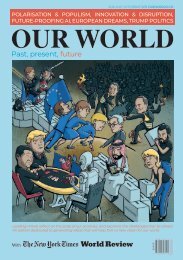

Our World in 2018

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

Leading minds reflect on the state of our societies, and examine the challenges that lie ahead. An edition dedicated to generating ideas that will help form a new vision for our world.

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

the outlook. For example, annual

per capita growth in the advanced

economies averaged 2.2% in the

decade following 1995, and naturally

dipped following the crisis; but even

for the years between now and 2022,

annual per capita growth will reach

only 1.4%, according to International

Monetary Fund projections.

Absent some unforeseen

surge in productivity, the

current upswing in advanced

economies will inevitably moderate:

growth will slow as monetary policies

as countries are forced to consolidate

public finances strained by high

government debts and burgeoning

spending on pensions and health

care. In turn, slower overall growth

will make it harder to counter slow

wage growth, especially among the

unskilled, adding to the burden of

inequality and resulting resentments.

Many emerging-market and lowincome

economies will also face

headwinds.

Economic policymakers throughout

the world therefore face two major

challenges. First, can they act to

bolster output levels over the longer

term? Second, can they increase their

economies’ resilience and inclusiveness

while reducing the likelihood that the

current upswing ends in an abrupt

slowdown or even a new crisis?

These two challenges are closely

interrelated. Today’s favorable

economic conditions provide a

window of opportunity for policies

that can meet both.

The key to improving long-run

growth prospects and perceived

fairness is investment in people.

Educational investment increases

workers’ productivity and ability to

navigate structural transformation,

whether due to trade or technology.

Apprenticeship programs, moreover,

can save resources wasted through

high youth unemployment, while

counseling and retraining can

prolong working lives. Conversely,

failure here would be destabilizing,

as weak job prospects and income

inequities would fuel a stronger voter

backlash against multilateralism in

international relations and prudent

economic policies at home.

As essential as these investments

are, they require fiscal outlays. To

avoid inflating already-high publicdebt

burdens, governments will need

to reform tax regimes, enhancing

revenues without discouraging

growth.

Tax systems should be designed

to increase inclusion, not least by

promoting labor-force participation.

And citizens will have more

the channels for tax avoidance used

by big corporations and the rich are

.

Greater economic resilience is

.A

wane, financial instability poses an

increasing threat. Many countries

improved their macro-prudential

frameworks after the crisis, including

by raising banks’ capital and liquidity.

The prolonged period of low interest

rates following the crisis has,

however, led to a search for yield and

global debt buildup that could prove

problematic for some borrowers

once interest rates rise.

Several economic studies,

including from the IMF, suggest

that even if debt booms are

associated with faster growth in

the short run, they often end in

tears. Some countries must rein in

excessive credit growth and reduce

issuance, while others still need to

address the bad loans left behind by

previous recessions. Countries should

strengthen financial oversight as

OUR ECONOMIES

well as their international regulatory

cooperation, thereby avoiding a race

to the bottom in prudential policy.

Emerging and low-income

economies face some challenges

that resemble those in advanced

economies.

China’s leaders, for example,

have recognized the imbalances

in the country’s financial system

and are moving to address them.

But several challenges are distinct.

Notwithstanding the recent uptick

in commodity prices, commodityproducing

countries need to diversify

their economies’ export mixes to

support future growth.Because the

current upswing is broad, the moment

is also ripe for action on a range of

multilateral priorities. Probably the

most urgent of these is to slow longterm

climate change resulting from

dependence on fossil fuels.

IMF research shows how

vulnerable low-income countries are

to the likely temperature increase

over the rest of this century, even

if the 2015 Paris climate agreement

achieves its goal of holding the

increase to less than 2º Celsius above

pre-industrial levels. But advanced

economies are vulnerable as well,

including through the spillovers of

political instability and mass migration

originating in warmer regions. It is

in their interest to embrace more

ambitious emissions targets and aid

low-income countries’ adaptation

.

The bottom line is that reveries of

an economic sweet spot risk lulling

policymakers into a false sense of

security. Current good times are most

likely temporary – indeed, the forces

producing this upswing may not last

much longer. To make the recovery

more durable, policymakers should

seize the current opportunity and

reform while they still can. Otherwise,

the future may be closer than we

think.

OUR WORLD | 2018

Copyright: Project Syndicate, 2018. www.project-syndicate.org

57