Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

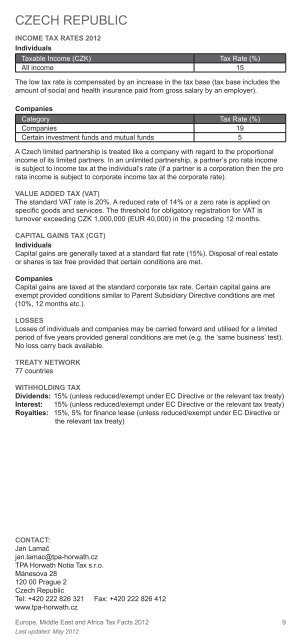

CZECH REPUBLIC<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

<strong>Tax</strong>able Income (CZK) <strong>Tax</strong> Rate (%)<br />

All income 15<br />

The low tax rate is compensated by an increase in the tax base (tax base includes the<br />

amount of social <strong>and</strong> health insurance paid from gross salary by an employer).<br />

Companies<br />

Category <strong>Tax</strong> Rate (%)<br />

Companies 19<br />

Certain investment funds <strong>and</strong> mutual funds 5<br />

A Czech limited partnership is treated like a company with regard to the proportional<br />

income of its limited partners. In an unlimited partnership, a partner’s pro rata income<br />

is subject to income tax at the individual’s rate (if a partner is a corporation then the pro<br />

rata income is subject to corporate income tax at the corporate rate).<br />

VALUE ADDED TAX (VAT)<br />

The st<strong>and</strong>ard VAT rate is 20%. A reduced rate of 14% or a zero rate is applied on<br />

specifi c goods <strong>and</strong> services. The threshold for obligatory registration for VAT is<br />

turnover exceeding CZK 1,000,000 (EUR 40,000) in the preceding 12 months.<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

Capital gains are generally taxed at a st<strong>and</strong>ard fl at rate (15%). Disposal of real estate<br />

or shares is tax free provided that certain conditions are met.<br />

Companies<br />

Capital gains are taxed at the st<strong>and</strong>ard corporate tax rate. Certain capital gains are<br />

exempt provided conditions similar to Parent Subsidiary Directive conditions are met<br />

(10%, 12 months etc.).<br />

LOSSES<br />

Losses of individuals <strong>and</strong> companies may be carried forward <strong>and</strong> utilised for a limited<br />

period of fi ve years provided general conditions are met (e.g. the ‘same business’ test).<br />

No loss carry back available.<br />

TREATY NETWORK<br />

77 countries<br />

WITHHOLDING TAX<br />

Dividends: 15% (unless reduced/exempt under EC Directive or the relevant tax treaty)<br />

Interest: 15% (unless reduced/exempt under EC Directive or the relevant tax treaty)<br />

Royalties: 15%, 5% for fi nance lease (unless reduced/exempt under EC Directive or<br />

the relevant tax treaty)<br />

CONTACT:<br />

Jan Lamač<br />

jan.lamac@tpa-horwath.cz<br />

TPA <strong>Horwath</strong> Notia <strong>Tax</strong> s.r.o.<br />

Mánesova 28<br />

120 00 Prague 2<br />

Czech Republic<br />

Tel: +420 222 826 321 Fax: +420 222 826 412<br />

www.tpa-horwath.cz<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong> 9<br />

Last updated: May <strong>2012</strong>