Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 1.15 — 57<br />

“All successful<br />

buying must<br />

be based on confidence,<br />

whether<br />

in a dealer or<br />

in oneself, and<br />

the only basis<br />

for confidence<br />

in oneself<br />

is knowledge.”<br />

Robin Duthy “Alternative Investment” –<br />

Founder of Art Market Research<br />

Drawing attention: The rise of<br />

Chinese contemporary art<br />

In 2007, art collector Howard Farber sold Wang<br />

Guangyi’s “Great Criticism: Coca-Cola (1993)”<br />

for USD 1.59 million at Philips, having claimed to<br />

have paid just USD 25,000 ten years earlier.<br />

The painting was sold in late 2007 as the market<br />

neared its peak for 63 times the reported acquisition<br />

cost. After 2005, the auction market for<br />

Chinese contemporary art entered a phase of rapid<br />

development. Two years later, Charles Saatchi<br />

was noted for selling off some of his younger<br />

German artists collection in order to fund his<br />

interest in Chinese contemporary art. The painting<br />

“1998.8.30” by Lijun sold at Sotheby’s Hong<br />

Kong in 2010 for over USD 1.2 million. Last year,<br />

his “Publication 2 No. 4” sold for over USD 7.6<br />

million. AMRD’s methodology enables comparison<br />

with other art sectors, for example, as represented<br />

by the AMRD Contemporary 100, a leading<br />

benchmark. Set against an overview of sales of<br />

contemporary artists across the globe, the index<br />

reveals that sales of top Chinese contemporary<br />

artists have been outperforming the competition<br />

for the last five years.<br />

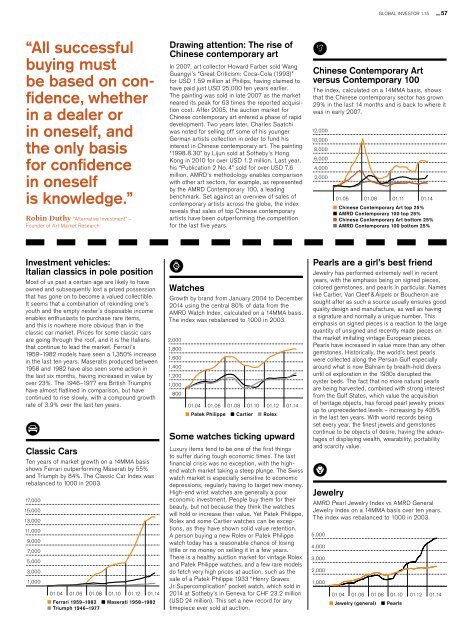

Chinese Contemporary Art<br />

versus Contemporary 100<br />

The index, calculated on a 14MMA basis, shows<br />

that the Chinese contemporary sector has grown<br />

29% in the last 14 months and is back to where it<br />

was in early 2007.<br />

12,000<br />

10,000<br />

8,000<br />

6,000<br />

4,000<br />

2,000<br />

01.05 01.08 01.11 01.14<br />

Chinese Contemporary Art top 25%<br />

AMRD Contemporary 100 top 25%<br />

Chinese Contemporary Art bottom 25%<br />

AMRD Contemporary 100 bottom 25%<br />

Investment vehicles:<br />

Italian classics in pole position<br />

Most of us past a certain age are likely to have<br />

owned and subsequently lost a prized possession<br />

that has gone on to become a valued collectible.<br />

It seems that a combination of rekindling one’s<br />

youth and the empty nester’s disposable income<br />

enables enthusiasts to purchase rare items,<br />

and this is nowhere more obvious than in the<br />

classic car market. Prices for some classic cars<br />

are going through the roof, and it is the Italians<br />

that continue to lead the market. Ferrari’s<br />

1959–1982 models have seen a 1,350% increase<br />

in the last ten years. Maseratis produced between<br />

1958 and 1982 have also seen some action in<br />

the last six months, having increased in value by<br />

over 23%. The 1946–1977 era British Triumphs<br />

have almost flatlined in comparison, but have<br />

continued to rise slowly, with a compound growth<br />

rate of 3.9% over the last ten years.<br />

Classic Cars<br />

Ten years of market growth on a 14MMA basis<br />

shows Ferrari outperforming Maserati by 55%<br />

and Triumph by 84%. The Classic Car Index was<br />

rebalanced to 1000 in 2003.<br />

17,000<br />

15,000<br />

13,000<br />

11,000<br />

9,000<br />

7,000<br />

5,000<br />

3,000<br />

1,000<br />

01.04 01.06 01.08 01.10 01.12 01.14<br />

Ferrari 1959–1982 Maserati 1958–1982<br />

Triumph 1946–1977<br />

Watches<br />

Growth by brand from January 2004 to December<br />

2014 using the central 80% of data from the<br />

AMRD Watch Index, calculated on a 14MMA basis.<br />

The index was rebalanced to 1000 in 2003.<br />

2,000<br />

1,800<br />

1,600<br />

1,400<br />

1,200<br />

1,000<br />

800<br />

01.04 01.06 01.08 01.10 01.12<br />

Patek Philippe Cartier Rolex<br />

01.14<br />

Some watches ticking upward<br />

Luxury items tend to be one of the first things<br />

to suffer during tough economic times. The last<br />

financial crisis was no exception, with the highend<br />

watch market taking a steep plunge. The Swiss<br />

watch market is especially sensitive to economic<br />

depressions, regularly having to target new money.<br />

High-end wrist watches are generally a poor<br />

economic investment. People buy them for their<br />

beauty, but not because they think the watches<br />

will hold or increase their value. Yet Patek Philippe,<br />

Rolex and some Cartier watches can be exceptions,<br />

as they have shown solid value retention.<br />

A person buying a new Rolex or Patek Philippe<br />

watch today has a reasonable chance of losing<br />

little or no money on selling it in a few years.<br />

There is a healthy auction market for vintage Rolex<br />

and Patek Philippe watches, and a few rare models<br />

do fetch very high prices at auction, such as the<br />

sale of a Patek Philippe 1933 “Henry Graves<br />

Jr. Supercomplication” pocket watch, which sold in<br />

2014 at Sotheby’s in Geneva for CHF 23.2 million<br />

(USD 24 million). This set a new record for any<br />

timepiece ever sold at auction.<br />

Pearls are a girl’s best friend<br />

Jewelry has performed extremely well in recent<br />

years, with the emphasis being on signed pieces,<br />

colored gemstones, and pearls in particular. Names<br />

like Cartier, Van Cleef & Arpels or Boucheron are<br />

sought after as such a source usually ensures good<br />

quality design and manufacture, as well as having<br />

a signature and normally a unique number. This<br />

emphasis on signed pieces is a reaction to the large<br />

quantity of unsigned and recently made pieces on<br />

the market imitating vintage European pieces.<br />

Pearls have increased in value more than any other<br />

gemstones. Historically, the world’s best pearls<br />

were collected along the Persian Gulf especially<br />

around what is now Bahrain by breath-hold divers<br />

until oil exploration in the 1930s disrupted the<br />

oyster beds. The fact that no more natural pearls<br />

are being harvested, combined with strong interest<br />

from the Gulf States, which value the acquisition<br />

of heritage objects, has forced pearl jewelry prices<br />

up to unprecedented levels – increasing by 405%<br />

in the last ten years. With world records being<br />

set every year, the finest jewels and gemstones<br />

continue to be objects of desire, having the advantages<br />

of displaying wealth, wearability, portability<br />

and scarcity value.<br />

Jewelry<br />

AMRD Pearl Jewelry Index vs AMRD General<br />

Jewelry Index on a 14MMA basis over ten years.<br />

The index was rebalanced to 1000 in 2003.<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

01.04 01.06 01.08 01.10 01.12 01.14<br />

Jewelry (general)<br />

Pearls