E_mg_GB_03_vorne-29_3_04

E_mg_GB_03_vorne-29_3_04

E_mg_GB_03_vorne-29_3_04

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

MANAGEMENT SHARE STRATEGY SPECIAL SECTION MANAGEMENT REPORT FINANCIAL STATEMENTS FURTHER INFORMATION<br />

Consolidated Balance Sheets • Statements of Income • Statements of Cash Flows • Statements of Changes in shareholders’ Equity • Fixed Assets Schedule • Notes • Independent Auditors’ Report<br />

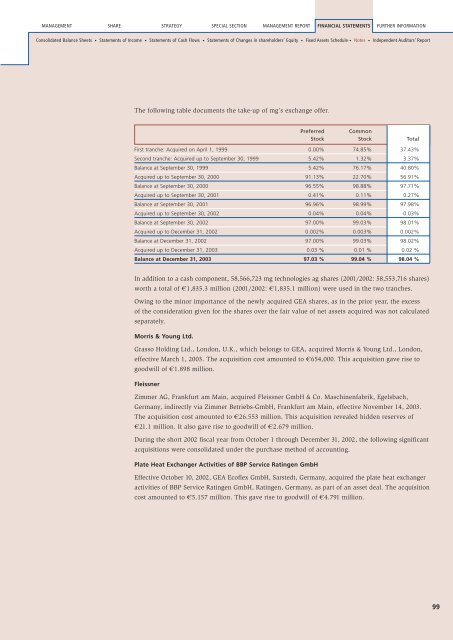

The following table documents the take-up of <strong>mg</strong>’s exchange offer.<br />

Preferred Common<br />

Stock Stock Total<br />

First tranche: Acquired on April 1, 1999 0.00% 74.85% 37.43%<br />

Second tranche: Acquired up to September 30, 1999 5.42% 1.32% 3.37%<br />

Balance at September 30, 1999 5.42% 76.17% 40.80%<br />

Acquired up to September 30, 2000 91.13% 22.70% 56.91%<br />

Balance at September 30, 2000 96.55% 98.88% 97.71%<br />

Acquired up to September 30, 2001 0.41% 0.11% 0.27%<br />

Balance at September 30, 2001 96.96% 98.99% 97.98%<br />

Acquired up to September 30, 2002 0.<strong>04</strong>% 0.<strong>04</strong>% 0.<strong>03</strong>%<br />

Balance at September 30, 2002 97.00% 99.<strong>03</strong>% 98.01%<br />

Acquired up to December 31, 2002 0.002% 0.0<strong>03</strong>% 0.002%<br />

Balance at December 31, 2002 97.00% 99.<strong>03</strong>% 98.02%<br />

Acquired up to December 31, 20<strong>03</strong> 0.<strong>03</strong> % 0.01 % 0.02 %<br />

Balance at December 31, 20<strong>03</strong> 97.<strong>03</strong> % 99.<strong>04</strong> % 98.<strong>04</strong> %<br />

In addition to a cash component, 58,566,723 <strong>mg</strong> technologies ag shares (2001/2002: 58,553,716 shares)<br />

worth a total of a1,835.3 million (2001/2002: a1,835.1 million) were used in the two tranches.<br />

Owing to the minor importance of the newly acquired GEA shares, as in the prior year, the excess<br />

of the consideration given for the shares over the fair value of net assets acquired was not calculated<br />

separately.<br />

Morris & Young Ltd.<br />

Grasso Holding Ltd., London, U.K., which belongs to GEA, acquired Morris & Young Ltd., London,<br />

effective March 1, 20<strong>03</strong>. The acquisition cost amounted to a654,000. This acquisition gave rise to<br />

goodwill of a1.898 million.<br />

Fleissner<br />

Zimmer AG, Frankfurt am Main, acquired Fleissner GmbH & Co. Maschinenfabrik, Egelsbach,<br />

Germany, indirectly via Zimmer Betriebs-GmbH, Frankfurt am Main, effective November 14, 20<strong>03</strong>.<br />

The acquisition cost amounted to a26.553 million. This acquisition revealed hidden reserves of<br />

a21.1 million. It also gave rise to goodwill of a2.679 million.<br />

During the short 2002 fiscal year from October 1 through December 31, 2002, the following significant<br />

acquisitions were consolidated under the purchase method of accounting.<br />

Plate Heat Exchanger Activities of BBP Service Ratingen GmbH<br />

Effective October 10, 2002, GEA Ecoflex GmbH, Sarstedt, Germany, acquired the plate heat exchanger<br />

activities of BBP Service Ratingen GmbH, Ratingen, Germany, as part of an asset deal. The acquisition<br />

cost amounted to a5.157 million. This gave rise to goodwill of a4.791 million.<br />

99