Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL INVESTOR 1.15 — 29<br />

Adrian Orr: You have to take your<br />

mind out of an SAA framework. We asked<br />

ourselves, how could we achieve our purpose<br />

in the least-cost, simplest manner?<br />

That means going out and buying listed,<br />

low-cost liquid <strong>assets</strong> to create what we<br />

call our reference portfolio. It ends up being<br />

effectively 80% equity, 20% fixed income,<br />

globally diversified. And we think of that<br />

reference portfolio as delivering a Treasury<br />

bill plus 2.5% return, on average, over<br />

20 years. We then get out of bed every<br />

morning and say: how can we outperform<br />

that reference portfolio? How can we<br />

add value?<br />

José Antonio Blanco: Adding value<br />

means …?<br />

Adrian Orr: Improving the Sharpe ratio,<br />

a higher return for the same risk, or the<br />

same return for less risk. And that is when<br />

we start actively investing.<br />

Oliver Adler: If you compared your actual<br />

allocations with a typical SAA for a balanced<br />

fund, how marked would the deviations<br />

be, say, in the main asset classes from any<br />

kind of starting or “reference” point?<br />

Adrian Orr: The deviation is quite big,<br />

and has become more visible since about<br />

2007, when we shifted away from our<br />

SAA (we had one once!) and got far more<br />

active and more direct in our investment<br />

strategies. This is also the period of<br />

high growth in the value-add of the fund.<br />

So I would compare our strategy style to<br />

a growth fund’s, not a balanced fund’s.<br />

We have performed exceptionally strongly<br />

over the last five years or so, with<br />

annualized returns anywhere between<br />

17% and 25%.<br />

Oliver Adler: What about illiquid asset<br />

classes such as real estate, which<br />

is probably very local? Or infrastructure,<br />

which everyone is talking about?<br />

Adrian Orr: Many of our illiquid <strong>assets</strong><br />

have entered the portfolio as diversifiers<br />

(like timber) or because there was a<br />

significant market mispricing, or a specific<br />

asset mispricing (like Life Insurance Settlements).<br />

Infrastructure has been the real<br />

tough one. Infrastructure <strong>assets</strong> have been<br />

very sought after; so we rarely see a<br />

mispricing opportunity, and they aren’t as<br />

good a diversifier as people claim unless<br />

they are true infrastructure.<br />

José Antonio Blanco: How do you handle<br />

the delicate question of ethical and<br />

sustainable investment vis-à-vis illiquid<br />

<strong>assets</strong>?<br />

“We then get out of<br />

bed every morning and<br />

say: how can we<br />

outperform that reference<br />

portfolio? How can<br />

we add value?”<br />

Adrian Orr<br />

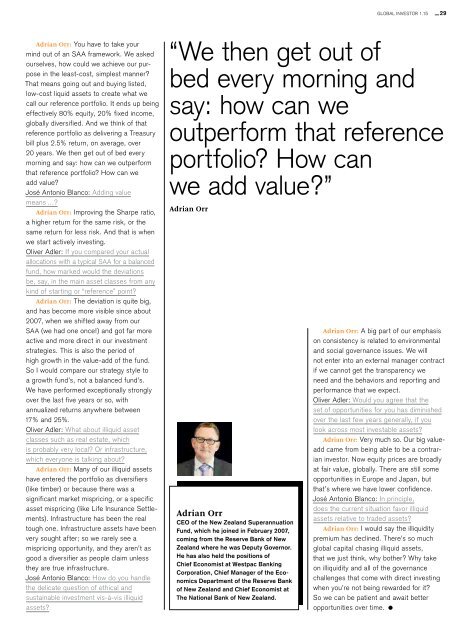

Adrian Orr<br />

CEO of the New Zealand Superannuation<br />

Fund, which he joined in February 2007,<br />

coming from the Reserve Bank of New<br />

Zealand where he was Deputy Governor.<br />

He has also held the positions of<br />

Chief Economist at Westpac Banking<br />

Corporation, Chief Manager of the Economics<br />

Department of the Reserve Bank<br />

of New Zealand and Chief Economist at<br />

The National Bank of New Zealand.<br />

Adrian Orr: A big part of our emphasis<br />

on consistency is related to environmental<br />

and social governance issues. We will<br />

not enter into an external manager contract<br />

if we cannot get the transparency we<br />

need and the behaviors and reporting and<br />

performance that we expect.<br />

Oliver Adler: Would you agree that the<br />

set of opportunities for you has diminished<br />

over the last few years generally, if you<br />

look across most investable <strong>assets</strong>?<br />

Adrian Orr: Very much so. Our big valueadd<br />

came from being able to be a contrarian<br />

investor. Now equity prices are broadly<br />

at fair value, globally. There are still some<br />

opportunities in Europe and Japan, but<br />

that’s where we have lower confidence.<br />

José Antonio Blanco: In principle,<br />

does the current situation favor illiquid<br />

<strong>assets</strong> relative to traded <strong>assets</strong>?<br />

Adrian Orr: I would say the illiquidity<br />

premium has declined. There’s so much<br />

global capital chasing illiquid <strong>assets</strong>,<br />

that we just think, why bother? Why take<br />

on illiquidity and all of the governance<br />

challenges that come with direct investing<br />

when you’re not being rewarded for it?<br />

So we can be patient and await better<br />

opportunities over time.