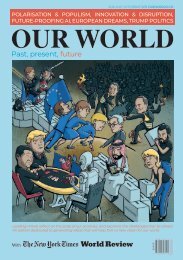

Our World in 2018

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

OUR ECONOMIES

Short-Term

Gains,

Long-Term

Hazards

By Maurice Obstfeld

AN

the state-mint in Rome, Italy.

EPA

The year 2017 appears to be ending

on a high note, with GDP growth in

much of the world continuing to rise,

marking the broadest cyclical upswing since

the start of the decade. Throughout Europe

and Asia, and in the United States and Canada,

growth expectations have risen, while some

important emerging economies that until

recently were shrinking – for example, Brazil

and Russia – have resumed growth.

Several countries continue to struggle,

including many fuel exporters and low-

or natural disasters, especially drought. But

faster recovery is benefiting roughly twothirds

of the world’s population.

These developments follow years of

geographically uneven, stop-and-go growth

following the global crisis of 2008-2009 and

the subsequent 2010-2011 rebound. As

recently as early 2016, the world economy

sputtered, driving the price of oil to near $25

per barrel (it is now around $60) and yielding

the weakest global growth rate since the

outright contraction of 2009. Thus, heading

into 2018, the sense of relief among many

economic policymakers is palpable.

Why has economic performance

improved? While there has been a marked

rise in indicators of consumer and business

sentiment, and with them, investment, it

would be wrong to attribute the recent

upswing entirely to happenstance or “animal

spirits.” Fundamental factors, notably

Maurice

Obstfeld

Maurice Obstfeld

is Chief Economist

of the International

Monetary Fund.

macroeconomic policies, have been at work

as well.

Monetary policy has long been and

remains accommodative in the largest

countries. Even though the United States

Federal Reserve continues to raise interest

rates gradually, it has been cautious, having

wisely responded to the turbulence of early

2016 by postponing previously expected

rate increases. The European Central Bank

has started to taper its large-scale asset

purchases, but has also signaled that interestrate

increases are a distant prospect.

As a result, financial conditions have

been easy, buoying both lending and asset

prices worldwide. Fiscal policy in advanced

economies has, on balance, shifted from

contractionary to roughly neutral over the

past few years, while China has provided

slowed at mid-decade, with important

positive spillovers to its trade partners.

remain relatively low – indeed, puzzlingly so

in the advanced economies – even as gaps

between actual and potential GDP have

narrowed or closed. Some might view the

of all possible worlds.

For many countries, however, longer-term

growth prospects are less encouraging. Aging

workforces, slower productivity growth, and

higher debt burdens since the crisis darken

56 2018 | OUR WORLD