Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

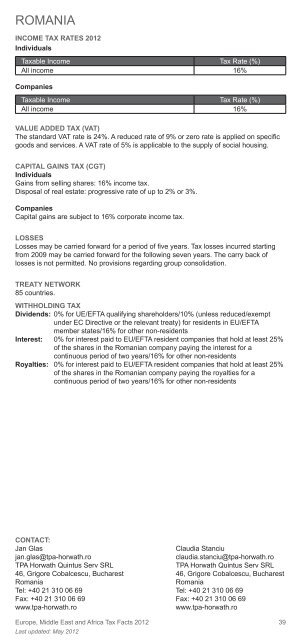

ROMANIA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

<strong>Tax</strong>able Income <strong>Tax</strong> Rate (%)<br />

All income 16%<br />

Companies<br />

<strong>Tax</strong>able Income <strong>Tax</strong> Rate (%)<br />

All income 16%<br />

VALUE ADDED TAX (VAT)<br />

The st<strong>and</strong>ard VAT rate is 24%. A reduced rate of 9% or zero rate is applied on specifi c<br />

goods <strong>and</strong> services. A VAT rate of 5% is applicable to the supply of social housing.<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

Gains from selling shares: 16% income tax.<br />

Disposal of real estate: progressive rate of up to 2% or 3%.<br />

Companies<br />

Capital gains are subject to 16% corporate income tax.<br />

LOSSES<br />

Losses may be carried forward for a period of fi ve years. <strong>Tax</strong> losses incurred starting<br />

from 2009 may be carried forward for the following seven years. The carry back of<br />

losses is not permitted. No provisions regarding group consolidation.<br />

TREATY NETWORK<br />

85 countries.<br />

WITHHOLDING TAX<br />

Dividends: 0% for UE/EFTA qualifying shareholders/10% (unless reduced/exempt<br />

under EC Directive or the relevant treaty) for residents in EU/EFTA<br />

member states/16% for other non-residents<br />

Interest: 0% for interest paid to EU/EFTA resident companies that hold at least 25%<br />

of the shares in the Romanian company paying the interest for a<br />

continuous period of two years/16% for other non-residents<br />

Royalties: 0% for interest paid to EU/EFTA resident companies that hold at least 25%<br />

of the shares in the Romanian company paying the royalties for a<br />

continuous period of two years/16% for other non-residents<br />

CONTACT:<br />

Jan Glas<br />

jan.glas@tpa-horwath.ro<br />

TPA <strong>Horwath</strong> Quintus Serv SRL<br />

46, Grigore Cobalcescu, Bucharest<br />

Romania<br />

Tel: +40 21 310 06 69<br />

Fax: +40 21 310 06 69<br />

www.tpa-horwath.ro<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong> 39<br />

Last updated: May <strong>2012</strong><br />

Claudia Stanciu<br />

claudia.stanciu@tpa-horwath.ro<br />

TPA <strong>Horwath</strong> Quintus Serv SRL<br />

46, Grigore Cobalcescu, Bucharest<br />

Romania<br />

Tel: +40 21 310 06 69<br />

Fax: +40 21 310 06 69<br />

www.tpa-horwath.ro