E_mg_GB_03_vorne-29_3_04

E_mg_GB_03_vorne-29_3_04

E_mg_GB_03_vorne-29_3_04

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

144<br />

21) Minority Interests<br />

Minority interests relate mainly to GEA and to the Menzolit Fibron Group, which belongs to Dynamit<br />

Nobel.<br />

22) Profit/Loss on discontinued operations<br />

A breakdown of the profit/loss on discontinued operations is shown under Note G) ‘Discontinued<br />

operations’.<br />

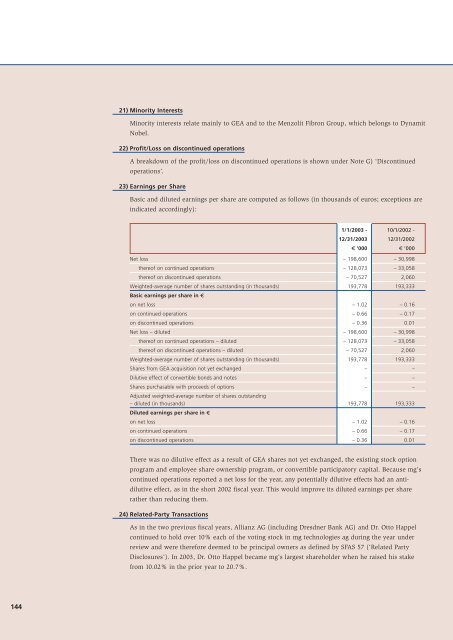

23) Earnings per Share<br />

Basic and diluted earnings per share are computed as follows (in thousands of euros; exceptions are<br />

indicated accordingly):<br />

1/1/20<strong>03</strong> - 10/1/2002 -<br />

12/31/20<strong>03</strong> 12/31/2002<br />

u ’000 t ’000<br />

Net loss – 198,600 – 30,998<br />

thereof on continued operations – 128,073 – 33,058<br />

thereof on discontinued operations – 70,527 2,060<br />

Weighted-average number of shares outstanding (in thousands) 193,778 193,333<br />

Basic earnings per share in u<br />

on net loss – 1.02 – 0.16<br />

on continued operations – 0.66 – 0.17<br />

on discontinued operations – 0.36 0.01<br />

Net loss – diluted – 198,600 – 30,998<br />

thereof on continued operations – diluted – 128,073 – 33,058<br />

thereof on discontinued operations – diluted – 70,527 2,060<br />

Weighted-average number of shares outstanding (in thousands) 193,778 193,333<br />

Shares from GEA acquisition not yet exchanged – –<br />

Dilutive effect of convertible bonds and notes – –<br />

Shares purchasable with proceeds of options<br />

Adjusted weighted-average number of shares outstanding<br />

– –<br />

– diluted (in thousands) 193,778 193,333<br />

Diluted earnings per share in u<br />

on net loss – 1.02 – 0.16<br />

on continued operations – 0.66 – 0.17<br />

on discontinued operations – 0.36 0.01<br />

There was no dilutive effect as a result of GEA shares not yet exchanged, the existing stock option<br />

program and employee share ownership program, or convertible participatory capital. Because <strong>mg</strong>’s<br />

continued operations reported a net loss for the year, any potentially dilutive effects had an antidilutive<br />

effect, as in the short 2002 fiscal year. This would improve its diluted earnings per share<br />

rather than reducing them.<br />

24) Related-Party Transactions<br />

As in the two previous fiscal years, Allianz AG (including Dresdner Bank AG) and Dr. Otto Happel<br />

continued to hold over 10% each of the voting stock in <strong>mg</strong> technologies ag during the year under<br />

review and were therefore deemed to be principal owners as defined by SFAS 57 (‘Related Party<br />

Disclosures’). In 20<strong>03</strong>, Dr. Otto Happel became <strong>mg</strong>’s largest shareholder when he raised his stake<br />

from 10.02% in the prior year to 20.7%.