<br />

to find viable exits through IPO routes. The<br />

aggregate value of venture capital exits quadrupled<br />

over 2013–2014 to reach USD 38 billion.<br />

Number of Asian venture capital exits<br />

8%<br />

5%<br />

3%<br />

22% 7%<br />

2007<br />

2014<br />

83 exits<br />

145 exits<br />

65%<br />

USD 9 bn<br />

50%<br />

Aggregate exit value<br />

Trade sale IPO<br />

Write-off Sale to GP<br />

USD 38 bn<br />

40%<br />

Moving up the value chain<br />

African private equity is moving up the value chain,<br />

away from extractive industries.<br />

PE investments in 2014,<br />

USD mn<br />

454<br />

415<br />

242<br />

119<br />

42<br />

Financials<br />

Telecoms<br />

Consumer<br />

goods<br />

Oil and gas<br />

Basic<br />

materials<br />

PE investments in 2009,<br />

USD mn<br />

253<br />

126<br />

63<br />

539<br />

458