Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

Dollars per Hundredweight<br />

$16.00<br />

$15.00<br />

$14.00<br />

$13.00<br />

$12.00<br />

$11.00<br />

$10.00<br />

$ 9.00<br />

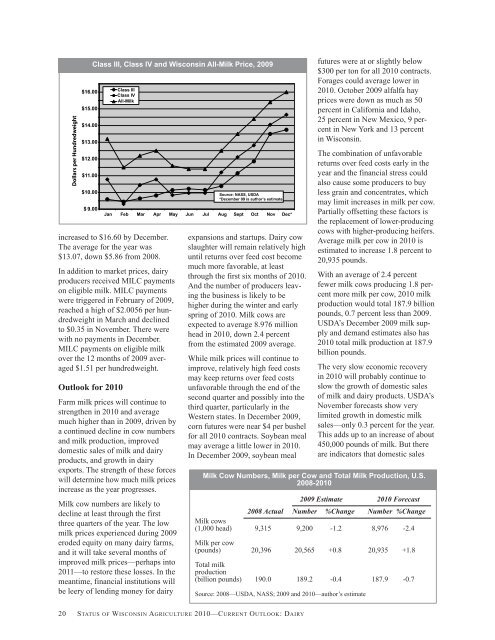

increased to $16.60 by December.<br />

The average for the year was<br />

$13.07, down $5.86 from 2008.<br />

In addition to market prices, dairy<br />

producers received MILC payments<br />

on eligible milk. MILC payments<br />

were triggered in February <strong>of</strong> 2009,<br />

reached a high <strong>of</strong> $2.0056 per hundredweight<br />

in March and declined<br />

to $0.35 in November. There were<br />

with no payments in December.<br />

MILC payments on eligible milk<br />

over the 12 months <strong>of</strong> 2009 averaged<br />

$1.51 per hundredweight.<br />

Outlook for <strong>2010</strong><br />

Class III, Class IV and <strong>Wisconsin</strong> All-Milk Price, 2009<br />

Class III<br />

Class IV<br />

All-Milk<br />

Jan Feb Mar Apr May Jun Jul Aug Sept Oct Nov Dec*<br />

Farm milk prices will continue to<br />

strengthen in <strong>2010</strong> and average<br />

much higher than in 2009, driven by<br />

a continued decline in cow numbers<br />

and milk production, improved<br />

domestic sales <strong>of</strong> milk and dairy<br />

products, and growth in dairy<br />

exports. The strength <strong>of</strong> these forces<br />

will determine how much milk prices<br />

increase as the year progresses.<br />

Milk cow numbers are likely to<br />

decline at least through the first<br />

three quarters <strong>of</strong> the year. The low<br />

milk prices experienced during 2009<br />

eroded equity on many dairy farms,<br />

and it will take several months <strong>of</strong><br />

improved milk prices—perhaps into<br />

2011—to restore these losses. In the<br />

meantime, financial institutions will<br />

be leery <strong>of</strong> lending money for dairy<br />

Source: NASS, USDA<br />

*December 09 is author’s estimate<br />

expansions and startups. Dairy cow<br />

slaughter will remain relatively high<br />

until returns over feed cost become<br />

much more favorable, at least<br />

through the first six months <strong>of</strong> <strong>2010</strong>.<br />

And the number <strong>of</strong> producers leaving<br />

the business is likely to be<br />

higher during the winter and early<br />

spring <strong>of</strong> <strong>2010</strong>. Milk cows are<br />

expected to average 8.976 million<br />

head in <strong>2010</strong>, down 2.4 percent<br />

from the estimated 2009 average.<br />

While milk prices will continue to<br />

improve, relatively high feed costs<br />

may keep returns over feed costs<br />

unfavorable through the end <strong>of</strong> the<br />

second quarter and possibly into the<br />

third quarter, particularly in the<br />

Western states. In December 2009,<br />

corn futures were near $4 per bushel<br />

for all <strong>2010</strong> contracts. Soybean meal<br />

may average a little lower in <strong>2010</strong>.<br />

In December 2009, soybean meal<br />

futures were at or slightly below<br />

$300 per ton for all <strong>2010</strong> contracts.<br />

Forages could average lower in<br />

<strong>2010</strong>. October 2009 alfalfa hay<br />

prices were down as much as 50<br />

percent in California and Idaho,<br />

25 percent in New Mexico, 9 percent<br />

in New York and 13 percent<br />

in <strong>Wisconsin</strong>.<br />

The combination <strong>of</strong> unfavorable<br />

returns over feed costs early in the<br />

year and the financial stress could<br />

also cause some producers to buy<br />

less grain and concentrates, which<br />

may limit increases in milk per cow.<br />

Partially <strong>of</strong>fsetting these factors is<br />

the replacement <strong>of</strong> lower-producing<br />

cows with higher-producing heifers.<br />

Average milk per cow in <strong>2010</strong> is<br />

estimated to increase 1.8 percent to<br />

20,935 pounds.<br />

With an average <strong>of</strong> 2.4 percent<br />

fewer milk cows producing 1.8 percent<br />

more milk per cow, <strong>2010</strong> milk<br />

production would total 187.9 billion<br />

pounds, 0.7 percent less than 2009.<br />

USDA’s December 2009 milk supply<br />

and demand estimates also has<br />

<strong>2010</strong> total milk production at 187.9<br />

billion pounds.<br />

The very slow economic recovery<br />

in <strong>2010</strong> will probably continue to<br />

slow the growth <strong>of</strong> domestic sales<br />

<strong>of</strong> milk and dairy products. USDA’s<br />

November forecasts show very<br />

limited growth in domestic milk<br />

sales—only 0.3 percent for the year.<br />

This adds up to an increase <strong>of</strong> about<br />

450,000 pounds <strong>of</strong> milk. But there<br />

are indicators that domestic sales<br />

Milk Cow Numbers, Milk per Cow and Total Milk Production, U.S.<br />

2008-<strong>2010</strong><br />

2009 Estimate <strong>2010</strong> Forecast<br />

2008 Actual Number %Change Number %Change<br />

Milk cows<br />

(1,000 head) 9,315 9,200 -1.2 8,976 -2.4<br />

Milk per cow<br />

(pounds) 20,396 20,565 +0.8 20,935 +1.8<br />

Total milk<br />

production<br />

(billion pounds) 190.0 189.2 -0.4 187.9 -0.7<br />

Source: 2008—USDA, NASS; 2009 and <strong>2010</strong>—author’s estimate<br />

20 STATUS OF WISCONSIN AGRICULTURE <strong>2010</strong>—CURRENT OUTLOOK: DAIRY