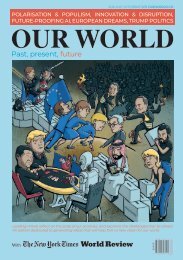

Our World in 2018

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

OUR ECONOMIES

The Global Economy’s Risky Recovery

By Joseph E. Stiglitz

A

year ago, I predicted that the most

distinctive aspect of 2017 would be

uncertainty, fueled by, among other

things, Donald Trump’s election as president

in the United States and the United Kingdom’s

vote to leave the European Union. The only

certainty, it seemed, was uncertainty – and

that the future could become a very messy

place.

As it turned out, although 2017 was not a

particularly great year, it was far better than

many had feared. Trump proved every bit as

bombastic and erratic as expected. Anyone

who paid attention only to his incessant tweets

might think the US was teetering between a

trade war and a nuclear war. Trump would

insult Sweden one day, Australia the next, and

then the EU – and then support neo-Nazis at

home. And the members of his plutocratic

of interest, incompetence, and sheer nastiness.

There have been some worrisome

regulatory rollbacks, especially concerning

environmental protection, not to mention

the many hate-driven acts that Trump’s

bigotry may have encouraged. But, so far,

the combination of America’s institutions and

the Trump administration’s incompetence has

meant that there is (fortunately) a yawning

gap between the president’s ugly rhetoric and

what he has actually accomplished.

Most important for the global economy,

there has been no trade war. Using the

exchange rate between Mexico and the US as

a barometer, fears for the future of the North

American Free Trade Agreement have largely

subsided, even as trade negotiations have

stalled. Yet the Trump roller-coaster never

ends: 2018 may be the year that the hand

grenade Trump has thrown into the global

.

Some point to the US stock market’s

record highs as evidence of some Trumpian

economic miracle. I take it partly as evidence

that the decade-long recovery from the

Joseph E.

Stiglitz

Joseph E. Stiglitz,

a Nobel laureate

in economics, is

University Professor

at Columbia

University and Chief

Economist at the

Roosevelt Institute.

GR.E

downturn – even the deepest – eventually

comes to an end; and Trump was lucky to be

of his predecessor in setting the scene.

But I also take it as evidence of market

participants’ short-sightedness, owing to

their exuberance at potential tax cuts and

the money that might once again flow to

Wall Street, if only the world of 2007 could

be restored. They ignore what followed in

2008 – the worst downturn in three quarters

inequality that previous tax cuts for the super

rich have brought.

They give short shrift to the deglobalization

risks posed by Trump’s protectionism. And

T

tax cuts are enacted, the Fed will raise interest

.

In other words, the market is once again

showing its proclivity for short-term thinking

and pure greed. None of this bodes well for

America’s long-term economic performance;

and it suggests that while 2018 is likely to be

a better year than 2017, there are large risks

on the horizon.

It’s a similar picture in Europe. The UK’s

decision to leave the EU didn’t have the jolting

anticipated, largely because of the pound’s

depreciation. But it has become increasingly

clear that Prime Minister Theresa May’s

government has no clear view about how to

manage the UK’s withdrawal, or about the

country’s post-Brexit relationship with the EU.

There are two further potential hazards

for Europe. One risk is that heavily indebted

I

avoid crisis once interest rates return to more

normal levels, as they inevitably will. After

all, is it really possible for the eurozone to

maintain record-low rates for the foreseeable

future, even as US rates increase? Hungary

and Poland represent a more existential

50 2018 | OUR WORLD