Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

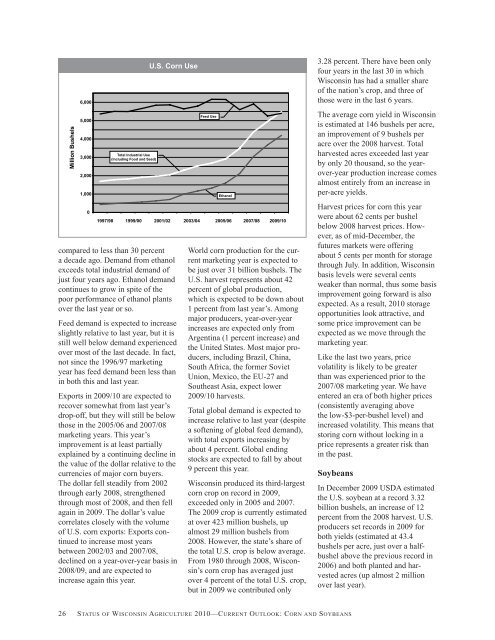

Million Bushels<br />

6,000<br />

5,000<br />

4,000<br />

3,000<br />

2,000<br />

1,000<br />

0<br />

Total Industrial Use<br />

(Including Food and Seed)<br />

U.S. Corn Use<br />

compared to less than 30 percent<br />

a decade ago. Demand from ethanol<br />

exceeds total industrial demand <strong>of</strong><br />

just four years ago. Ethanol demand<br />

continues to grow in spite <strong>of</strong> the<br />

poor performance <strong>of</strong> ethanol plants<br />

over the last year or so.<br />

Feed demand is expected to increase<br />

slightly relative to last year, but it is<br />

still well below demand experienced<br />

over most <strong>of</strong> the last decade. In fact,<br />

not since the 1996/97 marketing<br />

year has feed demand been less than<br />

in both this and last year.<br />

Exports in 2009/10 are expected to<br />

recover somewhat from last year’s<br />

drop-<strong>of</strong>f, but they will still be below<br />

those in the 2005/06 and 2007/08<br />

marketing years. This year’s<br />

improvement is at least partially<br />

explained by a continuing decline in<br />

the value <strong>of</strong> the dollar relative to the<br />

currencies <strong>of</strong> major corn buyers.<br />

The dollar fell steadily from 2002<br />

through early 2008, strengthened<br />

through most <strong>of</strong> 2008, and then fell<br />

again in 2009. The dollar’s value<br />

correlates closely with the volume<br />

<strong>of</strong> U.S. corn exports: Exports continued<br />

to increase most years<br />

between 2002/03 and 2007/08,<br />

declined on a year-over-year basis in<br />

2008/09, and are expected to<br />

increase again this year.<br />

Feed Use<br />

World corn production for the current<br />

marketing year is expected to<br />

be just over 31 billion bushels. The<br />

U.S. harvest represents about 42<br />

percent <strong>of</strong> global production,<br />

which is expected to be down about<br />

1 percent from last year’s. Among<br />

major producers, year-over-year<br />

increases are expected only from<br />

Argentina (1 percent increase) and<br />

the United States. Most major producers,<br />

including Brazil, China,<br />

South Africa, the former Soviet<br />

Union, Mexico, the EU-27 and<br />

Southeast Asia, expect lower<br />

2009/10 harvests.<br />

Total global demand is expected to<br />

increase relative to last year (despite<br />

a s<strong>of</strong>tening <strong>of</strong> global feed demand),<br />

with total exports increasing by<br />

about 4 percent. Global ending<br />

stocks are expected to fall by about<br />

9 percent this year.<br />

<strong>Wisconsin</strong> produced its third-largest<br />

corn crop on record in 2009,<br />

exceeded only in 2005 and 2007.<br />

The 2009 crop is currently estimated<br />

at over 423 million bushels, up<br />

almost 29 million bushels from<br />

2008. However, the state’s share <strong>of</strong><br />

the total U.S. crop is below average.<br />

From 1980 through 2008, <strong>Wisconsin</strong>’s<br />

corn crop has averaged just<br />

over 4 percent <strong>of</strong> the total U.S. crop,<br />

but in 2009 we contributed only<br />

26 STATUS OF WISCONSIN AGRICULTURE <strong>2010</strong>—CURRENT OUTLOOK: CORN AND SOYBEANS<br />

Ethanol<br />

1997/98 1999/00 2001/02 2003/04 2005/06 2007/08 2009/10<br />

3.28 percent. There have been only<br />

four years in the last 30 in which<br />

<strong>Wisconsin</strong> has had a smaller share<br />

<strong>of</strong> the nation’s crop, and three <strong>of</strong><br />

those were in the last 6 years.<br />

The average corn yield in <strong>Wisconsin</strong><br />

is estimated at 146 bushels per acre,<br />

an improvement <strong>of</strong> 9 bushels per<br />

acre over the 2008 harvest. Total<br />

harvested acres exceeded last year<br />

by only 20 thousand, so the yearover-year<br />

production increase comes<br />

almost entirely from an increase in<br />

per-acre yields.<br />

Harvest prices for corn this year<br />

were about 62 cents per bushel<br />

below 2008 harvest prices. However,<br />

as <strong>of</strong> mid-December, the<br />

futures markets were <strong>of</strong>fering<br />

about 5 cents per month for storage<br />

through July. In addition, <strong>Wisconsin</strong><br />

basis levels were several cents<br />

weaker than normal, thus some basis<br />

improvement going forward is also<br />

expected. As a result, <strong>2010</strong> storage<br />

opportunities look attractive, and<br />

some price improvement can be<br />

expected as we move through the<br />

marketing year.<br />

Like the last two years, price<br />

volatility is likely to be greater<br />

than was experienced prior to the<br />

2007/08 marketing year. We have<br />

entered an era <strong>of</strong> both higher prices<br />

(consistently averaging above<br />

the low-$3-per-bushel level) and<br />

increased volatility. This means that<br />

storing corn without locking in a<br />

price represents a greater risk than<br />

in the past.<br />

Soybeans<br />

In December 2009 USDA estimated<br />

the U.S. soybean at a record 3.32<br />

billion bushels, an increase <strong>of</strong> 12<br />

percent from the 2008 harvest. U.S.<br />

producers set records in 2009 for<br />

both yields (estimated at 43.4<br />

bushels per acre, just over a halfbushel<br />

above the previous record in<br />

2006) and both planted and harvested<br />

acres (up almost 2 million<br />

over last year).