Royal Botanic Gardens Victoria Annual Report 2018-19

Royal Botanic Gardens Victoria Annual Report 2018-19

Royal Botanic Gardens Victoria Annual Report 2018-19

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

7. RISKS, CONTINGENCIES AND VALUATION JUDGEMENTS<br />

The net holding gains or losses disclosed above are determined as follows:<br />

h<br />

h<br />

for cash and cash equivalents and financial assets at amortised cost, the net gain or loss is calculated by taking the movement in<br />

interest income minus any impairment recognised in the net result; and<br />

for financial liabilities measured at amortised cost, the net gain or loss is equal to the interest expense incurred during the reporting<br />

period.<br />

7.1.5<br />

Financial risk management objectives and policy<br />

As a whole, the Board’s financial risk management program seeks to manage these risks and the associated volatility of its financial<br />

performance.<br />

Details of the significant accounting policies and methods adopted, including the criteria for recognition, the basis of measurement and the<br />

basis on which income and expenses are recognised, with respect to each class of financial asset and financial liability above, are<br />

disclosed in Note 7.2 to the financial statements.<br />

The main purpose in holding financial instruments is to prudentially manage the Board's financial risks within the requirements of the<br />

<strong>Royal</strong> <strong>Botanic</strong> <strong>Gardens</strong> Act <strong>19</strong>91 and the government's policy parameters.<br />

The Board’s main financial risks include credit risk, liquidity risk and interest rate risk. The Board manages these financial risks in<br />

accordance with its financial risk management policy.<br />

The Board uses different methods to measure and manage the different risks to which it is exposed. Primary responsibility for the<br />

identification and management of financial risks rests with the Finance and Audit Committee of the Board.<br />

Financial instruments - credit risk<br />

Credit risk refers to the possibility that a borrower will default on its financial obligations as and when they fall due. The Board’s exposure<br />

to credit risk arises from the potential default of a counter party on their contractual obligations resulting in financial loss to the Board.<br />

Credit risk is measured at fair value and is monitored on a regular basis.<br />

Credit risk associated with the Board's contractual financial assets is minimal, especially in relation to its sale of goods and services<br />

receivables due to the adoption of stringent credit establishment and collection policies and procedures. In addition, the Board does not<br />

engage in hedging for its contractual financial assets and mainly obtains contractual financial assets that are on fixed interest, except for<br />

cash and deposits, which are mainly cash at bank. As with the policy for debtors, the Board’s policy is to only deal with banks with high<br />

credit ratings.<br />

Provision of impairment for contractual financial assets is recognised when there is objective evidence that the Board will not be able to<br />

collect a receivable. Objective evidence includes financial difficulties of the debtor, default payments, debts which are more than 60 days<br />

overdue, and changes in debtor credit ratings.<br />

The carrying amount of contractual financial assets recorded in the financial statements represents the Board’s maximum exposure to<br />

credit risk without taking account of the value of any collateral obtained.<br />

There has been no material change to the Board’s credit risk profile in <strong>2018</strong>-<strong>19</strong>.<br />

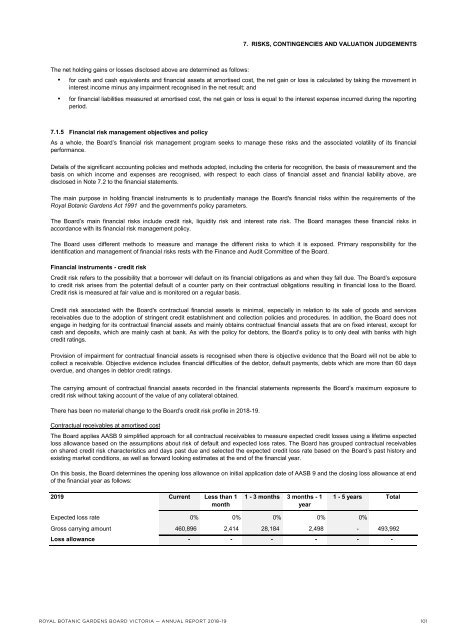

Contractual receivables at amortised cost<br />

The Board applies AASB 9 simplified approach for all contractual receivables to measure expected credit losses using a lifetime expected<br />

loss allowance based on the assumptions about risk of default and expected loss rates. The Board has grouped contractual receivables<br />

on shared credit risk characteristics and days past due and selected the expected credit loss rate based on the Board’s past history and<br />

existing market conditions, as well as forward looking estimates at the end of the financial year.<br />

On this basis, the Board determines the opening loss allowance on initial application date of AASB 9 and the closing loss allowance at end<br />

of the financial year as follows:<br />

20<strong>19</strong> Current Less than 1<br />

month<br />

1 - 3 months 3 months - 1<br />

year<br />

1 - 5 years<br />

Total<br />

Expected loss rate<br />

Gross carrying amount<br />

Loss allowance<br />

0% 0% 0% 0% 0%<br />

460,896 2,414 28,184 2,498 - 493,992<br />

- - - - - -<br />

ROYAL BOTANIC GARDENS BOARD VICTORIA — ANNUAL REPORT <strong>2018</strong>–<strong>19</strong> 101<br />

<strong>Royal</strong> <strong>Botanic</strong> <strong>Gardens</strong> Board <strong>Victoria</strong> <strong>2018</strong>-<strong>19</strong> Financial <strong>Report</strong> Page 24