Royal Botanic Gardens Victoria Annual Report 2018-19

Royal Botanic Gardens Victoria Annual Report 2018-19

Royal Botanic Gardens Victoria Annual Report 2018-19

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

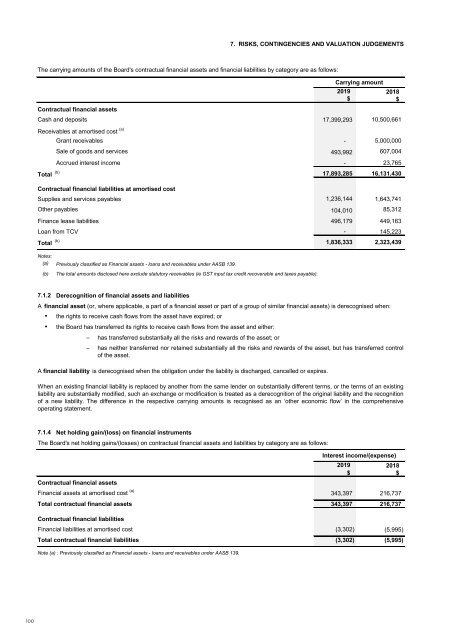

7. RISKS, CONTINGENCIES AND VALUATION JUDGEMENTS<br />

The carrying amounts of the Board's contractual financial assets and financial liabilities by category are as follows:<br />

Contractual financial assets<br />

Carrying amount<br />

20<strong>19</strong><br />

$<br />

<strong>2018</strong><br />

$<br />

Cash and deposits 17,399,293<br />

Receivables at amortised cost (a)<br />

Grant receivables -<br />

Sale of goods and services 493,992<br />

Accrued interest income -<br />

Total (b) 17,893,285<br />

10,500,661<br />

5,000,000<br />

607,004<br />

23,765<br />

16,131,430<br />

Contractual financial liabilities at amortised cost<br />

Supplies and services payables 1,236,144<br />

Other payables 104,010<br />

Finance lease liabilities 496,179<br />

Loan from TCV -<br />

Total (b) 1,836,333<br />

1,643,741<br />

85,312<br />

449,163<br />

145,223<br />

2,323,439<br />

Notes:<br />

(a)<br />

(b)<br />

Previously classified as Financial assets - loans and receivables under AASB 139.<br />

The total amounts disclosed here exclude statutory receivables (ie GST input tax credit recoverable and taxes payable).<br />

7.1.2<br />

Derecognition of financial assets and liabilities<br />

A financial asset (or, where applicable, a part of a financial asset or part of a group of similar financial assets) is derecognised when:<br />

h<br />

h<br />

the rights to receive cash flows from the asset have expired; or<br />

the Board has transferred its rights to receive cash flows from the asset and either:<br />

– has transferred substantially all the risks and rewards of the asset; or<br />

–<br />

has neither transferred nor retained substantially all the risks and rewards of the asset, but has transferred control<br />

of the asset.<br />

A financial liability is derecognised when the obligation under the liability is discharged, cancelled or expires.<br />

When an existing financial liability is replaced by another from the same lender on substantially different terms, or the terms of an existing<br />

liability are substantially modified, such an exchange or modification is treated as a derecognition of the original liability and the recognition<br />

of a new liability. The difference in the respective carrying amounts is recognised as an ‘other economic flow’ in the comprehensive<br />

operating statement.<br />

7.1.4<br />

Net holding gain/(loss) on financial instruments<br />

The Board's net holding gains/(losses) on contractual financial assets and liabilities by category are as follows:<br />

Interest income/(expense)<br />

Contractual financial assets<br />

20<strong>19</strong><br />

$<br />

<strong>2018</strong><br />

$<br />

Financial assets at amortised cost (a) 343,397<br />

Total contractual financial assets 343,397<br />

216,737<br />

216,737<br />

Contractual financial liabilities<br />

Financial liabilities at amortised cost (3,302)<br />

(5,995)<br />

Total contractual financial liabilities (3,302) (5,995)<br />

Note (a) : Previously classified as Financial assets - loans and receivables under AASB 139.<br />

100<br />

<strong>Royal</strong> <strong>Botanic</strong> <strong>Gardens</strong> Board <strong>Victoria</strong> <strong>2018</strong>-<strong>19</strong> Financial <strong>Report</strong> Page 23