Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

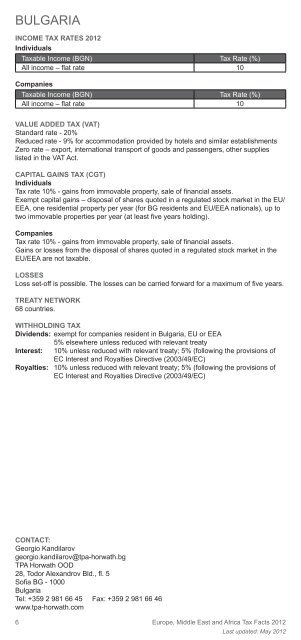

BULGARIA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

6<br />

<strong>Tax</strong>able Income (BGN) <strong>Tax</strong> Rate (%)<br />

All income – fl at rate 10<br />

Companies<br />

<strong>Tax</strong>able Income (BGN) <strong>Tax</strong> Rate (%)<br />

All income – fl at rate 10<br />

VALUE ADDED TAX (VAT)<br />

St<strong>and</strong>ard rate - 20%<br />

Reduced rate - 9% for accommodation provided by hotels <strong>and</strong> similar establishments<br />

Zero rate – export, international transport of goods <strong>and</strong> passengers, other supplies<br />

listed in the VAT Act.<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

<strong>Tax</strong> rate 10% - gains from immovable property, sale of fi nancial assets.<br />

Exempt capital gains – disposal of shares quoted in a regulated stock market in the EU/<br />

EEA, one residential property per year (for BG residents <strong>and</strong> EU/EEA nationals), up to<br />

two immovable properties per year (at least fi ve years holding).<br />

Companies<br />

<strong>Tax</strong> rate 10% - gains from immovable property, sale of fi nancial assets.<br />

Gains or losses from the disposal of shares quoted in a regulated stock market in the<br />

EU/EEA are not taxable.<br />

LOSSES<br />

Loss set-off is possible. The losses can be carried forward for a maximum of fi ve years.<br />

TREATY NETWORK<br />

68 countries.<br />

WITHHOLDING TAX<br />

Dividends: exempt for companies resident in Bulgaria, EU or EEA<br />

5% elsewhere unless reduced with relevant treaty<br />

Interest: 10% unless reduced with relevant treaty; 5% (following the provisions of<br />

EC Interest <strong>and</strong> Royalties Directive (2003/49/EC)<br />

Royalties: 10% unless reduced with relevant treaty; 5% (following the provisions of<br />

EC Interest <strong>and</strong> Royalties Directive (2003/49/EC)<br />

CONTACT:<br />

Georgio K<strong>and</strong>ilarov<br />

georgio.k<strong>and</strong>ilarov@tpa-horwath.bg<br />

TPA <strong>Horwath</strong> OOD<br />

28, Todor Alex<strong>and</strong>rov Bld., fl . 5<br />

Sofi a BG - 1000<br />

Bulgaria<br />

Tel: +359 2 981 66 45 Fax: +359 2 981 66 46<br />

www.tpa-horwath.com<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>