- Page 1 and 2:

J "0 °e .° !989 ~REST

- Page 3 and 4:

1.7 !.7.2 1.7.3 ! .7.4 1.7.5 Certai

- Page 5 and 6:

i be deployed in the area to ins’

- Page 7 and 8:

i ! 4.7.2 4.7.3 4.8 4.S 4.10 4.i! 4

- Page 9 and 10:

0 COMMUNICATIONS HQ Communications

- Page 13 and 14:

PHASE 1 APPENDIX B/I 1900 HOURS ON

- Page 15 and 16:

4~ 50O APPENDIX B/3 Nobi!e serials

- Page 17 and 18:

,v’b Hillsborough Grotmd -0 o :

- Page 19 and 20:

:;I I1’:1"1’" I I’.’1 .I) 4

- Page 22 and 23:

I i: I 1.1 The match ~ill attract a

- Page 24 and 25:

5.1 Livoroool S-~@regation~ithln th

- Page 26 and 27:

! ! ! ! 9.1 sheffield cell bus mann

- Page 28 and 29:

a o I I I Note I I sign I GHX1 GHV

- Page 30 and 31:

I ! ! Trm followir~ o~icors will ~F

- Page 32 and 33:

P 1 ~TIE~ R~ 6TAT]C TR~’FIC POINT

- Page 34 and 35:

q L~or Bt/~r~reave Rd t rngroavo Rd

- Page 36 and 37:

I i pi ~tr i butlon A.C.C Operation

- Page 38 and 39:

I I ! ! O ORRA.TIOPRL ~ ’ p’ 1/

- Page 40 and 41:

i ! I I 2.1 Zt is the intention of

- Page 42 and 43:

t ! I 3. F,.2 I 3.E.~, 3. [ I O 3.9

- Page 44 and 45:

@ 4.12.2 @ O-ZZE~ ~ ’ F’ D-~~ E

- Page 46 and 47:

| i ! ! ! ! (~CUqD O3RI’RI o~e£

- Page 48 and 49:

I IE ~SIT VA~ - ~ IEIEST ~-:t~ Fore

- Page 50 and 51:

! ! t 3.12.38 3.12.39 ! J.12.40 3.1

- Page 52 and 53:

! I I I 1 1 I 4.1.3 4.1.4 ~._-e 8 p

- Page 54 and 55:

I | I ! ( ] } 4 i 4.9.2 4.11.2 4.11

- Page 56 and 57:

! ((X1~T’D) Cell Sign Sub Sectcr

- Page 58 and 59:

i II PS 2777 - Stagge~ during ~ratc

- Page 60 and 61:

pS 729 ~ ) PC 2e i:x-e~tt ~) l=C 28

- Page 62 and 63:

i i I I ] T SF~IH K~P [ ~a.L.~ c~-

- Page 64 and 65:

° ~ 2409 2209 IN? 1.506 ) PC 3116

- Page 66 and 67:

I ) 1=C 1423 Ne~t~lf. LtLr~3 for br

- Page 68 and 69:

¯ ¯ !~;~: ~3 Evans ¯ 620 Yate.s

- Page 70 and 71:

t~t T:t:z~t 8~tU~t :A(.: ~te.~ ~ o(

- Page 72 and 73:

l lt~ for ~ as per ]) ] k -:~ 2640

- Page 74 and 75:

8 ~rj~ 3_tnSl.tZ~ ~s.~e 2. foz- ]po

- Page 76 and 77:

~pS 12J5 Ports "A~’ ~ MrJ5 ~ l I

- Page 78 and 79:

O ~-_,.,~ for t~.e.fing as per p!an

- Page 80 and 81:

.? ~t~ for br~-~ is ~m at~ (See ~-~

- Page 82 and 83:

i 1 1) 3,’: 2153 ~.~Lt’~ ! libe

- Page 84 and 85:

5 1ILK) Yl.._---lry ’~’ I~ 243!

- Page 86 and 87:

.~~ 8t~ (See ’T’ ) 1 J ~--ial 5

- Page 88 and 89:

= ~ ’t’) e --ial 55 ; 2467 ~ ,~

- Page 90 and 91:

) I~ 1539 WeSt r l ! 0 sea~ f~ ~f~

- Page 92 and 93:

i IP¢: IK)4 Oaznez C~ - ~rLva= I~

- Page 94 and 95:

i~m~=~t s~as OOuISJ.u~ ~I~ (m~CI3ND

- Page 96 and 97:

! I ! ! ! 1 ! 0 ~ _ . ~m~---~ of th

- Page 98 and 99:

~ /.264 Bew-i ~ I~_ 102 Fidler ) PC

- Page 100 and 101:

! ! ! ! ! 1 1. 2. 3. 4. 5. followin

- Page 102 and 103:

I I II O re_J_ ~_’l I.iv~--q:ool

- Page 104 and 105:

i 0 0 4 5 6 AP?E~DIX ’N" %~nsit v

- Page 106 and 107:

0 i 2 4 5 7 9 o Unaut~orised person

- Page 108 and 109:

e e I. Pri~- _--~te si~-~ by AA in

- Page 110 and 111:

© 0 MAPS (i) ~~ ~s~ (ii) (iv) (v)

- Page 112:

,~ ~.,IF:FIELD WEI~SDAY i:oou~,JJ C

- Page 116 and 117:

"--------------~ 167-Y7~ B~!Eq~ A:E

- Page 118 and 119:

I I ! ! SOUTH YORKSHIRE POLICE ’F

- Page 120 and 121:

. - I I ! I- 1.8.2 1.8.3 1.8.4 2 IN

- Page 122 and 123:

! ! ! I ,I 1- ! ! ! ] ] 1 e 3.11 3.

- Page 124 and 125:

I I I ~,~-~ ~.._~_

- Page 126 and 127:

I Hil/sborough Ground . ,0 o ray Fa

- Page 128 and 129:

) % l~ot Ls LEADE~ ~D. G~ .I ~’~C

- Page 130 and 131:

i I I i I t 1 ! ] ] I I Sub 5e:_tc_

- Page 132 and 133:

! ! ! | !l ! , , n~S~TOPS (~’D) S

- Page 134 and 135:

FOOTBALL DU’YY : S~MI FINAL ’F

- Page 136 and 137:

O ROW SEAT ENTRANCE GANGWAY £ £ 1

- Page 138 and 139:

e C ( t---=-~T. / ’ ROW SEAT ENTR

- Page 140 and 141:

FROM: ..TO: .=r .,~ EN/2 Superinten

- Page 142 and 143:

t . ar~ for tl-. = Liverpool Sups,

- Page 144 and 145:

.~.,-...~ ~ ~..-.~. e’~nts t.~a/~

- Page 146 and 147:

@ ~’- OF REPORT L F [ran but ~a

- Page 148 and 149:

To en~ure ~ha% suppo-.’.~r}, ~’

- Page 150 and 151:

0 ~=ction Superintenientz ’ sho~!

- Page 152 and 153:

0 0 d_ ff\/ Briefin8 Notes ?.... ..

- Page 154 and 155:

i O 0 Chief Inspector Bea], Chief I

- Page 156 and 157:

@ @ .-" LANE FZSSA~ WILL BE PASS~:-

- Page 158 and 159:

o 0 \ o,.,t 1 .... ,.’.."’""’

- Page 161 and 162:

l, o. ->

- Page 163 and 164:

o oo .~ ¯ . Le~. r~o~L- ! fl

- Page 165 and 166:

/ e.un~6x B / ._~ ~~. ...-> &n.~ o~

- Page 167 and 168:

SECgDR 2A Sub-Sector i0 Insp Humi~r

- Page 169 and 170:

THIS IS ~IAT EACH SI~JAL WILL DO: H

- Page 171 and 172:

e f Segregation Liverpool in N/Stan

- Page 173 and 174:

Transit Van Parking area - wardsend

- Page 175 and 176:

0 Account for your serials Prisoner

- Page 177 and 178:

I c’) ’ ( ~atlll U for hriefill

- Page 179 and 180:

.. . ¯ . . o-, :( 0 t . , f~-r |hi

- Page 181 and 182:

,,

- Page 183 and 184:

!~r lal 41,, ~alilil’J loT hr:ef

- Page 185 and 186:

".: HX|III~I) ~ :L-’I"] Clt I ¯

- Page 188 and 189:

, It,|

- Page 190 and 191:

d 15/~4/89 17:56 FIA F12~ SEMI FINA

- Page 192 and 193:

15/04/89 17:56 FIA F1230 SEMI FINAL

- Page 194 and 195:

15/04/89 17:57 FIA F1230 SEMI FINAL

- Page 196 and 197:

.5/04/89 17:57 FIA FI23B ADD COMMEN

- Page 198 and 199:

15/~/89 17:57 FIA F1~30 SEMI FINAL

- Page 200 and 201:

~5/04/89 17:58 FIA F1230 ~Dii COMME

- Page 202 and 203:

15/04/89 18:~1FIA F1230 ADO C(’~I

- Page 204 and 205:

15/04/89 18:01FIA F1230 SEMI FINAL

- Page 206 and 207:

i 1117 - Radio Checks - Serzals I-?

- Page 208 and 209:

(i ..- SAI6 TAPE TIME (Real Time) i

- Page 210 and 211:

Q / SAI6 o 14m 14m 10s (1454) 14m 2

- Page 212 and 213:

18m (1457) 18m 10s 18m 40s (1458) 1

- Page 214 and 215:

0 24m (1503) 24m 10s 24m 20s 24m 30

- Page 216 and 217:

o SAI6 9. 28m I0 s ( 1507.53 ) 28m

- Page 218 and 219:

RC RC F/C RC F/C RC F/C RC F/C RC F

- Page 220 and 221:

O 15 08 13 15 08 27 F/C RC F/C RC F

- Page 222 and 223:

Track No. 11 Time ~ -[ 1507-49 1507

- Page 224 and 225:

NATCH-DAY STAFF ON DUTY: 15th AI’

- Page 226 and 227:

I L . ( %.. ( I. 1. CHECK GATE GATE

- Page 228 and 229:

! k_ t. % £ lj ~" -,. CL ’= =EP

- Page 230 and 231:

O i Znterna~ Examination continued

- Page 232 and 233:

The body appears uncircumciosec. Th

- Page 234 and 235:

th_~o.,-.bo zic occlusien~ ¯. ¯ .

- Page 236 and 237:

~ safety. Chief E.xecutive: R. H. G

- Page 238 and 239:

The ~,:::I ~-(’,i:;] i,.:-,~ :~-=

- Page 240 and 241:

I \ ~111 ION \ \ 1o I0~ V[~l lfJ~([

- Page 242 and 243:

MEETINGS OF STEWARDS, GATEMEN AND A

- Page 244 and 245:

f?, ¯ 3. SHEFFIELD CITY CO~CIL SAF

- Page 246 and 247:

Curre=~ Provision 3. S=he~-., i e 3

- Page 248 and 249:

# ¯ ~9~:or ZIY, G P/F’." 15th Au

- Page 250 and 251:

.. - °\ APPENDIX 1 - A.w _ND.U _h

- Page 252 and 253:

The Safety Certificate issued by th

- Page 254 and 255:

e From Date Ref. Tel. Ext 23rd N~,~

- Page 256 and 257:

Clearly, urgent attention needs to

- Page 258 and 259:

O REPORT OF THE HEAD OF ADMINISTRAT

- Page 260 and 261:

Town Hall SHEFFIELD (b) ask the Adv

- Page 262 and 263:

O The Safety Certificate Issued by

- Page 264 and 265:

." :.’ ;t . - ...-..:.....~_.:-.-

- Page 266 and 267:

During the game it was necessary fo

- Page 268 and 269:

0 ,/ EAS3".’~,OOD ~ PARTNERS v ¯

- Page 270 and 271:

T ? i ! i :l i i I i "i .I II [ I I

- Page 272 and 273:

. , ~. ~,.~.K~,, 0 ~ . E SHEFFIELD

- Page 274 and 275:

@ From: To: ~OUTH YORKSHIRE POLICE

- Page 276 and 277:

e t- The Secretary, Sheffield Wedne

- Page 278 and 279:

e // EASTWOOD ~ PARTNERS Consulting

- Page 280 and 281:

e e "t / 7ASTWOOD Et PARTNERS Contu

- Page 282 and 283:

1P EASTWOOD ~ PARTNERS Consulting E

- Page 284 and 285:

@ EASTWOOD ~ PARTNERS W. Eastwood A

- Page 286 and 287:

O .... m. ¯ 8ysCan wL~ing to allo~

- Page 288 and 289:

l~rtner’m tim tn dLrocttng work a

- Page 290 and 291:

EASTWOOD ~t PARTNERS Consulting Eng

- Page 292 and 293:

) / O EASTWOOD ~ PARTNERS Consultin

- Page 294 and 295:

l:Abl VVUOD Et PARTNERS Conaultln g

- Page 296 and 297:

@ Partner’s time (Dr. W. Eastwood

- Page 298 and 299:

e staff how to carry out certain ma

- Page 300 and 301:

q~- ,. I .=ASTWOOD 5" PARTNERS Cons

- Page 302 and 303:

O Use of test Van hire to Travellin

- Page 304 and 305:

/ EASTWOOD ~ PARTNERS Consulting En

- Page 306 and 307:

EASTWOOD Et PARTNERS Consulting Eng

- Page 308 and 309:

Partner’. time (Dr. W. Eastwood}

- Page 310 and 311:

o-, approval including calculations

- Page 312 and 313:

e EASTWOOD ~ PARTNERS Consulting En

- Page 314 and 315:

e O EASTWOOD 8’ Dkwxors: W. Eastw

- Page 316 and 317:

O o FROM : TO- SUBJECT : EASTWOOD 6

- Page 318 and 319: e EASTWOOD E~ PARTNERS (Consulting

- Page 320 and 321: e EASTWOOD ~ PARTNERS (Consulting E

- Page 322 and 323: e EASTWOOD ~ PARTNERS (Consulting E

- Page 324 and 325: e EASTWOOD 8’ PARTNERS (Coneultln

- Page 326 and 327: J EASTWOOD ~ PARTNERS (Consulting E

- Page 328 and 329: EASTWOOD ~ PARTNERS (Consulting Eng

- Page 330 and 331: my partners] will both be available

- Page 332 and 333: O EASTWOOD i~ PARTNERS (Coneultlng

- Page 334 and 335: e EASTWOOD Et PARTNERS (Consulting

- Page 336 and 337: O Agreed Contract Sum with Gleesons

- Page 338 and 339: ./,,./"" .".~ - -T Van hire to tran

- Page 340 and 341: testing and inspection of crush bar

- Page 342 and 343: EASTWOOD ~ PARTNERS (Consulting Eng

- Page 344 and 345: e O I01 of £26,000 - £2600 Say 95

- Page 346 and 347: .ASTWOOD Direcfon: W. East’wood A

- Page 348 and 349: e 4) EASTWOOD Et PARTNERS (Consulti

- Page 350 and 351: e F.ASTWOOD Et PARTNERS (Con=ulting

- Page 352 and 353: Q ,&~./ 8TWOOD ,! . W’~--~I~I~

- Page 354 and 355: EASTWOOD b PARTNERS (Coneultln9 Eng

- Page 356 and 357: EASTWOOD ~ PARTNERS (Consulting Eng

- Page 358 and 359: e EASTWOOD & PARTNERS (Consulting E

- Page 360 and 361: @ 0 Shefflold Wednenday Football Cl

- Page 362 and 363: O ,=ASTWOOD & PARTNERS (Consulting

- Page 364 and 365: e O EASTWOOD & PARTNERS (Consulting

- Page 366 and 367: e Sheffield Wednesday Football Club

- Page 370 and 371: ~00 Sheffield Wednesday Football Cl

- Page 372 and 373: o~o~ ¯ ¯ o ¯ ¯ T° . ° . ¯ ¯

- Page 374 and 375: %- :., : ~. .. - .--_" .:.:. ":~. S

- Page 376 and 377: e t~O Sheffield Wednesday Directors

- Page 378 and 379: 9tO[~ 1 Sheffield Wednesday Footbal

- Page 380 and 381: e Sheffield Wednesday Football Club

- Page 382 and 383: o~,o I~ Sheffield Wednesday Footbal

- Page 384 and 385: e g ~o~ Sheffield Wednesday Footbal

- Page 386 and 387: i:i:~ : - P~ KERR FORStt~ Chartered

- Page 388 and 389: Q O Sheffield Wednesday Football Cl

- Page 390 and 391: Sheffield Wednesday Football Club p

- Page 392 and 393: I . .::.;’: = .... " ;; ........

- Page 394 and 395: ° o,. -..:-.., Sheffield Wednesday

- Page 396 and 397: O O ° ° ° ; : - o" . " i-¯ Shef

- Page 398 and 399: = O o, o. o .. . . o .... Sheffield

- Page 400 and 401: .;." ,.° Sheffield Wednesday Footb

- Page 402 and 403: @ . ..." @ , =. ," .¯ o, oro Sheff

- Page 404 and 405: ¯ r .° .- . ¯ o ° Sheffield Wed

- Page 406 and 407: O e Sheffield Wednesday Football Cl

- Page 408 and 409: O O .°’.- ....’.. . . ° o, ¯

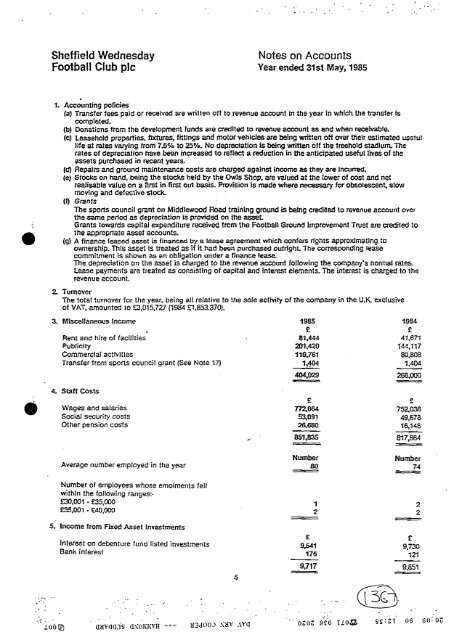

- Page 410 and 411: J SHEFFIELD WEDNESDAY F.C. PLC ACCO

- Page 412 and 413: il i I

- Page 414 and 415: 3~ ° . ADD Financial year ending 3