Illiquid assets

Unwrapping alternative returns Global Investor, 01/2015 Credit Suisse

Unwrapping alternative returns

Global Investor, 01/2015

Credit Suisse

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

GLOBAL INVESTOR 1.15 — 61<br />

regulatory rules for insurance companies, which made the capital<br />

charges less onerous for high-quality securitization. Further, rules on<br />

the Liquidity Coverage Ratio (LCR) for banks have also allowed some<br />

high quality securitization to qualify under certain criteria. However,<br />

there is still considerable debate on whether the existing rules on<br />

securitization still make the capital treatment too onerous for the issuing<br />

banks and this is an area that needs to see some change to<br />

help revive the European securitization market.<br />

Securitization market with significant volume<br />

We believe that the data published by the EBA and ECB on banks’<br />

risk exposures and risk-weighted <strong>assets</strong> should allow the market to<br />

better understand and quantify the eligible securities. From an issuer’s<br />

point of view, we conclude that there are currently situations where<br />

an unsecuritized portfolio may require less capital than a securitized<br />

portfolio (see adjacent box). As a result, the loan portfolio to be<br />

securitized might contain a higher proportion of <strong>assets</strong> with a higher<br />

risk weight attached to it. Thus, we believe that securitization may<br />

take place in regard to high-quality small and medium enterprise (SME)<br />

loans due to the higher risk weights applied. This is precisely the<br />

area where the ECB is trying to unlock the funding gridlock.<br />

With securitization accounting far from clear under International<br />

Financial Reporting Standards (IFRS) and a likely piecemeal<br />

approach to capital relief, we have tried to estimate the potential<br />

size of qualifying securitization <strong>assets</strong> for Europe. Depending on the<br />

range of <strong>assets</strong> taken into account, we have adjusted the data for<br />

asset encumbrance and estimate that the market could range from<br />

a minimum of EUR 1 trillion (including mainly SME loans) to EUR 2.4<br />

trillion (including lower risk-weighted asset categories such as securitized<br />

or collateralized lending). From the asset breakdown, we<br />

predict that securitization is more likely to reopen bank funding channels<br />

for SMEs and corporate lending as we would expect the capital<br />

relief to transmit into lower sustainable funding costs in these sectors.<br />

We therefore believe that securitization can play a key role in<br />

serving the macroeconomic policy objectives of the ECB to foster<br />

economic growth.<br />

Given the completion of the AQR and the launch of the ABS<br />

purchase program, we believe that these are supportive steps toward<br />

a fully fledged securitization market throughout 2015. In turn, we<br />

continue to believe this will provide a positive backdrop for the<br />

Eurozone by releasing capital pressure from banks’ balance sheets,<br />

reducing the cost of borrowing for SME clients and providing lending<br />

to the economy. In an environment of very low yields, investors<br />

(including the ECB) will gain access to higher-yielding <strong>assets</strong>, which<br />

we expect to be attractively priced at the beginning to reopen the<br />

securitization market.<br />

Christine Schmid<br />

Head of Global Equity & Credit Research<br />

+41 44 334 56 43<br />

christine.schmid@credit-suisse.com<br />

Carla Antunes da Silva<br />

Head of European Banks<br />

Investment Banking Equity Research<br />

+44 20 7883 0500<br />

carla.antunes-silva@credit-suisse.com<br />

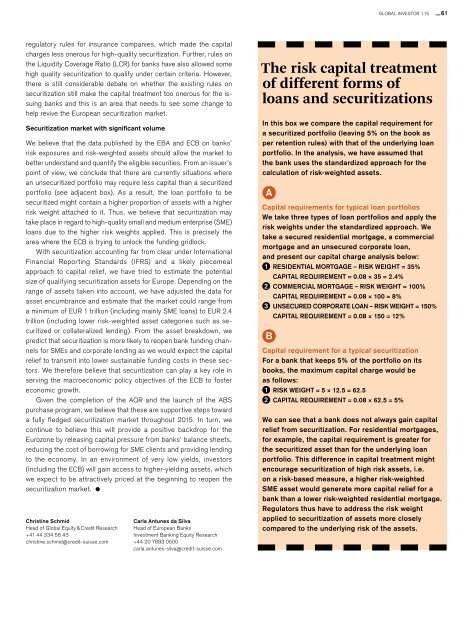

The risk capital treatment<br />

of different forms of<br />

loans and securitizations<br />

In this box we compare the capital requirement for<br />

a securitized portfolio (leaving 5% on the book as<br />

per retention rules) with that of the underlying loan<br />

portfolio. In the analysis, we have assumed that<br />

the bank uses the standardized approach for the<br />

calculation of risk-weighted <strong>assets</strong>.<br />

A<br />

Capital requirements for typical loan portfolios<br />

We take three types of loan portfolios and apply the<br />

risk weights under the standardized approach. We<br />

take a secured residential mortgage, a commercial<br />

mortgage and an unsecured corporate loan,<br />

and present our capital charge analysis below:<br />

1 RESIDENTIAL MORTGAGE – RISK WEIGHT = 35%<br />

CAPITAL REQUIREMENT = 0.08 × 35 = 2.4%<br />

2 COMMERCIAL MORTGAGE – RISK WEIGHT = 100%<br />

CAPITAL REQUIREMENT = 0.08 × 100 = 8%<br />

3 UNSECURED CORPORATE LOAN – RISK WEIGHT = 150%<br />

CAPITAL REQUIREMENT = 0.08 × 150 = 12%<br />

B<br />

Capital requirement for a typical securitization<br />

For a bank that keeps 5% of the portfolio on its<br />

books, the maximum capital charge would be<br />

as follows:<br />

1 RISK WEIGHT = 5 × 12.5 = 62.5<br />

2 CAPITAL REQUIREMENT = 0.08 × 62.5 = 5%<br />

We can see that a bank does not always gain capital<br />

relief from securitization. For residential mortgages,<br />

for example, the capital requirement is greater for<br />

the securitized asset than for the underlying loan<br />

portfolio. This difference in capital treatment might<br />

encourage securitization of high risk <strong>assets</strong>, i.e.<br />

on a risk-based measure, a higher risk-weighted<br />

SME asset would generate more capital relief for a<br />

bank than a lower risk-weighted residential mortgage.<br />

Regulators thus have to address the risk weight<br />

applied to securitization of <strong>assets</strong> more closely<br />

compared to the underlying risk of the <strong>assets</strong>.