Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Status of Wisconsin Agriculture 2010 - Agricultural & Applied ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

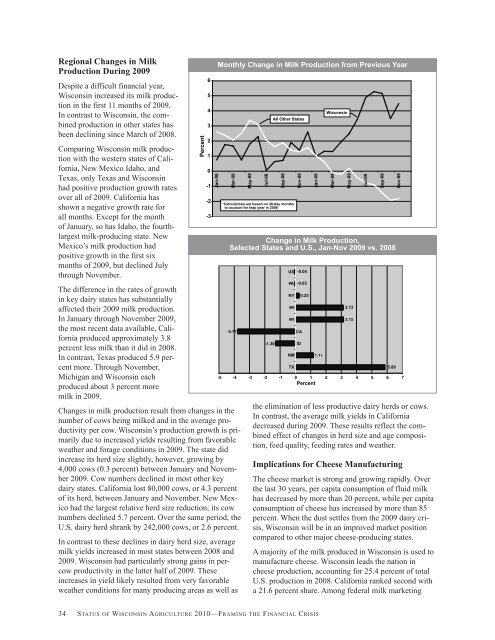

Regional Changes in Milk<br />

Production During 2009<br />

Despite a difficult financial year,<br />

<strong>Wisconsin</strong> increased its milk production<br />

in the first 11 months <strong>of</strong> 2009.<br />

In contrast to <strong>Wisconsin</strong>, the combined<br />

production in other states has<br />

been declining since March <strong>of</strong> 2008.<br />

Comparing <strong>Wisconsin</strong> milk production<br />

with the western states <strong>of</strong> California,<br />

New Mexico Idaho, and<br />

Texas, only Texas and <strong>Wisconsin</strong><br />

had positive production growth rates<br />

over all <strong>of</strong> 2009. California has<br />

shown a negative growth rate for<br />

all months. Except for the month<br />

<strong>of</strong> January, so has Idaho, the fourthlargest<br />

milk-producing state. New<br />

Mexico’s milk production had<br />

positive growth in the first six<br />

months <strong>of</strong> 2009, but declined July<br />

through November.<br />

The difference in the rates <strong>of</strong> growth<br />

in key dairy states has substantially<br />

affected their 2009 milk production.<br />

In January through November 2009,<br />

the most recent data available, California<br />

produced approximately 3.8<br />

percent less milk than it did in 2008.<br />

In contrast, Texas produced 5.9 percent<br />

more. Through November,<br />

Michigan and <strong>Wisconsin</strong> each<br />

produced about 3 percent more<br />

milk in 2009.<br />

Changes in milk production result from changes in the<br />

number <strong>of</strong> cows being milked and in the average productivity<br />

per cow. <strong>Wisconsin</strong>’s production growth is primarily<br />

due to increased yields resulting from favorable<br />

weather and forage conditions in 2009. The state did<br />

increase its herd size slightly, however, growing by<br />

4,000 cows (0.3 percent) between January and November<br />

2009. Cow numbers declined in most other key<br />

dairy states. California lost 80,000 cows, or 4.3 percent<br />

<strong>of</strong> its herd, between January and November. New Mexico<br />

had the largest relative herd size reduction; its cow<br />

numbers declined 5.7 percent. Over the same period, the<br />

U.S. dairy herd shrank by 242,000 cows, or 2.6 percent.<br />

In contrast to these declines in dairy herd size, average<br />

milk yields increased in most states between 2008 and<br />

2009. <strong>Wisconsin</strong> had particularly strong gains in percow<br />

productivity in the latter half <strong>of</strong> 2009. These<br />

increases in yield likely resulted from very favorable<br />

weather conditions for many producing areas as well as<br />

Percent<br />

6<br />

5<br />

4<br />

3<br />

2<br />

1<br />

0<br />

-1<br />

-2<br />

-3<br />

Jan-08<br />

Monthly Change in Milk Production from Previous Year<br />

Mar-08<br />

-3.77<br />

May-08<br />

Jul-08<br />

-1.30<br />

All Other States<br />

Sep-08<br />

*Calculations are based on 30-day months<br />

to account for leap year in 2008<br />

Change in Milk Production,<br />

Selected States and U.S., Jan-Nov 2009 vs. 2008<br />

US -0.04<br />

PA -0.03<br />

NY<br />

MI<br />

WI<br />

NM<br />

TX<br />

CA<br />

ID<br />

0.25<br />

-5 -4 -3 -2 -1 0 1 2 3 4 5 6 7<br />

Percent<br />

34 STATUS OF WISCONSIN AGRICULTURE <strong>2010</strong>—FRAMING THE FINANCIAL CRISIS<br />

Nov-08<br />

Jan-09<br />

1.17<br />

<strong>Wisconsin</strong><br />

the elimination <strong>of</strong> less productive dairy herds or cows.<br />

In contrast, the average milk yields in California<br />

decreased during 2009. These results reflect the combined<br />

effect <strong>of</strong> changes in herd size and age composition,<br />

feed quality, feeding rates and weather.<br />

Implications for Cheese Manufacturing<br />

Mar-09<br />

The cheese market is strong and growing rapidly. Over<br />

the last 30 years, per capita consumption <strong>of</strong> fluid milk<br />

has decreased by more than 20 percent, while per capita<br />

consumption <strong>of</strong> cheese has increased by more than 85<br />

percent. When the dust settles from the 2009 dairy crisis,<br />

<strong>Wisconsin</strong> will be in an improved market position<br />

compared to other major cheese-producing states.<br />

A majority <strong>of</strong> the milk produced in <strong>Wisconsin</strong> is used to<br />

manufacture cheese. <strong>Wisconsin</strong> leads the nation in<br />

cheese production, accounting for 25.4 percent <strong>of</strong> total<br />

U.S. production in 2008. California ranked second with<br />

a 21.6 percent share. Among federal milk marketing<br />

May-09<br />

3.13<br />

3.15<br />

Jul-09<br />

Sep-09<br />

5.86<br />

Nov-09