Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

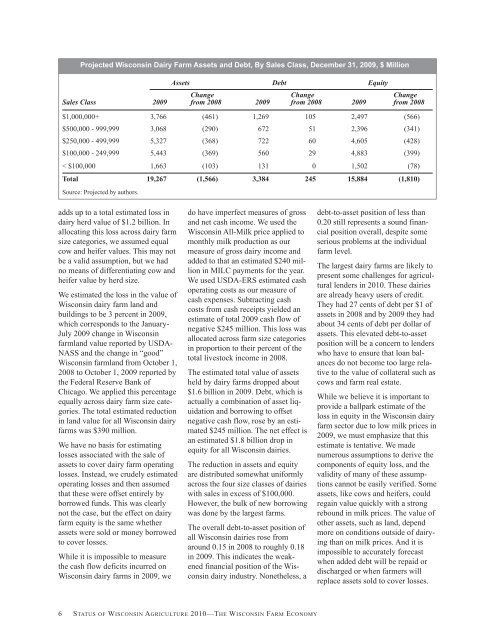

Projected <strong>Wisconsin</strong> Dairy Farm Assets and Debt, By Sales Class, December 31, 2009, $ Million<br />

Assets Debt Equity<br />

Sales Class 2009<br />

Change<br />

from 2008 2009<br />

Change<br />

from 2008 2009<br />

Change<br />

from 2008<br />

$1,000,000+ 3,766 (461) 1,269 105 2,497 (566)<br />

$500,000 - 999,999 3,068 (290) 672 51 2,396 (341)<br />

$250,000 - 499,999 5,327 (368) 722 60 4,605 (428)<br />

$100,000 - 249,999 5,443 (369) 560 29 4,883 (399)<br />

< $100,000 1,663 (103) 131 0 1,502 (78)<br />

Total 19,267 (1,566) 3,384 245 15,884 (1,810)<br />

Source: Projected by authors.<br />

adds up to a total estimated loss in<br />

dairy herd value <strong>of</strong> $1.2 billion. In<br />

allocating this loss across dairy farm<br />

size categories, we assumed equal<br />

cow and heifer values. This may not<br />

be a valid assumption, but we had<br />

no means <strong>of</strong> differentiating cow and<br />

heifer value by herd size.<br />

We estimated the loss in the value <strong>of</strong><br />

<strong>Wisconsin</strong> dairy farm land and<br />

buildings to be 3 percent in 2009,<br />

which corresponds to the January-<br />

July 2009 change in <strong>Wisconsin</strong><br />

farmland value reported by USDA-<br />

NASS and the change in “good”<br />

<strong>Wisconsin</strong> farmland from October 1,<br />

2008 to October 1, 2009 reported by<br />

the Federal Reserve Bank <strong>of</strong><br />

Chicago. We applied this percentage<br />

equally across dairy farm size categories.<br />

The total estimated reduction<br />

in land value for all <strong>Wisconsin</strong> dairy<br />

farms was $390 million.<br />

We have no basis for estimating<br />

losses associated with the sale <strong>of</strong><br />

assets to cover dairy farm operating<br />

losses. Instead, we crudely estimated<br />

operating losses and then assumed<br />

that these were <strong>of</strong>fset entirely by<br />

borrowed funds. This was clearly<br />

not the case, but the effect on dairy<br />

farm equity is the same whether<br />

assets were sold or money borrowed<br />

to cover losses.<br />

While it is impossible to measure<br />

the cash flow deficits incurred on<br />

<strong>Wisconsin</strong> dairy farms in 2009, we<br />

do have imperfect measures <strong>of</strong> gross<br />

and net cash income. We used the<br />

<strong>Wisconsin</strong> All-Milk price applied to<br />

monthly milk production as our<br />

measure <strong>of</strong> gross dairy income and<br />

added to that an estimated $240 million<br />

in MILC payments for the year.<br />

We used USDA-ERS estimated cash<br />

operating costs as our measure <strong>of</strong><br />

cash expenses. Subtracting cash<br />

costs from cash receipts yielded an<br />

estimate <strong>of</strong> total 2009 cash flow <strong>of</strong><br />

negative $245 million. This loss was<br />

allocated across farm size categories<br />

in proportion to their percent <strong>of</strong> the<br />

total livestock income in 2008.<br />

The estimated total value <strong>of</strong> assets<br />

held by dairy farms dropped about<br />

$1.6 billion in 2009. Debt, which is<br />

actually a combination <strong>of</strong> asset liquidation<br />

and borrowing to <strong>of</strong>fset<br />

negative cash flow, rose by an estimated<br />

$245 million. The net effect is<br />

an estimated $1.8 billion drop in<br />

equity for all <strong>Wisconsin</strong> dairies.<br />

The reduction in assets and equity<br />

are distributed somewhat uniformly<br />

across the four size classes <strong>of</strong> dairies<br />

with sales in excess <strong>of</strong> $100,000.<br />

However, the bulk <strong>of</strong> new borrowing<br />

was done by the largest farms.<br />

The overall debt-to-asset position <strong>of</strong><br />

all <strong>Wisconsin</strong> dairies rose from<br />

around 0.15 in 2008 to roughly 0.18<br />

in 2009. This indicates the weakened<br />

financial position <strong>of</strong> the <strong>Wisconsin</strong><br />

dairy industry. Nonetheless, a<br />

6 STATUS OF WISCONSIN AGRICULTURE <strong>2010</strong>—THE WISCONSIN FARM ECONOMY<br />

debt-to-asset position <strong>of</strong> less than<br />

0.20 still represents a sound financial<br />

position overall, despite some<br />

serious problems at the individual<br />

farm level.<br />

The largest dairy farms are likely to<br />

present some challenges for agricultural<br />

lenders in <strong>2010</strong>. These dairies<br />

are already heavy users <strong>of</strong> credit.<br />

They had 27 cents <strong>of</strong> debt per $1 <strong>of</strong><br />

assets in 2008 and by 2009 they had<br />

about 34 cents <strong>of</strong> debt per dollar <strong>of</strong><br />

assets. This elevated debt-to-asset<br />

position will be a concern to lenders<br />

who have to ensure that loan balances<br />

do not become too large relative<br />

to the value <strong>of</strong> collateral such as<br />

cows and farm real estate.<br />

While we believe it is important to<br />

provide a ballpark estimate <strong>of</strong> the<br />

loss in equity in the <strong>Wisconsin</strong> dairy<br />

farm sector due to low milk prices in<br />

2009, we must emphasize that this<br />

estimate is tentative. We made<br />

numerous assumptions to derive the<br />

components <strong>of</strong> equity loss, and the<br />

validity <strong>of</strong> many <strong>of</strong> these assumptions<br />

cannot be easily verified. Some<br />

assets, like cows and heifers, could<br />

regain value quickly with a strong<br />

rebound in milk prices. The value <strong>of</strong><br />

other assets, such as land, depend<br />

more on conditions outside <strong>of</strong> dairying<br />

than on milk prices. And it is<br />

impossible to accurately forecast<br />

when added debt will be repaid or<br />

discharged or when farmers will<br />

replace assets sold to cover losses.