MIPIM 2023 Digital Edition

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>MIPIM</strong> <strong>2023</strong>: Special digital edition for a sustainable real estate industry<br />

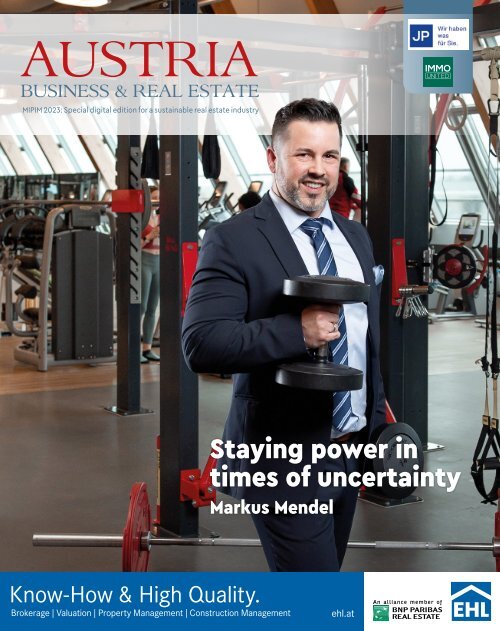

Staying power in<br />

times of uncertainty<br />

Markus Mendel<br />

Know-How Wir leben Immobilien. & High Quality.<br />

Brokerage Vermittlung | Valuation | Verwaltung | Property | Bewertung Management | Baumanagement<br />

| Construction Management<br />

ehl.at ehl.at

04 ImmoFokus<br />

CARE Österreich<br />

CO2-neutral

Worte füllen keine Hilfspakete.<br />

Ihre Spende schon.<br />

Ausgabe 01|<strong>2023</strong> 05<br />

paket.care.at

Investing in Austria<br />

42 Turnaround on the<br />

investment market<br />

10<br />

Staying power in<br />

times of uncertainty<br />

Interview with<br />

Markus Mendel<br />

28 Certifications & Co.<br />

Orientation Guide<br />

or Advertising Gag?<br />

<strong>2023</strong><br />

<strong>MIPIM</strong><br />

Column<br />

Investing in Austria<br />

08 EDITORIAL<br />

86 IMPRINT<br />

10 STAYING POWER IN TIMES<br />

OF UNCERTAINTY<br />

Interview with Markus Mendel<br />

22 THE STRATEGIST<br />

Interview with Sebastian G. Nitsch<br />

28 REAL CIRCLE #30<br />

Certifications & Co.: Orientation Guide<br />

or Advertising Gag?<br />

42 AUSTRIAN INVESTMENT MARKET<br />

48 OFFICE MARKET IN VIENNA<br />

50 LOGISTICS / INDUSTRIAL MARKET<br />

IN VIENNA<br />

52 RESIDENTIAL PROJECTS IN THE PIPELINE<br />

70 IMMOVISION <strong>2023</strong><br />

Highlights and trends<br />

Fotos: BTL Media, Gugumuck, Adobe Stock<br />

06 ImmoFokus

Investing in Austria<br />

Join us at<br />

<strong>MIPIM</strong>, Cannes,<br />

14.–17.3.<strong>2023</strong>,<br />

stand R7.E2,<br />

Espace Riviera<br />

Let’s build Central<br />

Europe together.<br />

Real estate financing and project development requires<br />

more than just knowledge: It requires a partner who<br />

believes in your projects just like you do. That’s why Erste<br />

Group Commercial Real Estate focuses its services on a<br />

wide variety of offerings beyond just financial solutions.<br />

Time to believe. Time to invest.<br />

07 ImmoFokus<br />

www.erstegroup.com/cre

Investing in Austria<br />

You can‘t do<br />

without it<br />

„„Thanks to EU-<br />

Taxonomy and ESG<br />

criteria, there is no way<br />

around certifications.“<br />

Know-How Wir leben Immobilien. & High Quality.<br />

Vermittlung | Verwaltung | Bewertung | Baumanagement<br />

Brokerage | Valuation | Property Management | Construction Management<br />

Wir leben Immobilien.<br />

Vermittlung | Verwaltung | Bewertung | Baumanagement<br />

Staying power in<br />

times of uncertainty<br />

Markus Mendel<br />

ehl.at<br />

ehl.at<br />

ehl.at<br />

A<br />

t the <strong>MIPIM</strong> 2022, it was not<br />

a great topic of conversation<br />

just yet. In fact, few people<br />

gave it a second thought.<br />

After all, everyone was just happy to be back<br />

in Cannes after a year‘s break due to Covid.<br />

Frankly, it didn‘t come as a complete surprise<br />

- as we all know, it is particularly easy to be<br />

wise after the event - but on the other side of<br />

the Atlantic, the Federal Reserve had already<br />

sent out signals to this effect in 2021. We are<br />

talking about the interest rate turnaround<br />

initiated by the ECB last summer, with several<br />

steps in quick succession. It left hardly a<br />

stone unturned in the real estate sector.<br />

The state of shock in the real estate investment<br />

market, which has set in across Europe<br />

since the summer of 2022, is only slowly beginning<br />

to dissipate. The repricing process<br />

is still underway, and there continues to be a<br />

significant gap in the price expectations between<br />

the sellers and the buyers. Particularly<br />

in an environment characterized by question<br />

marks and uncertainties, industry events<br />

such as <strong>MIPIM</strong> are particularly importance.<br />

Here we have the unique opportunity to get<br />

together, to sound out what is possible, to<br />

establish or maintain contacts and possibly<br />

even to initiate deals. It is not without good<br />

reason that the <strong>MIPIM</strong> is considered the<br />

world’s leading real estate exhibition.<br />

As the most relevant domestic medium for<br />

real estate investments, ImmoFokus continues<br />

to be present at <strong>MIPIM</strong>, of course. With<br />

this publication, we would like to take the opportunity<br />

to introduce ourselves to the new<br />

participants and naturally to accompany old<br />

acquaintances once again during their rewarding<br />

stay in the South of France.<br />

The special edition of ImmoFokus on the<br />

occasion of <strong>MIPIM</strong> <strong>2023</strong> has a lot to offer in<br />

any case: In a short report, we inform about<br />

the latest developments on the Austrian real<br />

estate investment market and venture an<br />

outlook for the rest of <strong>2023</strong>. We have asked<br />

real estate investment experts on page XX for<br />

an even closer look into the future. And in a<br />

very personal cover interview, Markus Mendel<br />

gives us a glimpse into his daily routine as<br />

an investment broker at market leader EHL<br />

Investment Consulting.<br />

Michael Neubauer<br />

Herausgeber<br />

08 ImmoFokus

Investing in Austria<br />

Join us at<br />

<strong>MIPIM</strong>, Cannes,<br />

14.–17.3.<strong>2023</strong>,<br />

stand R7.E2,<br />

Espace Riviera<br />

Take new<br />

perspectives on<br />

real estate financing.<br />

We see the big picture and manage the details<br />

that are necessary to develop commercial real<br />

estate projects all over Central and Eastern Europe.<br />

Erste Group offers financing solutions for your<br />

visions across the entire real estate value chain.<br />

Time to believe. Time to invest.<br />

09 ImmoFokus<br />

www.erstegroup.com/cre

Investing in Austria<br />

Markus Mendel<br />

Born in Bavaria, Markus Mendel studied<br />

business administration, specializing<br />

in real estate and financial<br />

services in Stuttgart and started<br />

his career in leading German real<br />

estate companies back in 2004.<br />

In 2011, he then took on a senior<br />

position at PwC, where he was<br />

most recently a senior manager in<br />

the Real Estate Advisory division.<br />

He changed to EHL Investment<br />

Consulting at the beginning of<br />

2015, where he took over as head<br />

of the Transaction Advisory division.<br />

In 2020, Markus Mendel was<br />

appointed Managing Director of<br />

EHL Investment Consulting GmbH,<br />

which is part of the EHL Group.<br />

10 ImmoFokus

Staying power in<br />

times of uncertainty<br />

A man with endurance. „I assume that this year we will see significantly more investors from the international<br />

sector, especially also from the Anglo-Saxon region in Austria due to the changed yield situation, says Markus<br />

Mendel in an interview with ImmoFokus. The native Bavarian draws strength from (almost) daily fitness training.<br />

The interview was conducted by: Patrick Baldia und Michael Neubauer<br />

Is it true that you are passionate about<br />

going to the gym? How do you get into<br />

this hobby?<br />

Markus Mendel: II think you simply need<br />

a sensible balance to office work, the many<br />

evening events and the frequent client<br />

meetings over lunch or dinner. The good<br />

thing about the gym is that you can always<br />

go, almost around the clock and in any<br />

weather, which makes it very accessible. In<br />

addition, a large circle of friends also go to<br />

the gym regularly. That makes it even easier<br />

and keeps motivation high.<br />

Do you go to the gym every day?<br />

If I can, I try to. In the past few weeks, I‘ve<br />

actually been to the gym almost every day,<br />

always in the morning at 6 a.m. even before<br />

the workday starts. But of course, you also<br />

miss out occasionally. For example, when<br />

you‘re at a trade show or an evening event<br />

has gone on a bit longer again.<br />

Does the gym help you with your other<br />

great passion, motorcycling? I‘ve been<br />

told that it can also be quite strenuous ...<br />

It depends on how you ride. But yes, riding a<br />

motorcycle is not only relaxing, it can also be<br />

quite exhausting, especially if you like to ride<br />

in the mountains and on the serpentines in<br />

curving terrain, which is often the case with me.<br />

So, you take holidays on your bike?<br />

Yes. For the past 15 years, I have been going<br />

on a motorcycle tour lasting several days<br />

with a larger group of long-time friends<br />

every year at the end of June or the beginning<br />

of July. We usually head for the mountains<br />

and often south to Italy, to Lake Garda, for<br />

example. A tour like this is an excellent way<br />

to switch off and enjoy the surroundings, but<br />

you‘ll also find plenty of riding challenges in<br />

the winding regions.<br />

That sounds a bit risky. Has anything ever<br />

happened to you?<br />

It‘s undoubtedly one of the slightly riskier<br />

hobbies. And yes, something has happened<br />

to me before. A few years ago, I suffered<br />

a few of fractures in a fall. Unfortunately,<br />

something like that can happen, even if it<br />

shouldn‘t. But I also have to say that I was<br />

younger then and certainly took more risks<br />

than I do now. You learn from experiences<br />

like that.<br />

What can you take away from the gym<br />

or the back of the motorcycle into the<br />

professional world?<br />

What you can certainly take away from<br />

riding a motorcycle is that you can go full<br />

throttle, but at the same time, you have to<br />

have the risk under control if you want to<br />

last in the long term. I think this is a very<br />

important point. In the gym, or in sports<br />

in general, you need motivation, stamina,<br />

and endurance to achieve your goals, which<br />

doesn‘t happen overnight. That definitely<br />

helps me on the job as well.<br />

Do you have a dream bike?<br />

I do, actually. I bought it at the end of last<br />

year. Unfortunately, it‘s now sitting in the garage<br />

and of course, couldn‘t even be broken<br />

in yet in winter, but that will change soon.<br />

How do you break in a motorcycle?<br />

You ride a thousand kilometers at a maximum<br />

of six and a half thousand revolutions.<br />

To be more precise, first you go a bit easy<br />

on the road and then, after a thousand<br />

kilometers and the first service, you go into<br />

full gear.<br />

Can you still remember the first transaction<br />

in which you played a significant role?<br />

One of the first major transactions I was<br />

involved in during my professional life<br />

occurred in Germany. It involved the acquisition<br />

of an extensive residential portfolio.<br />

For me, it was a completely new field and<br />

absolutely exciting. It‘s something I‘ll<br />

always remember, and I‘m sure it sparked<br />

my enthusiasm for the job.<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

11

Investing in Austria<br />

How did you end up in the real estate<br />

industry?<br />

I have always been interested in real estate.<br />

In course of my studies, I also focused on real<br />

estate management and financial services<br />

and then stayed in the field. In the beginning,<br />

I concentrated on valuations. That‘s how I got<br />

into it. Then I quickly moved into international<br />

business in the transaction area.<br />

Later, at PwC, the consulting focus became<br />

more significant. But for me, the transaction<br />

business is still the most exciting field in the<br />

real estate industry.<br />

Do you have a particular favorite asset<br />

class?<br />

No particular asset class. What I personally<br />

like best are the unusual transactions. In<br />

other words, not the tenth residential or<br />

office property with the same pattern. That‘s<br />

also interesting, of course, and you learn<br />

something new with every transaction. But<br />

especially in turbulent times on the market,<br />

as we are experiencing right now, there are<br />

also deals that are a bit more complicated<br />

and complex. You have to be a bit creative in<br />

your approach and find solutions to challenging<br />

issues. For me, deals like that are the<br />

cherry on the cake.<br />

At last year‘s Expo Real, there was of a<br />

feeling that the atmosphere in Germany<br />

was one of disaster. The Austrian, on the<br />

other hand, as the famous popular saying<br />

goes, likes to say that the situation is not<br />

hopeless but serious. Are the Germans<br />

more pessimistic?<br />

Well, as a German optimist, I wouldn‘t agree<br />

with that. But I do believe that Germans<br />

are very fact orientated. Based on the facts<br />

and figures, conclusions are drawn, and the<br />

mood then tips in one direction or the other.<br />

The Austrians, as I have experienced it and<br />

as I like it, also concentrate on facts, but<br />

they approach things with a certain cynical<br />

charm and therefore tend to come across a<br />

bit more positively. But not every German is<br />

so pessimistic that he’s ready to throw in the<br />

towel. You can see that on the market at the<br />

moment. Some German investors who are<br />

active despite the current difficult market<br />

circumstances, with whom we are examining<br />

and also implementing transactions.<br />

Therefore, I think it very much depends on<br />

one’s personality - whether you see the glass<br />

half full or half empty.<br />

How did you come to work at EHL?<br />

The contact came about during my time at<br />

PwC and it was through the valuation team<br />

at EHL. We sat down together and chatted.<br />

Then I had a conversation with Michael Ehlmaier<br />

and Franz Pöltl, in which we found out<br />

quite quickly that we might be a good fit and<br />

could do something together in the future.<br />

As the saying goes, we then actually sketched<br />

out on a blank sheet of paper the direction in<br />

which the collaboration could go. And that‘s<br />

exactly the direction it took. I still have the<br />

paper at home, by the way.<br />

What convinced you to make a move to<br />

EHL back then?<br />

I was impressed by the fact that I came from a<br />

rather large company background, where many<br />

things were very bureaucratic and sometimes<br />

quite complicated, and that at EHL everything<br />

could be decided very quickly and efficiently,<br />

and in a highly professional manner. That was<br />

the deciding factor; I took the job and was able<br />

to become part of this powerful team.<br />

12 ImmoFokus

What has been your biggest deal so far?<br />

We were involved in the purchase of Icon Vienna<br />

by Allianz Real Estate and the DC Tower<br />

by Deka. Quartier Lassalle is also definitely<br />

one of them. However, it is not only the large<br />

transactions that attract a lot of attention<br />

in the media that give you a lot of pleasure.<br />

Many transactions that often go unnoticed<br />

can make you particularly proud.<br />

„You have to be<br />

very fast and<br />

efficient to be able<br />

to do a deal off<br />

market.“<br />

Markus Mendel,<br />

EHL Investment Consulting<br />

How do you prepare for such deals? How<br />

much teamwork goes into it?<br />

It always depends on the way something<br />

is being sold. It can happen in a structured<br />

bidding process, private sale, or entirely<br />

off market and, of course, it has an impact<br />

on the workload. Our investment team is<br />

genuinely the absolute mainstay and the<br />

secret of our success because this is where<br />

we prepare and structure what is then used<br />

for underwriting by the investors. This has to<br />

happen professionally and quickly.<br />

Is it more interesting to work for the<br />

buyer or the seller?<br />

It can be exciting for one as well as for the<br />

other. Of course, it is most exciting when<br />

you initiate the deal yourself. Then we are<br />

particularly happy.<br />

There is probably little reason to be happy<br />

at the moment, or is something happening<br />

off market?<br />

I disagree with the general pessimism that<br />

can be discerned at the moment. Obviously,<br />

fewer transactions are taking place. The<br />

big names among investors, i.e., the core<br />

capital is much more cautious than usual,<br />

and there is a lot of uncertainty about how<br />

the markets will develop, driven by the<br />

continuing interest rate hikes. But we are<br />

seeing first first-hand that a lot is happening<br />

at a lower price level and with alternative<br />

investors. So, the investment market has<br />

not ground to a standstill. As is the case in a<br />

changing market environment, new opportunities<br />

are simply emerging and there will<br />

be winners and losers, but the transactions<br />

will remain.<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

13

Investing in Austria<br />

„Of course, it is most<br />

exciting when you initiate<br />

the deal yourself. Then we<br />

are especially happy.“<br />

Markus Mendel,<br />

EHL Investment Consulting<br />

14 ImmoFokus

<strong>MIPIM</strong> | <strong>2023</strong><br />

15

Investing in Austria<br />

Does it take longer to complete deals in<br />

market phases like the current one?<br />

Transactions are definitely taking longer at<br />

the moment. And the more time that passes,<br />

the more can happen. This also increases the<br />

risk of another interest rate adjustment or something<br />

else happening. In other words, if it<br />

usually takes two to three months on average<br />

to complete a deal, it‘s currently perhaps four<br />

to six. Financing in particular takes longer.<br />

And when you are close to the finish line<br />

at the end of the day and find out that the<br />

financing has fallen through, that is of course,<br />

highly annoying to all parties involved.<br />

Is it true that some sellers only start<br />

negotiating with secured financing?<br />

In the current situation, securing financing<br />

is particularly important for the seller, as it is<br />

not uncommon for financing requested by the<br />

buyer to end up not being approved or not approved<br />

as planned. As a seller, you understandably<br />

want to make sure that your counterpart,<br />

to whom you are also granting exclusivity and<br />

thus rejecting other investors, can also handle<br />

the deal financially at the end of the day and<br />

that you are not entering negotiations in vain.<br />

At the moment, there is optimism in the<br />

industry that something is moving with<br />

the KIM regulation, regarding the ban on<br />

interim financing. Do you see it that way<br />

as well?<br />

I think it‘s obvious that something has to<br />

change here. If it is no longer possible for<br />

people to acquire property, or if the KIM<br />

Regulation creates such major obstacles,<br />

then that is not a healthy development.<br />

Particularly when you talk about interim<br />

financing, this is really incomprehensible: If,<br />

for example, you have already built up real<br />

estate assets or an extensive stock portfolio<br />

and thus clearly have a credit rating that can<br />

be financed, the KIM Regulation prevents financing<br />

from taking place if you do not have<br />

an additional 20% equity capital, a paradoxical<br />

situation. Although banks are allowed to<br />

finance such borrowers to a certain extent,<br />

this quota is exhausted relatively quickly.<br />

What would be the impact on the market<br />

of lifting the ban on interim financing?<br />

First and foremost, something that was<br />

created by regulation and hinders the market<br />

would be abolished. However, it remains to<br />

be seen whether the market would then be<br />

noticeably boosted because the increased<br />

interest rates are not exactly conducive to<br />

transaction activity either.<br />

Should the legislature not consider how<br />

to help people to raise the 20 percent<br />

equity? If one asks around, one gets the<br />

distinct impression that above all younger<br />

people cannot afford a loan.<br />

To begin with, it is difficult for many people<br />

to raise even 20 percent of their own capital.<br />

But that‘s not the main reason why you can‘t<br />

get a loan. In many cases, there are still<br />

moms, dads, grandmas and grandpas who<br />

can help out if you can’t raise this 20 percent<br />

on your own. A bigger hurdle is the debt<br />

service ratio of 40 percent, which may not<br />

be exceeded. This often hinders the process<br />

even more.<br />

Various sources currently tell us that the<br />

cycle of interest rate hikes should come<br />

to an end in the first half of the year. Is<br />

that realistic, or will the interest rates stay<br />

higher for much longer?<br />

I assume that we will see a few more interest<br />

rate hikes this year, as announced. The next<br />

one in March. Over the course of the year, we<br />

will see at least one more interest rate step,<br />

so we can assume that interest rates will not<br />

only move up insignificantly but noticeably.<br />

With what consequences?<br />

As you know, the capital market has a<br />

significant impact on the real estate industry,<br />

especially in the institutional sector. And<br />

when interest rates are higher, alternatives to<br />

real estate investments also become attractive.<br />

When I look at German government<br />

bonds, for which you currently get around<br />

2.6 percent, or bonds from the USA, which<br />

even offer up to four percent. Not to mention<br />

good corporate bonds. That sends clear<br />

signals to large investors and financial intermediaries<br />

with broad investment spectrum.<br />

At present, they often prefer to look at more<br />

liquid asset classes, some of which offer<br />

higher returns than real estate. While real<br />

„Raising even 20 percent equity<br />

is difficult for many. But that‘s<br />

not the decisive issue why some<br />

people can‘t get a loan.“<br />

Markus Mendel,<br />

EHL Investment Consulting<br />

estate investments will never go out of style,<br />

they will have to offer different yields to be<br />

competitive. After all, one must remember:<br />

It‘s not just the brick I buy that counts, but<br />

also how much interest I have to pay to afford<br />

the brick or finance it.<br />

Because you are talking about other<br />

yields, do you see that the situation is<br />

slowly normalizing in asset classes such<br />

as logistics, where yields approached<br />

those of residential properties in the wake<br />

of the Corona crisis?<br />

Of course, logistics properties are also in demand<br />

again at significantly different prices.<br />

Many investors are not only active in Austria<br />

but also on a European level or at least in<br />

16 ImmoFokus

WORDRAP MIT MARKUS MENDEL<br />

Are you a<br />

risk taker?<br />

As long as it<br />

is calculable<br />

Favorite hobbies?<br />

Riding motorcycles<br />

and going to<br />

the gym<br />

Your favorite way<br />

to drink coffee<br />

Milk without sugar<br />

Morning or<br />

evening person?<br />

Definitely<br />

morning<br />

person<br />

Which book is<br />

on your desk?<br />

My notebook<br />

In the next ten years,<br />

I would definitely like to...<br />

… Take a trip<br />

around<br />

the world<br />

When you turn<br />

on the radio in the car,<br />

what‘s playing?<br />

Kronehit<br />

How did you earn<br />

your first money?<br />

Changing tires in a<br />

car repair shop<br />

If you won the lottery,<br />

what would you do?<br />

Treat myself to<br />

a longer vacation<br />

Your biggest vice?<br />

All types<br />

of sweets<br />

With whom (living or deceased)<br />

would you like to<br />

spend an evening?<br />

Steven Spielberg<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

17

Investing in Austria<br />

18 ImmoFokus

German-speaking countries. And if a very<br />

good, long-term leased logistics property in<br />

a suitable location can now be obtained in<br />

Germany for five percent, then it is not the<br />

case that you can score in Austria with four<br />

or three percent. That will no longer work.<br />

Above all, it doesn‘t pay off if you have to<br />

take out financing at the current conditions.<br />

Do you think that with higher yields, we<br />

will see other international investors and<br />

not just mainly Germans in Austria?<br />

That is an exciting question. I expect that<br />

this year, due to the change in the yield<br />

situation, we will see more investors from<br />

the international sector than has been the<br />

case so far. The Austrians and Germans,<br />

who have dominated the market so far, have<br />

been very core-oriented, or more precisely,<br />

very conservative. If the market continues to<br />

change and issues such as ESG become more<br />

important, which is why old office properties<br />

are being brought up to date or at least<br />

to a newer standard, then classic value-add<br />

investors will come into play. These will still<br />

come from Austria and Germany, but also<br />

increasingly from the Anglo-Saxon region.<br />

We have seen fewer of them in this country<br />

in recent years.<br />

Because you mentioned ESG - are the<br />

investors you work with also interested<br />

in the S and the G?<br />

Absolutely, not just in the institutional sector<br />

but also with family offices and private<br />

investors. Among other things, investors<br />

are having a closer look at tenants. Suppose<br />

they come across companies that demonstrably<br />

violate environmental goals, child labor,<br />

or the like. In that case, they think twice<br />

about buying anyway, or at least a plan is<br />

worked out to compensate for this deficit on<br />

the ESG scale, i.e., to find new tenants.<br />

Actually, several industries can be seen<br />

unfavorably, not just arms manufacturers<br />

and the like. For example, companies that<br />

sell goods that have been produced in<br />

countries with demonstrably poor working<br />

conditions, child labor, etc....<br />

This is true and is already being considered<br />

very closely. It can be assumed that such<br />

constellations will no longer be acceptable<br />

for investors and owners in the course of the<br />

further development of the EU taxonomy and<br />

that the players will react accordingly. One<br />

quickly realizes that one is in a very complex<br />

environment in which not everything has<br />

been settled yet. There is certainly still work<br />

to be done here.<br />

You said earlier that you are currently also<br />

handling or processing new projects that<br />

have only become available in <strong>2023</strong>. What<br />

asset classes are these?<br />

These are more or less widely diversified.<br />

There is a lot of office, and I think we will<br />

see a lot of office transactions this year -<br />

even more than in the last few years, when<br />

residential was the dominant asset class. But<br />

we will also see transactions in the hotel and<br />

retail sectors, where very little has happened<br />

in recent years. Of course, investors are also<br />

interested in residential, but there is considerable<br />

reluctance here at the moment due<br />

to the substantial change in interest rates.<br />

Overall, the transaction market has not come<br />

to a standstill. Transactions are just taking<br />

place at different price levels. There is still<br />

the demand and the capital, and those have<br />

to be brought together to get a deal done at<br />

the end of the day.<br />

Why is residential currently less in<br />

demand from global investors?<br />

Residential is complex. The large residential<br />

projects that worked very well in the past in<br />

the headwind of the market hardly exist anymore.<br />

Those who have bought land recently<br />

have paid very high prices for it. At the same<br />

time, construction costs are still high, even if<br />

the situation has eased somewhat, but not to<br />

the extent that some had hoped. In addition,<br />

financing costs have risen significantly.<br />

Many project developers were hopeful that<br />

the market environment of recent years<br />

would continue. That is, you buy, you file,<br />

and develop the project a month or two later<br />

with no financing costs. That business model<br />

no longer works. Money costs money again.<br />

And the exit, which was estimated at three<br />

percent, is also no longer happening or is<br />

becoming increasingly difficult. In other<br />

words, it‘s painful in all directions. That‘s<br />

why there are fewer projects on the market,<br />

„Many project developers<br />

were hopeful that the market<br />

environment of the last few years<br />

would continue. That hope has not<br />

materialized.“<br />

Markus Mendel,<br />

EHL Investment Consulting<br />

and some of them are not even being built<br />

because people know that it‘s not profitable<br />

at the moment.<br />

Perhaps alternative financing had also<br />

been used ...<br />

Exactly Suppose you financed adventurously,<br />

for example, with short-term mezzanine capital<br />

or often simply with variable financing<br />

at initially favorable conditions. In that case,<br />

many market participants are now experiencing<br />

that the financing costs are exploding.<br />

Is mezzanine capital now osolete or is it<br />

getting a new boost?<br />

It will not happen that mezzanine capital<br />

costs will stay the same as before; they will<br />

rather gradually become more expensive,<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

19

Investing in Austria<br />

„<strong>MIPIM</strong> is a<br />

fixed date on our<br />

schedules, just<br />

like Expo Real.“<br />

Markus Mendel,<br />

EHL Investment Consulting<br />

of course. I‘m sure that some investors will<br />

continue to be forced to tap an alternative<br />

source of financing, and mezzanine capital is<br />

simply one of them.<br />

Last question: What will we see at<br />

<strong>MIPIM</strong>? Filled halls, lots of people?<br />

I rather believe that we will see significantly<br />

fewer visitors at <strong>MIPIM</strong> this year, especially<br />

also fewer exhibitors or fewer employees<br />

of the participating companies. I hear from<br />

many that they are going to Cannes with a<br />

significantly reduced team. Nevertheless,<br />

I believe that those who are there will not<br />

be there for the fun of it, but to do business.<br />

<strong>MIPIM</strong> is a fixed date on our schedules, just<br />

like Expo Real, to discuss transactions and<br />

opportunities with those present. I do expect<br />

that we will also initiate one or two deals this<br />

year and meet new investors as well. <br />

20 ImmoFokus

<strong>MIPIM</strong> | <strong>2023</strong><br />

21

Investing in Austria<br />

The strategist<br />

Quarter Fund: 6B47 launches „Althan Quarter“ as German<br />

“6B47 Stadtquartiere I” fund. Sebastian G. Nitsch, CEO of 6B47<br />

Real Estate Investors, on entering the world of institutional<br />

investment products. „Urban quarters are in line with the sign<br />

of the times and focus in particular on risk diversification,<br />

sustainability and location quality.“<br />

The interview was conducted by: Michael Neubauer<br />

22 ImmoFokus

With „6B47 Stadtquartiere I“, 6B47 is<br />

entering the world of institutional investment<br />

products. Is the fund because, apart<br />

from a few deals, nothing is happening on<br />

the transaction market at the moment?<br />

Sebastian G. Nitsch: No. The fund was<br />

strategically planned for a long time. Initial<br />

considerations were made long before the war<br />

in Ukraine. With the ‚6B47 Stadtquartiere I‘<br />

fund, we are expanding our business activities<br />

in the direction of investment management -<br />

an essential logical step for 6B47.<br />

Why a fund focusing on „urban quarters“<br />

in particular - doesn‘t that restrict you?<br />

The strategic orientation of the neighborhood<br />

fund is in line with the sign of the times and<br />

focuses in particular on risk diversification,<br />

sustainability and location quality.<br />

We are bringing the „Althan Quarter“ into the<br />

fund as a seed investment, which already meets<br />

all the strategic objectives from the outset.<br />

What is the target fund volume?<br />

The planned fund volume of our first real<br />

estate special AIF is 800 million Euros.<br />

Why was the fund approved in Germany?<br />

Our target group is investors from Germanspeaking<br />

countries. The service KVG model we<br />

use for our fund, has already been established<br />

in Germany for years. Moreover, the number of<br />

potential future investors in Germany is simply<br />

higher than in Austria. But of course, we will<br />

also offer Austrian institutional investors a<br />

stake in our fund.<br />

We are very well positioned when it comes to<br />

ESG and EU taxonomy. Oliver Julian Huber<br />

joined our team at the beginning of the year<br />

million Euros with that, that‘s a different product.<br />

For the Real Estate Club, condominium<br />

projects are the most suitable. These are of no<br />

interest to institutional investors.<br />

In other words, you will go on as before …<br />

Absolutely. Absolutely. We have seen in<br />

recent years that if we can sell something for<br />

a two-and-a-half percent return but, on the<br />

other hand, get 16, 17, or 18 Euros in rent - we<br />

would rather build rental apartments. I have<br />

the feeling that there is no objective scientific<br />

analysis of the fact that too few condominiums<br />

„We will significantly expand<br />

our quarters pipeline. Our<br />

„neighborhood share“ is already 58<br />

percent of our total floor space.“<br />

Sebastian G. Nitsch,<br />

Real Estate Investors AG<br />

Fotos: @Rizar.Photo<br />

Why as an open-end fund?<br />

To be able to successively add further neighborhood<br />

projects with a high residential share<br />

in the Core and Core Plus risk classes to the<br />

portfolio. This means the investments will<br />

focus mainly on prime locations in Austrian<br />

and German metropolitan areas.<br />

We will significantly expand our quarters pipeline.<br />

We already have a “neighborhood share”<br />

of around 58 percent of our total floor space,<br />

which will probably be around 75 percent or<br />

higher in just a few years‘ time.<br />

Can we see quarters as a new asset class?<br />

Until now, quarters was not considered as a<br />

separate asset class. Now it is an asset class in<br />

its own right and is particularly attractive for<br />

institutional investors for reasons of risk diversification.<br />

And as far as I can assess the market<br />

at the moment, we are the only providers who<br />

can already come up with a high-class quarter<br />

as a seed investment.<br />

as Head of Corporate Sustainability & ESG.<br />

His main task is to develop our strategic focus<br />

on sustainability for the entire Group in all<br />

countries and also to forge this ahead at the<br />

project level. He is also the contact person for<br />

topics such as EU taxonomy, ESG reporting and<br />

building certification.<br />

Does this mean the end for the 6B47 Real<br />

Estate Club?<br />

The Real Estate Club was founded to give investors<br />

the opportunity to make very transparent<br />

real estate investments together with a professional<br />

investor. This direction has not changed.<br />

You have to look at the Real Estate Club in asset<br />

class-specific terms. Our Real Estate Club is<br />

what brought us here. We value it very much<br />

and have had 13 years of good experience. It<br />

always depends a little bit on the asset class and<br />

the size. If I have a large international fund and<br />

say we‘re building a pipeline of three hundred<br />

have been built. Some developers may now<br />

change their minds because the return on sales<br />

is now three and a half percent, but the rent is<br />

15 Euros - roughly corresponding to a capitalization<br />

of five thousand Euros per square meter.<br />

However, I currently achieve a higher average<br />

price per square meter in individual apartment<br />

sales.<br />

Given the troubled situation - war in<br />

Ukraine, high interest rates, sharply rising<br />

construction costs - is this an ideal time for<br />

the fund?<br />

Of course we have asked ourselves this question.<br />

The fund offers the historic opportunity to<br />

leave the neighborhood as a neighborhood and<br />

not to sell off the separate sections individually.<br />

Were individual sales up for discussion?<br />

In times like these, you calculate and think<br />

through every scenario. Despite a large number<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

23

Investing in Austria<br />

of attractive buying offers, we decided not to<br />

sell the Althan Quarter with its four project<br />

sections, the residential buildings Sophie and<br />

Joseph, the hotel, and Francis as the centerpiece.<br />

If we had removed the residential section<br />

and switched to individual apartment sales, we<br />

might have earned more on this one section.<br />

We are taking this step not only because we<br />

do not want to let the property out of our<br />

hands but also because of very sober economic<br />

facts: The high demand for high-quality space<br />

and the established location in the heart of<br />

Vienna are the ideal prerequisites for a positive<br />

performance.<br />

The focus was on strategic considerations:<br />

Do we, as 6B47 want to take this next step of<br />

evolution and develop into an investment<br />

and asset manager? I believe that after 13<br />

years and with over 80 projects, we have<br />

already proved our project development<br />

competence. In order to be able to offer our<br />

future investors the best possible investment<br />

and asset management services, we are<br />

launching our fund together with Jones Lang<br />

LaSalle Asset Management GmbH, which<br />

already has many years of experience in this<br />

field. The fund is administered as a service<br />

KVG by IntReal, International Real Estate<br />

Kapitalverwaltungsgesellschaft in Hamburg,<br />

the German market leader in this field. As a<br />

team, the ideal trio.<br />

What is the minimum designated denomination?<br />

In principle, the Core or Core Plus segment is<br />

designed as an open-end fund for professional<br />

and semi-professional investors. The minimum<br />

denomination is twenty million Euros.<br />

If I could wish for something as 6B47, it would<br />

be more in the direction of a club deal, six to<br />

eight or perhaps ten institutional investors<br />

with tickets of around fifty million Euros.<br />

What rate of return can investors expect?<br />

The Internal Rate of Return, which we<br />

currently calculate over ten years, is seven to<br />

eight percent. The distribution yield will be<br />

above four percent.<br />

Are there already potential investors?<br />

We have not yet started funding. Initial talks<br />

are planned for the <strong>MIPIM</strong>. But I am sure we<br />

will be fully financed when construction is<br />

completed in 2024. We are beginning extra<br />

early. Even if institutional investors aren’t<br />

currently making any decisions, they are<br />

thinking about where they want to invest and<br />

how they want to allocate.<br />

24 ImmoFokus

Is everything going according to plan with<br />

the subprojects?<br />

Everything according to plan. We are even a<br />

little ahead of schedule.<br />

Is it because other developers have stopped<br />

their projects and the construction companies<br />

have spare capacities?<br />

You‘ll have to ask the construction companies<br />

about that. Of course, we are pleased to be on<br />

schedule and within budget.<br />

How do you assess the current market<br />

situation?<br />

It‘s like skiing in the fog. That means we have<br />

to remain flexible in our knees and perhaps<br />

also be prepared to make a sharp turn to the<br />

left or the right because we don‘t see the tree<br />

until very late. I haven‘t always considered<br />

everything to be rosy. But I also don‘t see<br />

everything quite as pitch black as many<br />

others do. At the moment, I prefer to remain<br />

below the radar and see what opportunities<br />

are out there.<br />

We are not active only in the acquisition,<br />

market participants are also approaching<br />

us. We‘ve also offered one or two mezzanine<br />

capital funds to come in as developers on<br />

existing projects to work out a joint compensation<br />

model. The worst thing that can happen<br />

6B47 Real Estate Investors<br />

6B47 Real Estate Investors is an internationally oriented real estate developer<br />

based in Vienna with offices in Düsseldorf, Berlin, Munich, and<br />

Warsaw and focuses its business activities on metropolitan regions in<br />

Austria, Germany, and Poland. The company currently manages a project<br />

volume of around EUR 2 billion, making it one of the leading providers<br />

in the sector in Austria, Germany, and Poland. The services cover the<br />

entire value chain, from project development to realization and utilization.<br />

The company‘s business model also includes real estate financing as an<br />

integral part of project development.<br />

www.6B47.com<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

25

Investing in Austria<br />

to an investor is a half-finished product. some<br />

projects that are bequeathed to the funder because<br />

the project developer is no longer there.<br />

That‘s where you have to find joint solutions.<br />

The most important thing is that the building<br />

is finished. We are flexible in this respect and<br />

have sufficient capacity to look at projects to<br />

bring them to a successful conclusion for all<br />

parties involved.<br />

Do you see any easing in land and construction<br />

prices?<br />

We will not see any drop in construction<br />

prices. With eleven percent inflation, stable<br />

construction prices are almost impossible<br />

anyway. Construction prices will not fall to<br />

pre-crisis levels. I‘m sure about that. That will<br />

not happen. We are living in a triangle of sales,<br />

land, and construction prices. Land prices<br />

are always the slowest to react. That‘s why the<br />

sellers often don‘t want to acknowledge what‘s<br />

happening in the world. I think, as always, the<br />

profit is in the purchase.<br />

Have you noticed any distress sales on the<br />

market?<br />

Since Covid, everyone has been waiting for<br />

bargains. I haven‘t seen any yet. The real<br />

bargains are not here yet. My background is<br />

in quantitative equity analysis. Dangerous<br />

market situations are always when prices rise,<br />

but volume dries up. Why is that? Because<br />

the seller is not getting what he wants, and<br />

the buyer is unwilling to pay what the seller<br />

wants. Then nothing happens for a while until<br />

someone moves. And that standstill is causing<br />

the liquidity crunch across the industry right<br />

now.<br />

Liquidity is probably the most sacred commodity<br />

of all. Right now, you can‘t rely on anyone.<br />

It used to be that decision makers made deals<br />

knowing that their boards would approve<br />

them. Today, you can‘t rely on any board.<br />

Everyone evaluates the framework differently.<br />

Althan Quarter<br />

On the 2.4-hectare site around<br />

Franz-Josefs railway station, a<br />

completely new urban district<br />

center is being created - unique<br />

in its kind - the Althan Quarter.<br />

Here, offices, co-working spaces,<br />

gastronomy, local suppliers,<br />

stores and service providers,<br />

high-quality apartments as well<br />

as a hotel and a parking garage<br />

will all find their place. This sustainable<br />

mix on approximately<br />

130,000 m2 of gross floor space<br />

will enable contemporary, urban<br />

living with minimum necessary<br />

travel. This saves time and<br />

energy - and creates an aboveaverage<br />

quality of life.<br />

26 ImmoFokus

That is absolutely justified. But we‘ve also<br />

experienced notary appointments where<br />

the buyer didn’t show up. Today, more<br />

than ever, the good old business caution<br />

applies: the deal is not done until the<br />

ink is dry and the money is in the bank.<br />

We don’t see significant transactions at<br />

the moment. The institutional investor<br />

in particular is very much expectation<br />

driven. Bets are being taken on whether<br />

or not you will soon see a four percent<br />

prime rate. Ask three banks, and you get<br />

four opinions.<br />

... and if I ask you?<br />

My bet stands at 3.75. The question is,<br />

how fast will the peak be reached? I‘m<br />

one who prefers to rip the Band-Aid<br />

off quickly rather than slowly. Once<br />

you reach that peak, the expectation is<br />

already going back to, „How fast are interest<br />

rates going down?“ That stimulates<br />

financial markets.<br />

Whether it takes one, two, or three<br />

steps is up to the ECB. If you analyze the<br />

past ECB steps carefully, the last step<br />

was usually the one that was too much,<br />

according to experts from the Financial<br />

Times, among others.<br />

To return to our fund: Currently, there<br />

is a historic opportunity to buy three<br />

hectares of building land projects in<br />

the heart of the most stable real estate<br />

market in Europe. Whether we will see<br />

investor reluctance here because of an<br />

interest rate peak that may last twelve<br />

months - the next few months will tell. I<br />

don’t think so. <br />

Sebastian G. Nitsch<br />

Sebastian G. Nitsch has been at the helm of 6B47<br />

Real Estate Investors AG since September 2020.<br />

The native Viennese has been a member of the<br />

management team since 2010 and a member of<br />

the Board of Directors for Corporate Finance and<br />

Investor Relations at 6B47 since 2013. Since 2016,<br />

he has been responsible as CFO of the entire<br />

group of companies.<br />

Before joining 6B47 Real Estate Investors AG,<br />

Nitsch spent five years on the management<br />

board of the Dekron Group, where he was primarily<br />

responsible for investments in companies in<br />

the field of mergers and acquisitions, as well as<br />

driving the creation of real estate funds and the<br />

project development of commercial and retail<br />

properties. Prior to that, he started his career as<br />

a board member of an asset management company,<br />

where he worked for nine years.<br />

Dedicated to Real Estate,<br />

focused on solutions.<br />

Advisory | Assurance | Tax | Legal | <strong>Digital</strong><br />

www.pwc.at/real-estate<br />

„PwC“ bezeichnet das PwC-Netzwerk und/oder eine oder mehrere seiner Mitgliedsfirmen. Jedes Mitglied dieses<br />

Netzwerks ist ein selbstständiges Rechtssubjekt. Weitere Informationen finden Sie unter pwc.com/structure.<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

27

Investing in Austria<br />

Real Circle<br />

#30<br />

Orientation Guide<br />

or Advertising Gag?<br />

Certifications & Co. At the 30th Real Circle, hosted by ERSTE BANK, ERSTE Immobilien KAG, IMMOunited,<br />

PwC and ImmoFokus, the agenda included a topic currently the subject of lively discussions in the real estate<br />

industry: Certifications.<br />

Authors: Patrick Baldia, Gerhard Fritz, Lisa Grüner, Rudolf Oezelt und Heimo Rollett<br />

D<br />

o we really need them? If we<br />

do, which ones are suitable<br />

for whom? Do they have any<br />

influence on the valuation of<br />

real estate? How meaningful are they at the<br />

end of the day? And: do they protect against<br />

greenwashing? We are talking about certifications<br />

that document the ecological, social<br />

and economic quality of buildings. There are<br />

now countless of them. However, it‘s not just<br />

the different distribution and inconsistent<br />

standards of the various certification systems<br />

that raise questions. It is their significance in<br />

times of new developments on the regulatory<br />

side – namely, the EU taxonomy. There was<br />

plenty to talk about for the selected real estate<br />

professionals who attended the event in the<br />

Winter Garden of the Erste Campus at the end<br />

of February.<br />

Certifications are important<br />

„Building certifications play an important<br />

role, on the one hand, for society, on the<br />

other hand, to achieve the goals of the EU<br />

taxonomy, to collect and assess data and to<br />

generally improve the planning process,“ states<br />

Elisabeth Sardy-Rauter, Senior Manager<br />

in the Construction & Real Estate division<br />

at Ernst & Young in Group A, at the start of<br />

the summit. Michael Herbek, Head of Project<br />

Development at BUWOG, notes that in the<br />

past, certifications were not so relevant for<br />

real estate developers, but they were for the<br />

investors and the global exit. „Especially in<br />

commercial real estate, certifications are a<br />

must, but we also observe this development<br />

in residential construction. In the future,<br />

certifiers will have to deliver an offer to be<br />

able to handle the whole range correctly and<br />

transparently for the developer,“ Herbek<br />

says. „The ideal would be a certificate that<br />

can make a statement in several directions,<br />

i.e., for different stakeholders, e.g., the developer,<br />

the investor and the end customer/user<br />

(tenant/buyer) because the latter are also<br />

increasingly asking for sustainable quality<br />

features.“<br />

Markus Huber, Managing Director of CC Real<br />

Project Management, questions the relevance<br />

of certificates. „I am divided on this issue,<br />

CC Real is a portfolio holder with its own<br />

properties, and I am an ÖGNI auditor and an<br />

EU Taxonomy Advisor. The topic is becoming<br />

increasingly relevant among our owners and<br />

customers. Also, the question of investing for<br />

„S“ in ESG can be discussed with owners now;<br />

in the past, the additional equipment in the<br />

bike room was already a problem. Wien Mitte<br />

and Millennium City were recently awarded<br />

a DGNB Platinum certificate. It shows that<br />

although owners have already received a<br />

good rating, they are still interested in further<br />

improvements. When applying for financing,<br />

the first question is which certificate to aim<br />

for and to what extent the building meets the<br />

EU taxonomy. In the case of new buildings,<br />

the verification is easier; in old or existing<br />

buildings, the biggest problem is the lack of<br />

building data.“<br />

Data and links<br />

Anna-Vera Deinhammer, responsible for<br />

International Relations and Municipalities at<br />

ÖGNI agrees and adds, „We have been aware<br />

28 ImmoFokus

„Certificates assure that<br />

sustainability and EU<br />

taxonomy have been<br />

mapped correctly.“<br />

Anna-Vera Deinhammer,<br />

ÖGNI<br />

of the topic of certification with this intensity<br />

for a year now. Pre-certificates now play a<br />

big role; they show whether a building is EU<br />

taxonomy-ready at all.“ Deinhammer finds<br />

Herbek‘s idea of a certificate for different stakeholders<br />

interesting. „All the data you need<br />

for a building is there, after all, but not everyone<br />

is interested in everything. Whoever<br />

does the risk assessment for financing is<br />

necessarily interested in something different<br />

than the end customer.“ What‘s important<br />

about the certificates is quality. „ÖGNI and<br />

DGNB are expert opinions for which the<br />

advisers and auditors are responsible. You<br />

can see through the financing issue that no<br />

one wants to produce stranded assets, so the<br />

market is paying a lot of attention to that.“<br />

Uncertainty in the real estate market is high<br />

because the EU Taxonomy Regulation has<br />

not yet been defined. Only the criteria for the<br />

so-called „Substantial Contributions“ for the<br />

first two protection goals have been formulated.<br />

„Certificates also have their limitations,<br />

as they are a snapshot of the condition of<br />

the building at the date it was just tested.“<br />

„Financing large<br />

volumes without<br />

certifications is no<br />

longer possible today.“<br />

Roman Eisenmagen,<br />

Erste Bank<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

29

Investing in Austria<br />

In addition, Huber adds that certificates for<br />

existing buildings have limited validity, and<br />

you have to keep renewing them, whereas in<br />

new construction, they are valid indefinitely,<br />

even if standards change in ten years.<br />

Renewed assessment after ten years<br />

Deinhammer takes a critical view of this: „It<br />

would make sense, due to the volatility of the<br />

specifications, to also check new buildings<br />

again after ten years and to certify them again<br />

to gold, platinum or crystal with update measures.“<br />

Sardy-Rauter raises the question of whether<br />

it is not enough to build according to the criteria<br />

of the EU taxonomy or whether it is not<br />

possible without certificates. Herbek thinks<br />

certifications make life easier in the long<br />

run because only one document is needed to<br />

show that the taxonomy has been followed.<br />

„It‘s more efficient for all parties involved in<br />

providing proof. In new construction, it‘s important<br />

to have the documents handy. In this<br />

context, you should also consider the topic<br />

of digitization and look at how BIM, certification,<br />

documentation, etc., can be brought<br />

together,“ says the department head.<br />

Making work easier<br />

Deinhammer intercedes and finds linking<br />

certificates and BIM interesting for the<br />

auditors‘ workflow. „It‘s similar to digital<br />

„In valuation, we can<br />

only represent what<br />

the market rewards.“<br />

Wolfgang Fessl,<br />

Reinberg & Partner<br />

construction permit applications to the city.<br />

It makes the work easier and makes it comparable.<br />

The fact that you can look up the EU<br />

taxonomy yourself is undisputed, but a certificate<br />

issuer or an auditor is not an integral<br />

part of the project team; that‘s someone from<br />

the outside, like a referee, who ideally accompanies<br />

the entire planning process and improves<br />

the process quality. It‘s already easier<br />

if you can refer to a scheme or use the swarm<br />

intelligence of a certificate if you want to<br />

achieve platinum, for example.“ Huber sees it<br />

the same way. „An independent review is important<br />

when you want to sell the property.<br />

Any buyer would question a self-assessment.<br />

In addition, it also makes it easier for the<br />

project team, and it simplifies the process.<br />

Furthermore, the DGNB is already working<br />

on an integration to be able to assess the EU<br />

taxonomy compliance together with certification<br />

in the future.“ Deinhammer also sees<br />

it as a case of mapping the EU taxonomy in<br />

the certificate. „Across Europe, a data frame<br />

is being considered, and the data will have<br />

to come from external auditors. Regarding<br />

content, we are preparing to collect as little<br />

30 ImmoFokus

„A certificate that can<br />

make a statement for<br />

different stakeholders<br />

would be ideal.“<br />

Markus Herbek,<br />

BUWOG<br />

data as necessary for as much information<br />

as possible. Our auditors share with us their<br />

practical experience regarding the technical<br />

criteria of the EU taxonomy; this knowledge<br />

is collected by the ÖGNI team and reported<br />

„Positive feedback is<br />

necessary to motivate<br />

property owners to make<br />

and implement a ‚green‘<br />

roadmap.“<br />

Anna Geher,<br />

Otto Immobilien<br />

back to Brussels via think tanks. Another advantage<br />

of participating in certification is that<br />

you are part of a big family, and the wealth of<br />

experience benefits the overall quality.“ Herbek<br />

confirms the importance of monitoring<br />

projects to achieve sustainability goals.<br />

Challenge: Certificate jungle<br />

„The topic of ‚building certifications and<br />

ESG‘ has generally been with us for the last<br />

three or four years,“ Nadja Hafez, Managing<br />

Partner ADEQAT Investment Services, opens<br />

the Group F discussion panel. The legislative<br />

cornerstone of the EU Taxonomy Regulation<br />

and Disclosure Regulation establishing categories<br />

of ESG financial products for the first<br />

time provides a clear framework. „But we<br />

can see that building certifications do not yet<br />

automatically meet these taxonomy regulations.“<br />

It would be desirable, the panel quickly<br />

agrees on this point, if there were standardizations<br />

in the market - rather than this jungle<br />

of certificates. Not every asset class is affected,<br />

as Matthias Nödl, Senior Counsel Cerha<br />

Hempel, critically notes, „I am mainly active<br />

in residential construction and leisure lodging.<br />

Apart from the large new construction<br />

projects in these areas, this topic is still in the<br />

very early stages.“ As a result, he says, there<br />

is a lot of uncertainty among many clients,<br />

some of whom may be under the impression<br />

that „you need a certificate to be successful.“<br />

Sometimes only the costs are seen, but not<br />

the advantages.<br />

„Is there a general need for certificates? If so,<br />

shouldn‘t it be standardized?“ Gerald Kerbl,<br />

tax consultant and partner TPA, asks the discussion<br />

group. At the moment, everything is<br />

directed at the investor, whether it is ÖGNI,<br />

DGNB, BREEAM or LEED. Among Germans<br />

right now, unsurprisingly, we see mainly<br />

DGNB and ÖGNI. Where ÖGNI is a bit ahead<br />

regarding certificates: ÖGNI certificates are<br />

the only ones that have directly or were the<br />

first to manage to have an EU taxonomy certification<br />

add-on to it. In a nutshell, „In the<br />

large-volume institutional sector, certificates<br />

have been the norm for some time.“ „Also in<br />

new residential construction,“ notes Gabriela<br />

Hauer, Head of Real Estate Clients in ERSTE<br />

BANK‘s Commercial Housing team. „It is<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

31

Investing in Austria<br />

„Among our owners and<br />

customers, the topic of<br />

certification is becoming<br />

increasingly relevant.“<br />

Markus Huber,<br />

CC Real<br />

„Certificates are too<br />

building-specific and<br />

need a wider scope.“<br />

Nadja Hafez,<br />

Adeqat<br />

„Our customers are private<br />

investors. A certificate<br />

according to ÖGNI is completely<br />

irrelevant to them.“<br />

Peter Karl,<br />

Erste Immo KAG<br />

significantly more difficult in existing residential<br />

construction.“ Erste Bank is committed<br />

to „green“ new financing, she said. Large<br />

projects have also been certified in the past.<br />

Hauer also advocates standardization: „Standardization<br />

would make many things easier.“<br />

Are certificates too building-specific?<br />

„Certificates are too building-specific and<br />

need a wider scope,“ Hafez brings a new<br />

aspect into the discussion. ESG issues will<br />

increasingly factor into valuations. „We are<br />

at the beginning of the discussion,“ notes<br />

Anna Schimmer, an attorney at PwC Legal,<br />

„What is sustainable is, after all, very much in<br />

flux. What is green or considered sustainable<br />

today may be judged differently tomorrow.“<br />

All certificates have one shortcoming, and<br />

that is they lag behind technical developments.<br />

Nödl comments, „This is inevitably<br />

the case. Technical developments quickly<br />

overtake regulations. Ö or DIN standards, EU<br />

standards - everywhere the regulations are<br />

not up to date.“<br />

„The many different certificates lead to a considerable<br />

amount of consulting expenses,“<br />

says Schimmer. „There are details about EU<br />

taxonomy compliance, cost/benefit assessments,<br />

and investment as well as the improvement<br />

requirements.“ Increasingly, green<br />

leases are also being discussed but rarely concluded.<br />

After all, how could non-sustainable<br />

use be sanctioned? Schimmer sees mainly<br />

positive incentives here. „It‘s about creating<br />

incentives.“<br />

Pressure is increasing<br />

“The practice in contract drafting clearly<br />

shows that negative consequences for violating<br />

any specifications in that direction find<br />

virtually no consensus. This often results in<br />

failed deals, because many negotiating parties<br />

say. I will rent something else which is<br />

cheaper or where I do not have this contractual<br />

penalty or negative consequences. With<br />

rental agreements, it is generally difficult to<br />

establish sanctions,” the PwC legal expert<br />

continues. Many leases already contain a<br />

variety of contractual penalties that hardly<br />

have any effect. Generating grounds for termination<br />

from this is difficult.” “International<br />

corporations that I have had the privilege<br />

of assisting nevertheless stringently enforce<br />

this,” Kerbl notes. “There is actually an understanding<br />

of ESG within the group, and it<br />

is included in every contract. We’ve had more<br />

than one discussion with tenants, and one<br />

or two lease negotiations have broken down<br />

because the tenant said, ‘I’m not interested in<br />

working on your future ESG concepts out of<br />

the blue.<br />

For Hafez, at least, it’s clear that there will be<br />

more pressure to comply in the future. “The<br />

question at the end of the day will always be:<br />

Who pays for it? Who pays the consequen-<br />

ces or the certification? Who pays for the<br />

investments needed to obtain certification,”<br />

concludes Nödl.<br />

Do certificates have an expiration date?<br />

“Whether certificates are the end of the line<br />

is not yet clear. Perhaps we will see relevant<br />

monitoring instead. The only clear thing is<br />

that the topic of sustainability will continue<br />

to accompany us,” says Roman Eisenmagen,<br />

Head of Commercial Housing at Erste Bank,<br />

summing up the fundamental tone of Table<br />

D quite well. For example, Stephan Pasquali,<br />

Managing Director of New Construction at<br />

3SI Immogroup, also considers it possible<br />

that certificates could be replaced by another<br />

monitoring tool. Currently, certificates<br />

are still the best standard recognized on the<br />

market.<br />

However, the certification process, especially<br />

for smaller companies that do not employ<br />

their own experts, definitely involves some<br />

effort, Pasquali added. “But if the cooperation<br />

with the auditors works, then you also get<br />

constructive input - for example, regarding<br />

sustainable design options,” he suggests.<br />

Why do certificates, as they are currently<br />

known, have an expiration date? Wolfgang<br />

Fessl, managing director and partner Reinberg<br />

& Partner Immobilienberatung, believes<br />

that they will be obsolete in the foreseeable<br />

future for one reason and will have to be re-<br />

32 ImmoFokus

placed by another instrument or developed<br />

accordingly, “The long-term goal must be<br />

the circular economy, and here we will need<br />

different guidelines than those on which certificates<br />

are based today.”<br />

Crucial for financing<br />

But is it even possible without a certificate<br />

today? “The larger and more professional a<br />

company is, the less it can do without certification.<br />

The more it goes in the direction<br />

of medium-sized businesses or apartment<br />

sales, the more likely it is that you can get by<br />

without,” says Eisenmagen, only to add, “Financing<br />

large volumes without certifications<br />

actually doesn’t work anymore.”<br />

“In the investment sector, nothing works<br />

without certificates. EU taxonomy is also becoming<br />

increasingly important there,” says<br />

Kerstin Robausch-Löffelmann, Managing<br />

Director for Development at Value One. For<br />

domestic developers, one would have all projects<br />

certified without exception. “We often<br />

have them pre-certified, which gives us proper<br />

guidelines we can follow,” says Robausch-<br />

Löffelmann. Additionally, “It really pays off<br />

in terms of financing.”<br />

“I see the basic error of our thinking as being<br />

that it’s always just about being a bit ahead of<br />

the competition,” says Fessl, addressing an<br />

important point. In reality, this is entirely irrelevant.<br />

The question is not where I want to<br />

go next but where we have to go. And that, as<br />

I said, is the circular economy. “Now we have<br />

to take all the small, unpleasant steps to get<br />

there eventually,” Fessl says.<br />

Penalties for greenwashing<br />

Anna Geher, head of real estate valuation at<br />

Otto Immobilien, also believes a change in<br />

thinking is needed. “Energy costs are rising,<br />

and we’ve budgeted for that, but we haven’t<br />

„Building<br />

certifications are<br />

important to collect<br />

data and improve the<br />

planning proc.“<br />

Elisabeth Sardy-Rauter,<br />

EY<br />

Real Success<br />

for<br />

M E E T U S<br />

@ M I P I M 2 0 2 3<br />

S TA N D N R .<br />

R 7. E 2<br />

Real Estate<br />

DIE ETWAS ANDERE ART, IMMOBILIEN ZU ENTWICKELN.<br />

Mit Professionalität und Transparenz verfolgen wir von 6B47 den Ansatz des Umdenkens.<br />

Dinge anders anzugehen und neu zu denken. Zum Vorteil von unseren Partnern, Investoren,<br />

Mitarbeitern und Kunden.<br />

Wir lassen Immobilien wachsen und Zukunft entstehen. Mit Leidenschaft zur Immobilienentwicklung<br />

und hoher Einsatzbereitschaft – von der Auswahl unserer Projekte über Planung und Realisierung<br />

bis zur Nutzung und Verwertung. In Österreich, Deutschland und Polen.<br />

Das sind wir. Das ist 6B47. Das ist die etwas andere Art, Immobilien zu entwickeln.<br />

6B47 REAL ESTATE INVESTORS AG<br />

HEILIGENSTÄDTER LÄNDE 29 | 1190 WIEN<br />

WWW.6B47.COM | T + 43 1 350 10 10 | OFFICE@6B47.COM<br />

<strong>MIPIM</strong> | <strong>2023</strong><br />

33

Investing in Austria<br />

budgeted for the climate protection roadmap,”<br />

she says. It’s a matter of thinking more<br />

long-term, she adds. At the same time, she<br />

also believes positive feedback is necessary to<br />

motivate property owners - both private and<br />

institutional - to create and also implement a<br />

roadmap. “But there should also be negative<br />

feedback in the form of penalties for those<br />

who, for example, use certificates only for<br />

greenwashing,” Geher maintains.<br />

More than any other measure, Robausch-Löffelmann<br />

would like to see “much more clarity”<br />

from lawmakers. “We don’t know where<br />

the EU taxonomy is heading and what it will<br />

cover since the relevant guidelines have not<br />

yet been defined,” the expert explains. At<br />

Value One, we therefore assume that projects<br />

will have to exceed the current requirements<br />

by 30 percent so that the properties will still<br />

be valuable in ten or 15 years.<br />

Do certificates play a role in the valuation?<br />

Expert Fessl sees parallels with energy certificates.<br />

He says everyone believed they would<br />

bring something when they were introduced.<br />

“Both on the market and in valuation, however,<br />

no one was interested,” Fessl claims.<br />

Precious metal plaques would also have stood<br />

out in the market initially. However, they<br />

would not have played a role on the valuation<br />

side, only on the marketing side.<br />

Better property, more expensive<br />

“In the valuation, we can’t say, ‘This is a gold<br />

or platinum certificate, and this makes so and<br />

so much.’ We can only show what the market<br />

is willing to reward. And if it doesn’t reward<br />

it because there are enough buildings on the<br />

market with plaques, then that’s just how it<br />

is,” Fessl explains. At the end of the day, he<br />

says, it comes down to the better property.<br />

“And that is only partially expressed in criteria<br />

such as energy performance indicators,<br />

but more often than not, it’s the credit standing<br />

of the tenant or the location. “If a building<br />

sold for more, it’s usually because it’s the<br />

better property,” Fessl sums it up.<br />

“I see it in a more differentiated way in that<br />

we also have a feedback loop with the EU<br />

taxonomy for projects that are taxonomy-<br />

„Green leases are also<br />

increasingly being<br />

discussed. International<br />

corporations are stringently<br />

following through.“<br />

Gerald Kerbl,<br />

TPA<br />

34 ImmoFokus

„Financing might get<br />