Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

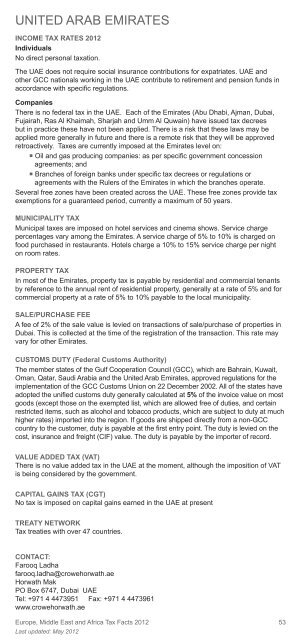

UNITED ARAB EMIRATES<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

No direct personal taxation.<br />

The UAE does not require social insurance contributions for expatriates. UAE <strong>and</strong><br />

other GCC nationals working in the UAE contribute to retirement <strong>and</strong> pension funds in<br />

accordance with specifi c regulations.<br />

Companies<br />

There is no federal tax in the UAE. Each of the Emirates (Abu Dhabi, Ajman, Dubai,<br />

Fujairah, Ras Al Khaimah, Sharjah <strong>and</strong> Umm Al Quwain) have issued tax decrees<br />

but in practice these have not been applied. There is a risk that these laws may be<br />

applied more generally in future <strong>and</strong> there is a remote risk that they will be approved<br />

retroactively. <strong>Tax</strong>es are currently imposed at the Emirates level on:<br />

� Oil <strong>and</strong> gas producing companies: as per specifi c government concession<br />

agreements; <strong>and</strong><br />

� Branches of foreign banks under specifi c tax decrees or regulations or<br />

agreements with the Rulers of the Emirates in which the branches operate.<br />

Several free zones have been created across the UAE. These free zones provide tax<br />

exemptions for a guaranteed period, currently a maximum of 50 years.<br />

MUNICIPALITY TAX<br />

Municipal taxes are imposed on hotel services <strong>and</strong> cinema shows. Service charge<br />

percentages vary among the Emirates. A service charge of 5% to 10% is charged on<br />

food purchased in restaurants. Hotels charge a 10% to 15% service charge per night<br />

on room rates.<br />

PROPERTY TAX<br />

In most of the Emirates, property tax is payable by residential <strong>and</strong> commercial tenants<br />

by reference to the annual rent of residential property, generally at a rate of 5% <strong>and</strong> for<br />

commercial property at a rate of 5% to 10% payable to the local municipality.<br />

SALE/PURCHASE FEE<br />

A fee of 2% of the sale value is levied on transactions of sale/purchase of properties in<br />

Dubai. This is collected at the time of the registration of the transaction. This rate may<br />

vary for other Emirates.<br />

CUSTOMS DUTY (Federal Customs Authority)<br />

The member states of the Gulf Cooperation Council (GCC), which are Bahrain, Kuwait,<br />

Oman, Qatar, Saudi Arabia <strong>and</strong> the United Arab Emirates, approved regulations for the<br />

implementation of the GCC Customs Union on 22 December 2002. All of the states have<br />

adopted the unifi ed customs duty generally calculated at 5% of the invoice value on most<br />

goods (except those on the exempted list, which are allowed free of duties, <strong>and</strong> certain<br />

restricted items, such as alcohol <strong>and</strong> tobacco products, which are subject to duty at much<br />

higher rates) imported into the region. If goods are shipped directly from a non-GCC<br />

country to the customer, duty is payable at the fi rst entry point. The duty is levied on the<br />

cost, insurance <strong>and</strong> freight (CIF) value. The duty is payable by the importer of record.<br />

VALUE ADDED TAX (VAT)<br />

There is no value added tax in the UAE at the moment, although the imposition of VAT<br />

is being considered by the government.<br />

CAPITAL GAINS TAX (CGT)<br />

No tax is imposed on capital gains earned in the UAE at present<br />

TREATY NETWORK<br />

<strong>Tax</strong> treaties with over 47 countries.<br />

CONTACT:<br />

Farooq Ladha<br />

farooq.ladha@crowehorwath.ae<br />

<strong>Horwath</strong> Mak<br />

PO Box 6747, Dubai UAE<br />

Tel: +971 4 4473951 Fax: +971 4 4473961<br />

www.crowehorwath.ae<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong> 53<br />

Last updated: May <strong>2012</strong>