Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

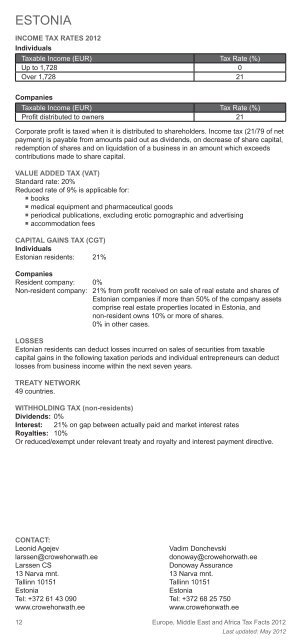

ESTONIA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

12<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

Up to 1,728 0<br />

Over 1,728 21<br />

Companies<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

Profi t distributed to owners 21<br />

Corporate profi t is taxed when it is distributed to shareholders. Income tax (21/79 of net<br />

payment) is payable from amounts paid out as dividends, on decrease of share capital,<br />

redemption of shares <strong>and</strong> on liquidation of a business in an amount which exceeds<br />

contributions made to share capital.<br />

VALUE ADDED TAX (VAT)<br />

St<strong>and</strong>ard rate: 20%<br />

Reduced rate of 9% is applicable for:<br />

� books<br />

� medical equipment <strong>and</strong> pharmaceutical goods<br />

� periodical publications, excluding erotic pornographic <strong>and</strong> advertising<br />

� accommodation fees<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

Estonian residents: 21%<br />

Companies<br />

Resident company: 0%<br />

Non-resident company: 21% from profi t received on sale of real estate <strong>and</strong> shares of<br />

Estonian companies if more than 50% of the company assets<br />

comprise real estate properties located in Estonia, <strong>and</strong><br />

non-resident owns 10% or more of shares.<br />

0% in other cases.<br />

LOSSES<br />

Estonian residents can deduct losses incurred on sales of securities from taxable<br />

capital gains in the following taxation periods <strong>and</strong> individual entrepreneurs can deduct<br />

losses from business income within the next seven years.<br />

TREATY NETWORK<br />

49 countries.<br />

WITHHOLDING TAX (non-residents)<br />

Dividends: 0%<br />

Interest: 21% on gap between actually paid <strong>and</strong> market interest rates<br />

Royalties: 10%<br />

Or reduced/exempt under relevant treaty <strong>and</strong> royalty <strong>and</strong> interest payment directive.<br />

CONTACT:<br />

Leonid Agejev<br />

larssen@crowehorwath.ee<br />

Larssen CS<br />

13 Narva mnt.<br />

Tallinn 10151<br />

Estonia<br />

Tel: +372 61 43 090<br />

www.crowehorwath.ee<br />

Vadim Donchevski<br />

donoway@crowehorwath.ee<br />

Donoway Assurance<br />

13 Narva mnt.<br />

Tallinn 10151<br />

Estonia<br />

Tel: +372 68 25 750<br />

www.crowehorwath.ee<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>