Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 1.15 — 21<br />

Hedge Funds<br />

Liquidity –<br />

a key to<br />

hedge fund<br />

performance<br />

Whether it’s related to an investor’s risk tolerance, or a<br />

fund manager’s decision on the appropriate trading strategy,<br />

the management of liquidity issues is a vital consideration<br />

when investing in hedge funds. And while illiquidity can be a<br />

source of risk, it can also be a source of additional returns.<br />

Annualized returns<br />

Liquidity is an important aspect to consider<br />

when investing in hedge funds.<br />

Liquidity issues have to be managed<br />

by both investors as well as hedge fund<br />

managers. While it is true that hedge fund<br />

liquidity has generally improved for investors<br />

since the global financial crisis, hedge funds<br />

are still less liquid investments than equities.<br />

To use Alexander Ineichen’s term, they can<br />

be called “quasi-liquid.” In the following, we<br />

take a closer look at the role liquidity plays<br />

for hedge funds and their investors. A key<br />

conclusion is that illiquidity is not only a drawback,<br />

but also a potential source of returns,<br />

which still has to be managed.<br />

<strong>Illiquid</strong>ity as a source of return<br />

Hedge fund returns can be divided into three<br />

components: (1) returns from general market<br />

performance (also called beta factors), (2)<br />

returns from exploiting risk premia, including<br />

illiquidity factors (alternative beta), and (3)<br />

returns related to manager skills (e.g. in selecting<br />

securities and timing entry and exit<br />

into an investment, called alpha.)<br />

The performance of equity and fixed income<br />

markets to which hedge funds have<br />

exposure are typical beta drivers. The sensitivity<br />

toward these drivers varies across hedge<br />

fund strategies. While long/short equity strategies<br />

(which belong to the fundamental style,<br />

see box) have a relatively high sensitivity to<br />

equity market performance, the influence on<br />

managed futures (a tactical trading strategy)<br />

or fixed income arbitrage (a relative value<br />

strategy) may be minor.<br />

Hedge funds provide advantages<br />

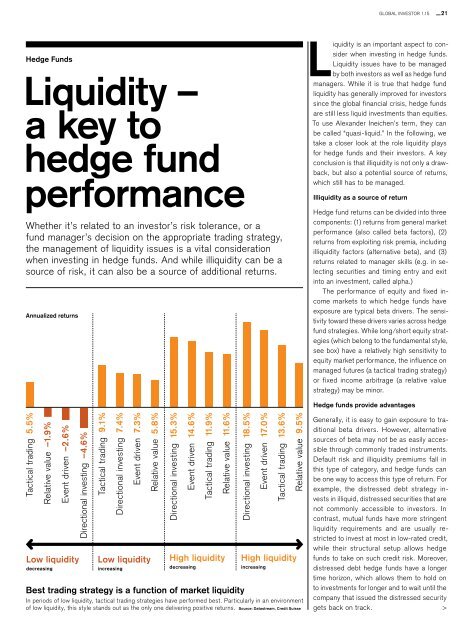

Tactical trading 5.5%<br />

Relative value –1.9%<br />

Event driven –2.6%<br />

Low liquidity<br />

decreasing<br />

Directional investing –4.6%<br />

Tactical trading 9.1%<br />

Directional investing 7.4%<br />

Event driven 7.3%<br />

Low liquidity<br />

increasing<br />

Relative value 5.8%<br />

Best trading strategy is a function of market liquidity<br />

In periods of low liquidity, tactical trading strategies have performed best. Particularly in an environment<br />

of low liquidity, this style stands out as the only one delivering positive returns. Source: Datastream, Credit Suisse<br />

Directional investing 15.3%<br />

Event driven 14.6%<br />

Tactical trading 11.9%<br />

Relative value 11.6%<br />

High liquidity<br />

decreasing<br />

Directional investing 18.5%<br />

Event driven 17.0%<br />

Tactical trading 13.6%<br />

High liquidity<br />

increasing<br />

Relative value 9.5%<br />

Generally, it is easy to gain exposure to traditional<br />

beta drivers. However, alternative<br />

sources of beta may not be as easily accessible<br />

through commonly traded instruments.<br />

Default risk and illiquidity premiums fall in<br />

this type of category, and hedge funds can<br />

be one way to access this type of return. For<br />

example, the distressed debt strategy in -<br />

vests in illiquid, distressed securities that are<br />

not commonly accessible to investors. In<br />

contrast, mutual funds have more stringent<br />

liquidity requirements and are usually restricted<br />

to invest at most in low-rated credit,<br />

while their structural setup allows hedge<br />

funds to take on such credit risk. Moreover,<br />

distressed debt hedge funds have a longer<br />

time horizon, which allows them to hold on<br />

to investments for longer and to wait until the<br />

company that issued the distressed security<br />

gets back on track.<br />

>