Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 1.15 — 45<br />

Hints for investors<br />

1 / Adopt a long investment<br />

horizon. Transaction costs<br />

are best absorbed by having a<br />

long investment horizon.<br />

2 / Mind the leverage. Sufficient<br />

own funds help to avoid<br />

fire sales as price and liquidity<br />

cycles can be long.<br />

3 / Know your product.<br />

Legis lation is very different for<br />

distinct types of real estate<br />

funds and country-dependent.<br />

Some setups are more<br />

exposed to liquidity problems.<br />

4 / Take your time. Avoid<br />

making your decision to buy<br />

or sell too quickly. This could<br />

turn out to be very costly.<br />

5 / Add real estate to your<br />

port folio. Do not be frightened<br />

of illiquidity. Real estate is<br />

a good diversifier in portfolios.<br />

01_Allocation to property in<br />

UHNWI investment portfolios<br />

While residential property (main residence and<br />

any second homes) makes up almost 30% of<br />

the total net worth of UHNWIs, real estate also<br />

plays an important role when it comes to making<br />

investments. On average, property accounts<br />

for 24% of UHNWI investment portfolios.<br />

In over 40% of all cases, this share has even<br />

increased in recent years.<br />

Source: Knight Frank, The Wealth Report 2014<br />

in percent<br />

35<br />

30<br />

25<br />

20<br />

15<br />

10<br />

5<br />

0<br />

Australasia<br />

Asia<br />

Russia/CIS<br />

Africa<br />

Global<br />

Europe<br />

Middle East<br />

North America<br />

Latin America<br />

When talking about illiquid <strong>assets</strong>,<br />

real estate is at the forefront as<br />

it belongs to the most prominent<br />

of illiquid <strong>assets</strong>. In developed<br />

markets, real estate is the most important<br />

wealth contributor in household portfolios and<br />

adds up to enormous amounts of wealth. It is<br />

not surprising that regulators and central<br />

banks pay a lot of attention to real estate<br />

markets. Residential real estate accounts<br />

for almost 30% of net worth in portfolios of<br />

ultrahigh-net-worth individuals (UHNWIs) (see<br />

Figure 1), and pension funds also have a substantial<br />

share of their allocation in real estate<br />

(see Figure 2).<br />

Causes of illiquidity of real estate <strong>assets</strong><br />

The illiquidity feature of real estate results<br />

from a combination of several characteristics.<br />

To begin with, real estate <strong>assets</strong> are always<br />

tied to a certain location. The combination of<br />

a particular location and a specific object<br />

quality creates a unique tangible asset. Consequently,<br />

every building requires a one-off<br />

analysis and, on a microlevel, prices can even<br />

differ heavily on the basis of, for example,<br />

exposure to noise or view. All this is reflected<br />

in the valuation of a property: there is no true<br />

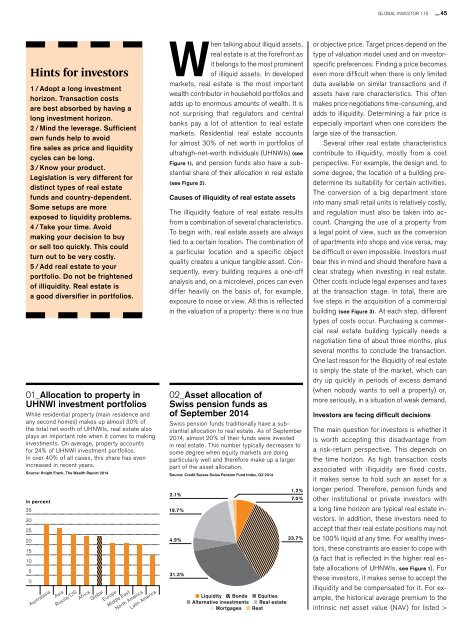

02_Asset allocation of<br />

Swiss pension funds as<br />

of September 2014<br />

Swiss pension funds traditionally have a substantial<br />

allocation to real estate. As of September<br />

2014, almost 20% of their funds were invested<br />

in real estate. This number typically decreases to<br />

some degree when equity markets are doing<br />

particularly well and therefore make up a larger<br />

part of the asset allocation.<br />

Source: Credit Suisse Swiss Pension Fund Index, Q3 2014<br />

2.1%<br />

19.7%<br />

4.9%<br />

31.3%<br />

Liquidity Bonds Equities<br />

Alternative investments Real estate<br />

Mortgages Rest<br />

1.2%<br />

7.0%<br />

33.7%<br />

or objective price. Target prices depend on the<br />

type of valuation model used and on investorspecific<br />

preferences. Finding a price becomes<br />

even more difficult when there is only limited<br />

data available on similar transactions and if<br />

<strong>assets</strong> have rare characteristics. This often<br />

makes price negotiations time-consuming, and<br />

adds to illiquidity. Determining a fair price is<br />

especially important when one considers the<br />

large size of the transaction.<br />

Several other real estate characteristics<br />

contribute to illiquidity, mostly from a cost<br />

perspective. For example, the design and, to<br />

some degree, the location of a building predetermine<br />

its suitability for certain activities.<br />

The conversion of a big department store<br />

into many small retail units is relatively costly,<br />

and regulation must also be taken into account.<br />

Changing the use of a property from<br />

a legal point of view, such as the conversion<br />

of apartments into shops and vice versa, may<br />

be difficult or even impossible. Investors must<br />

bear this in mind and should therefore have a<br />

clear strategy when investing in real estate.<br />

Other costs include legal expenses and taxes<br />

at the transaction stage. In total, there are<br />

five steps in the acquisition of a commercial<br />

building (see Figure 3). At each step, different<br />

types of costs occur. Purchasing a commercial<br />

real estate building typically needs a<br />

negotiation time of about three months, plus<br />

several months to conclude the transaction.<br />

One last reason for the illiquidity of real estate<br />

is simply the state of the market, which can<br />

dry up quickly in periods of excess demand<br />

(when nobody wants to sell a property) or,<br />

more seriously, in a situation of weak demand.<br />

Investors are facing difficult decisions<br />

The main question for investors is whether it<br />

is worth accepting this disadvantage from<br />

a risk-return perspective. This depends on<br />

the time horizon. As high transaction costs<br />

associated with illiquidity are fixed costs,<br />

it makes sense to hold such an asset for a<br />

longer period. Therefore, pension funds and<br />

other institutional or private investors with<br />

a long time horizon are typical real estate investors.<br />

In addition, these investors need to<br />

accept that their real estate positions may not<br />

be 100% liquid at any time. For wealthy investors,<br />

these constraints are easier to cope with<br />

(a fact that is reflected in the higher real estate<br />

allocations of UHNWIs, see Figure 1). For<br />

these investors, it makes sense to accept the<br />

illiquidity and be compensated for it. For example,<br />

the historical average premium to the<br />

intrinsic net asset value (NAV) for listed >