Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 1.15 — 64<br />

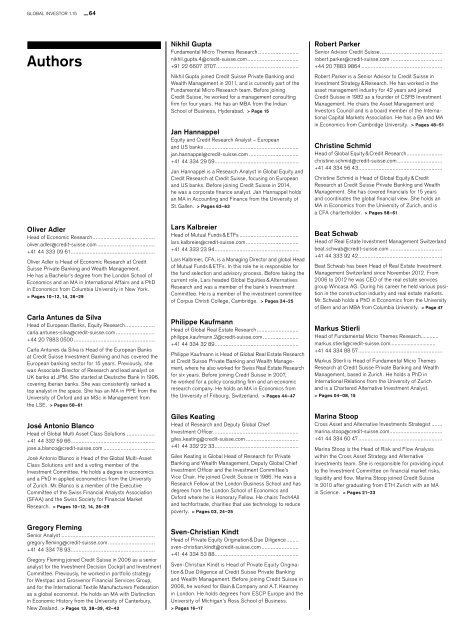

Authors<br />

Oliver Adler<br />

Head of Economic Research.........................................<br />

oliver.adler@credit-suisse.com......................................<br />

+41 44 333 09 61.......................................................<br />

Oliver Adler is Head of Economic Research at Credit<br />

Suisse Private Banking and Wealth Management.<br />

He has a Bachelor’s degree from the London School of<br />

Economics and an MA in International Affairs and a PhD<br />

in Economics from Columbia University in New York.<br />

> Pages 10–12, 14, 26–29<br />

Carla Antunes da Silva<br />

Head of European Banks, Equity Research....................<br />

carla.antunes-silva@credit-suisse.com..........................<br />

+44 20 7883 0500.....................................................<br />

Carla Antunes da Silva is Head of the European Banks<br />

at Credit Suisse Investment Banking and has covered the<br />

European banking sector for 15 years. Previously, she<br />

was Associate Director of Research and lead analyst on<br />

UK banks at JPM. She started at Deutsche Bank in 1996,<br />

covering Iberian banks. She was consistently ranked a<br />

top analyst in the space. She has an MA in PPE from the<br />

University of Oxford and an MSc in Management from<br />

the LSE. > Pages 58–61<br />

José Antonio Blanco<br />

Head of Global Multi Asset Class Solutions...................<br />

+41 44 332 59 66.......................................................<br />

jose.a.blanco@credit-suisse.com..................................<br />

José Antonio Blanco is Head of the Global Multi-Asset<br />

Class Solutions unit and a voting member of the<br />

Investment Committee. He holds a degree in economics<br />

and a PhD in applied econometrics from the University<br />

of Zurich. Mr. Blanco is a member of the Executive<br />

Committee of the Swiss Financial Analysts Association<br />

(SFAA) and the Swiss Society for Financial Market<br />

Research. > Pages 10–12, 14, 26–29<br />

Gregory Fleming<br />

Senior Analyst.............................................................<br />

gregory.fleming@credit-suisse.com...............................<br />

+41 44 334 78 93.......................................................<br />

Gregory Fleming joined Credit Suisse in 2006 as a senior<br />

analyst for the Investment Decision Cockpit and Investment<br />

Committee. Previously, he worked in portfolio strategy<br />

for Westpac and Grosvenor Financial Services Group,<br />

and for the International Textile Manufacturers Federation<br />

as a global economist. He holds an MA with Distinction<br />

in Economic History from the University of Canterbury,<br />

New Zealand. > Pages 13, 38–39, 42–43<br />

Nikhil Gupta<br />

Fundamental Micro Themes Research...........................<br />

nikhil.gupta.4@credit-suisse.com..................................<br />

+91 22 6607 3707......................................................<br />

Nikhil Gupta joined Credit Suisse Private Banking and<br />

Wealth Management in 2011, and is currently part of the<br />

Fundamental Micro Research team. Before joining<br />

Credit Suisse, he worked for a management consulting<br />

firm for four years. He has an MBA from the Indian<br />

School of Business, Hyderabad. > Page 15<br />

Jan Hannappel<br />

Equity and Credit Research Analyst – European<br />

and US banks..............................................................<br />

jan.hannappel@credit-suisse.com.................................<br />

+41 44 334 29 59.......................................................<br />

Jan Hannappel is a Research Analyst in Global Equity and<br />

Credit Research at Credit Suisse, focusing on European<br />

and US banks. Before joining Credit Suisse in 2014,<br />

he was a corporate finance analyst. Jan Hannappel holds<br />

an MA in Accounting and Finance from the University of<br />

St. Gallen. > Pages 62–63<br />

Lars Kalbreier<br />

Head of Mutual Funds & ETFs.......................................<br />

lars.kalbreier@credit-suisse.com...................................<br />

+41 44 333 23 94.......................................................<br />

Lars Kalbreier, CFA, is a Managing Director and global Head<br />

of Mutual Funds & ETFs. In this role he is responsible for<br />

the fund selection and advisory process. Before taking the<br />

current role, Lars headed Global Equities & Alterna tives<br />

Research and was a member of the bank’s Investment<br />

Committee. He is a member of the investment committee<br />

of Corpus Christi College, Cambridge. > Pages 24–25<br />

Philippe Kaufmann<br />

Head of Global Real Estate Research............................<br />

philippe.kaufmann.2@credit-suisse.com........................<br />

+41 44 334 32 89.......................................................<br />

Philippe Kaufmann is Head of Global Real Estate Research<br />

at Credit Suisse Private Banking and Wealth Manage -<br />

ment, where he also worked for Swiss Real Estate Research<br />

for six years. Before joining Credit Suisse in 2007,<br />

he worked for a policy consulting firm and an economic<br />

research company. He holds an MA in Economics from<br />

the Univer sity of Fribourg, Switzerland. > Pages 44–47<br />

Giles Keating<br />

Head of Research and Deputy Global Chief<br />

Investment Officer........................................................<br />

giles.keating@credit-suisse.com...................................<br />

+41 44 332 22 33.......................................................<br />

Giles Keating is Global Head of Research for Private<br />

Banking and Wealth Management, Deputy Global Chief<br />

Investment Officer and the Investment Committee’s<br />

Vice Chair. He joined Credit Suisse in 1986. He was a<br />

Research Fellow at the London Business School and has<br />

degrees from the London School of Economics and<br />

Oxford where he is Honorary Fellow. He chairs Tech4All<br />

and techfortrade, charities that use technology to reduce<br />

poverty. > Pages 03, 24–25<br />

Sven-Christian Kindt<br />

Head of Private Equity Origination & Due Diligence.........<br />

sven-christian.kindt@credit-suisse.com.........................<br />

+41 44 334 53 88.......................................................<br />

Sven-Christian Kindt is Head of Private Equity Origination<br />

& Due Diligence at Credit Suisse Private Banking<br />

and Wealth Management. Before joining Credit Suisse in<br />

2008, he worked for Bain & Company and A.T. Kearney<br />

in London. He holds degrees from ESCP Europe and the<br />

University of Michigan’s Ross School of Business.<br />

> Pages 16–17<br />

Robert Parker<br />

Senior Advisor Credit Suisse.........................................<br />

robert.parker@credit-suisse.com..................................<br />

+44 20 7883 9864.....................................................<br />

Robert Parker is a Senior Advisor to Credit Suisse in<br />

Investment Strategy & Research. He has worked in the<br />

asset management industry for 42 years and joined<br />

Credit Suisse in 1982 as a founder of CSFB Investment<br />

Management. He chairs the Asset Management and<br />

Investors Council and is a board member of the International<br />

Capital Markets Association. He has a BA and MA<br />

in Economics from Cambridge University. > Pages 48–51<br />

Christine Schmid<br />

Head of Global Equity & Credit Research........................<br />

christine.schmid@credit-suisse.com..............................<br />

+41 44 334 56 43.......................................................<br />

Christine Schmid is Head of Global Equity & Credit<br />

Research at Credit Suisse Private Banking and Wealth<br />

Management. She has covered financials for 15 years<br />

and coordinates the global financial view. She holds an<br />

MA in Economics from the University of Zurich, and is<br />

a CFA charterholder. > Pages 58–61<br />

Beat Schwab<br />

Head of Real Estate Investment Management Switzerland<br />

beat.schwab@credit-suisse.com...................................<br />

+41 44 333 92 42.......................................................<br />

Beat Schwab has been Head of Real Estate Investment<br />

Management Switzerland since November 2012. From<br />

2006 to 2012 he was CEO of the real estate services<br />

group Wincasa AG. During his career he held various position<br />

in the construction industry and real estate markets.<br />

Mr. Schwab holds a PhD in Economics from the University<br />

of Bern and an MBA from Columbia University. > Page 47<br />

Markus Stierli<br />

Head of Fundamental Micro Themes Research............<br />

markus.stierli@credit-suisse.com...............................<br />

+41 44 334 88 57.......................................................<br />

Markus Stierli is Head of Fundamental Micro Themes<br />

Research at Credit Suisse Private Banking and Wealth<br />

Management, based in Zurich. He holds a PhD in<br />

International Relations from the University of Zurich<br />

and is a Chartered Alternative Investment Analyst.<br />

> Pages 04–08, 15<br />

Marina Stoop<br />

Cross Asset and Alternative Investments Strategist........<br />

marina.stoop@credit-suisse.com...................................<br />

+41 44 334 60 47.......................................................<br />

Marina Stoop is the Head of Risk and Flow Analysis<br />

within the Cross Asset Strategy and Alternative<br />

Investments team. She is responsible for providing input<br />

to the Investment Committee on financial market risks,<br />

liquidity and flow. Marina Stoop joined Credit Suisse<br />

in 2010 after graduating from ETH Zurich with an MA<br />

in Science. > Pages 21–23