Climate Action 2010-2011

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

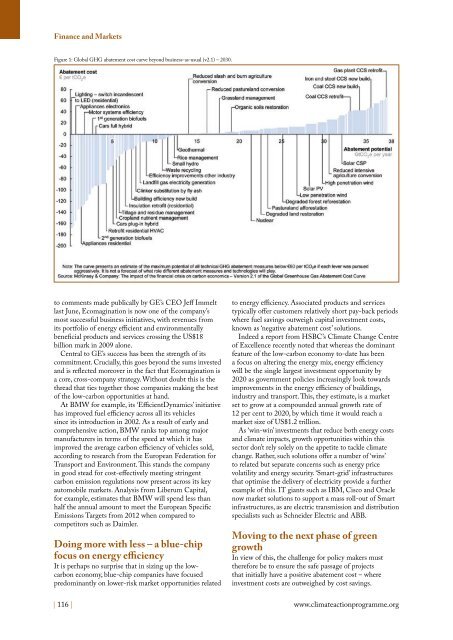

Finance and Markets<br />

Figure 1: Global GHG abatement cost curve beyond business-as-usual (v2.1) – 2030.<br />

to comments made publically by GE’s CEO Jeff Immelt<br />

last June, Ecomagination is now one of the company’s<br />

most successful business initiatives, with revenues from<br />

its portfolio of energy efficient and environmentally<br />

beneficial products and services crossing the US$18<br />

billion mark in 2009 alone.<br />

Central to GE’s success has been the strength of its<br />

commitment. Crucially, this goes beyond the sums invested<br />

and is reflected moreover in the fact that Ecomagination is<br />

a core, cross-company strategy. Without doubt this is the<br />

thread that ties together those companies making the best<br />

of the low-carbon opportunities at hand.<br />

At BMW for example, its ‘EfficientDynamics’ initiative<br />

has improved fuel efficiency across all its vehicles<br />

since its introduction in 2002. As a result of early and<br />

comprehensive action, BMW ranks top among major<br />

manufacturers in terms of the speed at which it has<br />

improved the average carbon efficiency of vehicles sold,<br />

according to research from the European Federation for<br />

Transport and Environment. This stands the company<br />

in good stead for cost-effectively meeting stringent<br />

carbon emission regulations now present across its key<br />

automobile markets. Analysis from Liberum Capital,<br />

for example, estimates that BMW will spend less than<br />

half the annual amount to meet the European Specific<br />

Emissions Targets from 2012 when compared to<br />

competitors such as Daimler.<br />

Doing more with less – a blue-chip<br />

focus on energy efficiency<br />

It is perhaps no surprise that in sizing up the lowcarbon<br />

economy, blue-chip companies have focused<br />

predominantly on lower-risk market opportunities related<br />

| 116 |<br />

to energy efficiency. Associated products and services<br />

typically offer customers relatively short pay-back periods<br />

where fuel savings outweigh capital investment costs,<br />

known as ‘negative abatement cost’ solutions.<br />

Indeed a report from HSBC’s <strong>Climate</strong> Change Centre<br />

of Excellence recently noted that whereas the dominant<br />

feature of the low-carbon economy to-date has been<br />

a focus on altering the energy mix, energy efficiency<br />

will be the single largest investment opportunity by<br />

2020 as government policies increasingly look towards<br />

improvements in the energy efficiency of buildings,<br />

industry and transport. This, they estimate, is a market<br />

set to grow at a compounded annual growth rate of<br />

12 per cent to 2020, by which time it would reach a<br />

market size of US$1.2 trillion.<br />

As ‘win-win’ investments that reduce both energy costs<br />

and climate impacts, growth opportunities within this<br />

sector don’t rely solely on the appetite to tackle climate<br />

change. Rather, such solutions offer a number of ‘wins’<br />

to related but separate concerns such as energy price<br />

volatility and energy security. ‘Smart-grid’ infrastructures<br />

that optimise the delivery of electricity provide a further<br />

example of this. IT giants such as IBM, Cisco and Oracle<br />

now market solutions to support a mass roll-out of Smart<br />

infrastructures, as are electric transmission and distribution<br />

specialists such as Schneider Electric and ABB.<br />

Moving to the next phase of green<br />

growth<br />

In view of this, the challenge for policy makers must<br />

therefore be to ensure the safe passage of projects<br />

that initially have a positive abatement cost – where<br />

investment costs are outweighed by cost savings.<br />

www.climateactionprogramme.org