You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

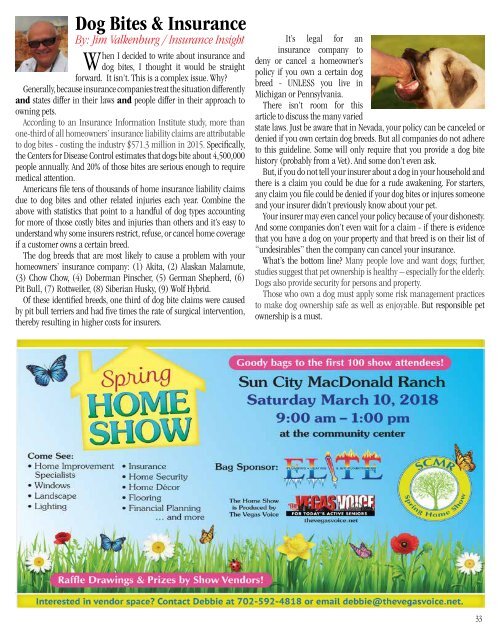

Dog Bites & Insurance<br />

By: Jim Valkenburg / Insurance Insight<br />

When I decided to write about insurance and<br />

dog bites, I thought it would be straight<br />

forward. It isn’t. This is a complex issue. Why?<br />

Generally, because insurance companies treat the situation differently<br />

and states differ in their laws and people differ in their approach to<br />

owning pets.<br />

According to an Insurance Information Institute study, more than<br />

one-third of all homeowners’ insurance liability claims are attributable<br />

to dog bites - costing the industry $571.3 million in 2015. Specifically,<br />

the Centers for Disease Control estimates that dogs bite about 4,500,000<br />

people annually. And 20% of those bites are serious enough to require<br />

medical attention.<br />

Americans file tens of thousands of home insurance liability claims<br />

due to dog bites and other related injuries each year. Combine the<br />

above with statistics that point to a handful of dog types accounting<br />

for more of those costly bites and injuries than others and it’s easy to<br />

understand why some insurers restrict, refuse, or cancel home coverage<br />

if a customer owns a certain breed.<br />

The dog breeds that are most likely to cause a problem with your<br />

homeowners’ insurance company: (1) Akita, (2) Alaskan Malamute,<br />

(3) Chow Chow, (4) Doberman Pinscher, (5) German Shepherd, (6)<br />

Pit Bull, (7) Rottweiler, (8) Siberian Husky, (9) Wolf Hybrid.<br />

Of these identified breeds, one third of dog bite claims were caused<br />

by pit bull terriers and had five times the rate of surgical intervention,<br />

thereby resulting in higher costs for insurers.<br />

It’s legal for an<br />

insurance company to<br />

deny or cancel a homeowner’s<br />

policy if you own a certain dog<br />

breed - UNLESS you live in<br />

Michigan or Pennsylvania.<br />

There isn’t room for this<br />

article to discuss the many varied<br />

state laws. Just be aware that in Nevada, your policy can be canceled or<br />

denied if you own certain dog breeds. But all companies do not adhere<br />

to this guideline. Some will only require that you provide a dog bite<br />

history (probably from a Vet). And some don’t even ask.<br />

But, if you do not tell your insurer about a dog in your household and<br />

there is a claim you could be due for a rude awakening. For starters,<br />

any claim you file could be denied if your dog bites or injures someone<br />

and your insurer didn’t previously know about your pet.<br />

Your insurer may even cancel your policy because of your dishonesty.<br />

And some companies don’t even wait for a claim - if there is evidence<br />

that you have a dog on your property and that breed is on their list of<br />

“undesirables” then the company can cancel your insurance.<br />

What’s the bottom line? Many people love and want dogs; further,<br />

studies suggest that pet ownership is healthy – especially for the elderly.<br />

Dogs also provide security for persons and property.<br />

Those who own a dog must apply some risk management practices<br />

to make dog ownership safe as well as enjoyable. But responsible pet<br />

ownership is a must.<br />

33