Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

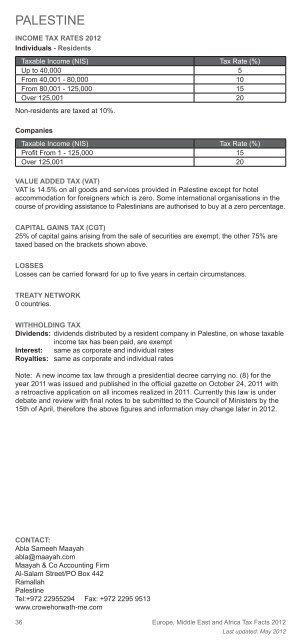

PALESTINE<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals - Residents<br />

<strong>Tax</strong>able Income (NIS) <strong>Tax</strong> Rate (%)<br />

Up to 40,000 5<br />

From 40,001 - 80,000 10<br />

From 80,001 - 125,000 15<br />

Over 125,001<br />

Non-residents are taxed at 10%.<br />

20<br />

Companies<br />

<strong>Tax</strong>able Income (NIS) <strong>Tax</strong> Rate (%)<br />

Profi t From 1 - 125,000 15<br />

Over 125,001 20<br />

VALUE ADDED TAX (VAT)<br />

VAT is 14.5% on all goods <strong>and</strong> services provided in Palestine except for hotel<br />

accommodation for foreigners which is zero. Some international organisations in the<br />

course of providing assistance to Palestinians are authorised to buy at a zero percentage.<br />

CAPITAL GAINS TAX (CGT)<br />

25% of capital gains arising from the sale of securities are exempt, the other 75% are<br />

taxed based on the brackets shown above.<br />

LOSSES<br />

Losses can be carried forward for up to fi ve years in certain circumstances.<br />

TREATY NETWORK<br />

0 countries.<br />

WITHHOLDING TAX<br />

Dividends: dividends distributed by a resident company in Palestine, on whose taxable<br />

income tax has been paid, are exempt<br />

Interest: same as corporate <strong>and</strong> individual rates<br />

Royalties: same as corporate <strong>and</strong> individual rates<br />

Note: A new income tax law through a presidential decree carrying no. (8) for the<br />

year 2011 was issued <strong>and</strong> published in the offi cial gazette on October 24, 2011 with<br />

a retroactive application on all incomes realized in 2011. Currently this law is under<br />

debate <strong>and</strong> review with fi nal notes to be submitted to the Council of Ministers by the<br />

15th of April, therefore the above fi gures <strong>and</strong> information may change later in <strong>2012</strong>.<br />

CONTACT:<br />

Abla Sameeh Maayah<br />

abla@maayah.com<br />

Maayah & Co Accounting Firm<br />

Al-Salam Street/PO Box 442<br />

Ramallah<br />

Palestine<br />

Tel:+972 22955294 Fax: +972 2295 9513<br />

www.crowehorwath-me.com<br />

36<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>