E_mg_GB_03_vorne-29_3_04

E_mg_GB_03_vorne-29_3_04

E_mg_GB_03_vorne-29_3_04

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

126<br />

The above tables give the fair values and the expected long-term returns on these plan assets for<br />

German pension plans. The returns are estimated based on both historical and future expected market<br />

and portfolio performance. a582,000 is expected to be allocated to German pension plan assets in<br />

20<strong>04</strong>. The plan assets continue to be managed by benevolent funds and foundations and are mainly<br />

invested in fixed-income securities and fixed-term deposits. There are no plans at present to change<br />

this investment strategy. The accumulated benefit obligation (excluding future salary increases) for<br />

German pension plans amounted to a790.572 million in 20<strong>03</strong> (prior year: a736.913 million). The<br />

balance sheet date used to report German pension plan assets is December 31, 20<strong>03</strong>.<br />

ab) Defined Contribution Plans<br />

The individual companies of the <strong>mg</strong> Group’s continued operations offer various postretirement benefits<br />

in the form of defined contribution plans. The pension cost of these plans lies not with <strong>mg</strong> but with<br />

the respective pension provider. Total contributions of a12.645 million (prior year: a639,000) were<br />

paid in 20<strong>03</strong>.<br />

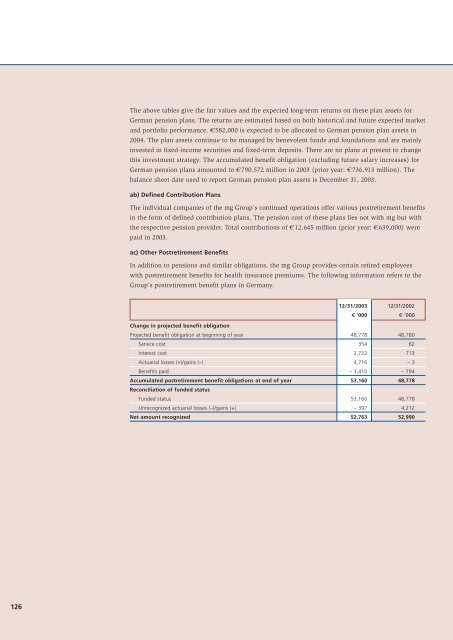

ac) Other Postretirement Benefits<br />

In addition to pensions and similar obligations, the <strong>mg</strong> Group provides certain retired employees<br />

with postretirement benefits for health insurance premiums. The following information refers to the<br />

Group’s postretirement benefit plans in Germany.<br />

Change in projected benefit obligation<br />

12/31/20<strong>03</strong> 12/31/2002<br />

u ’000 t ’000<br />

Projected benefit obligation at beginning of year 48,778 48,780<br />

Service cost 354 82<br />

Interest cost 2,722 713<br />

Actuarial losses (+)/gains (–) 4,716 – 3<br />

Benefits paid – 3,410 – 794<br />

Accumulated postretirement benefit obligations at end of year<br />

Reconciliation of funded status<br />

53,160 48,778<br />

Funded status 53,160 48,778<br />

Unrecognized actuarial losses (–)/gains (+) – 397 4,212<br />

Net amount recognized 52,763 52,990