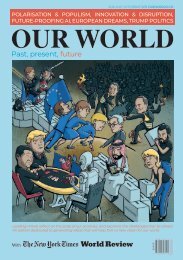

Our World in 2018

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

GLOBAL VS. LOCAL WORLDS

be achieved on an issue-by-issue basis,

and the boundaries will shift as the

world economy and popular opinion

change.

Harvard University economist Dani

Rodrik, whose writings expose the

weaknesses of neoliberal globalization,

suggests that, in some areas, we should

be expanding or consolidating the

nation-state’s power. Such an approach

would recognize, for example, domestic

preferences when it comes to food- and

product-safety standards, or the need

to moderate so-called Investor-State

Dispute Settlement processes, which

are frequently criticized for undercutting

domestic laws.

If we are to tame globalization and

respect national identities, we must

strike the right balance between

the national autonomy most citizens

desire and the international

agreements most countries so

patently need.

National governments must

also recognize the value of

self-imposed restrictions on

resist currency manipulation. But

macroeconomic imbalances may be

best reduced by reciprocal, cooperative

agreements.

Of course, nation-states will want

to make their own tax decisions to suit

local cultures and circumstances. But

a failure to cooperate to tackle unfair

tax competition and to close down

offshore tax havens will irrevocably

damage every country’s revenue base

and its domestic plans for spending on

education, health care, and security.

In 2018 and beyond, we should

establish realistic plans for responding

to the backlash against globalization by

managing globalization better. No one

has a complete roadmap for balancing

national autonomy and international

cooperation. But the best way to begin

is to focus international cooperative

greatest, or the costs of non-cooperation

are the highest. But we will also have

to deal directly and forthrightly with

distributional questions, whether in

trade, climate change, investment, or

the development and deployment of

technologies.

First, it is time to create a worldwide

early warning system for financial

markets that is based on globally

applicable standards for capital

adequacy, liquidity, transparency, and

accountability, and includes agreed

trigger points for action when risks

multiply. For example, New York

University economist Roman Frydman

has proposed a mechanism to impose a

ceiling on new debt creation when asset

prices escalate too quickly.

More broadly, we need to expand

the scope of post-crisis financial-

.

next crisis hits, we will still not know

what is owned or owed by whom,

where, and on what basis. Critics will

be right in asking why we failed to learn

.

Second, we need to reform global

supply and value chains. Of course we

should have fair intellectual-property,

tariff, and non-tariff rules. But we

must also address the fundamental

injustices that are at the heart of global

supply chains, fueling today’s antiglobalization

protests. Intelligent reform

of global supply chains should stamp

out environmental free riders; reverse

the current race to the bottom in labor

laundering; eliminate transfer-pricing

and tax-avoidance schemes that allow

for goods to be taxed – at a lower rate –

in countries they never enter; and shut

down the tax havens that now hold

trillions of dollars.

Third, we need to improve

macroeconomic cooperation. For

the past decade, growth in global

output and trade have been much

lower than they should and could

have been. Proposals such as the G20

Mutual Assessment Process (MAP)

and the International Monetary Fund’s

“imbalances” initiative have made only

token progress.

In 2009, I proposed a nominal

growth target for the world economy,

as a way to secure a faster recovery

from the post-crisis recession. Then, in

2010, the G20 reached an agreement

under which major exporting countries

such as China would limit their currentaccount

surpluses to 4%, and major

importing countries such as the US

.

Robert Skidelsky of Warwick

University recently updated this

Keynesian idea with a detailed proposal

136 2018 | OUR WORLD