Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

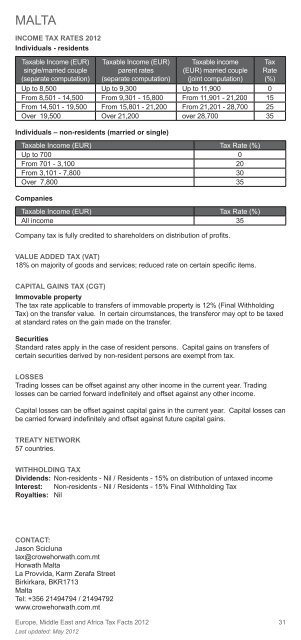

MALTA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals - residents<br />

<strong>Tax</strong>able Income (EUR)<br />

single/married couple<br />

(separate computation)<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong> 31<br />

Last updated: May <strong>2012</strong><br />

<strong>Tax</strong>able Income (EUR)<br />

parent rates<br />

(separate computation)<br />

<strong>Tax</strong>able income<br />

(EUR) married couple<br />

(joint computation)<br />

<strong>Tax</strong><br />

Rate<br />

(%)<br />

Up to 8,500 Up to 9,300 Up to 11,900 0<br />

From 8,501 - 14,500 From 9,301 - 15,800 From 11,901 - 21,200 15<br />

From 14,501 - 19,500 From 15,801 - 21,200 From 21,201 - 28,700 25<br />

Over 19,500 Over 21,200 over 28,700 35<br />

Individuals – non-residents (married or single)<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

Up to 700 0<br />

From 701 - 3,100 20<br />

From 3,101 - 7,800 30<br />

Over 7,800 35<br />

Companies<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

All income 35<br />

Company tax is fully credited to shareholders on distribution of profi ts.<br />

VALUE ADDED TAX (VAT)<br />

18% on majority of goods <strong>and</strong> services; reduced rate on certain specifi c items.<br />

CAPITAL GAINS TAX (CGT)<br />

Immovable property<br />

The tax rate applicable to transfers of immovable property is 12% (Final Withholding<br />

<strong>Tax</strong>) on the transfer value. In certain circumstances, the transferor may opt to be taxed<br />

at st<strong>and</strong>ard rates on the gain made on the transfer.<br />

Securities<br />

St<strong>and</strong>ard rates apply in the case of resident persons. Capital gains on transfers of<br />

certain securities derived by non-resident persons are exempt from tax.<br />

LOSSES<br />

Trading losses can be offset against any other income in the current year. Trading<br />

losses can be carried forward indefi nitely <strong>and</strong> offset against any other income.<br />

Capital losses can be offset against capital gains in the current year. Capital losses can<br />

be carried forward indefi nitely <strong>and</strong> offset against future capital gains.<br />

TREATY NETWORK<br />

57 countries.<br />

WITHHOLDING TAX<br />

Dividends: Non-residents - Nil / Residents - 15% on distribution of untaxed income<br />

Interest: Non-residents - Nil / Residents - 15% Final Withholding <strong>Tax</strong><br />

Royalties: Nil<br />

CONTACT:<br />

Jason Scicluna<br />

tax@crowehorwath.com.mt<br />

<strong>Horwath</strong> Malta<br />

La Provvida, Karm Zerafa Street<br />

Birkirkara, BKR1713<br />

Malta<br />

Tel: +356 21494794 / 21494792<br />

www.crowehorwath.com.mt