Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 1.15 — 60 The bank then bundles a number of home loans –<br />

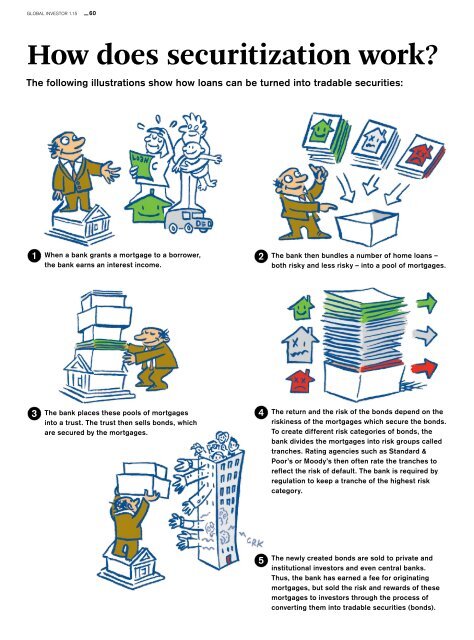

How does securitization work?<br />

The following illustrations show how loans can be turned into tradable securities:<br />

1<br />

When a bank grants a mortgage to a borrower,<br />

the bank earns an interest income.<br />

2<br />

both risky and less risky – into a pool of mortgages.<br />

3<br />

The bank places these pools of mortgages<br />

into a trust. The trust then sells bonds, which<br />

are secured by the mortgages.<br />

4<br />

The return and the risk of the bonds depend on the<br />

riskiness of the mortgages which secure the bonds.<br />

To create different risk categories of bonds, the<br />

bank divides the mortgages into risk groups called<br />

tranches. Rating agencies such as Standard &<br />

Poor’s or Moody’s then often rate the tranches to<br />

reflect the risk of default. The bank is required by<br />

regulation to keep a tranche of the highest risk<br />

category.<br />

5<br />

The newly created bonds are sold to private and<br />

institutional investors and even central banks.<br />

Thus, the bank has earned a fee for originating<br />

mortgages, but sold the risk and rewards of these<br />

mortgages to investors through the process of<br />

converting them into tradable securities (bonds).