Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

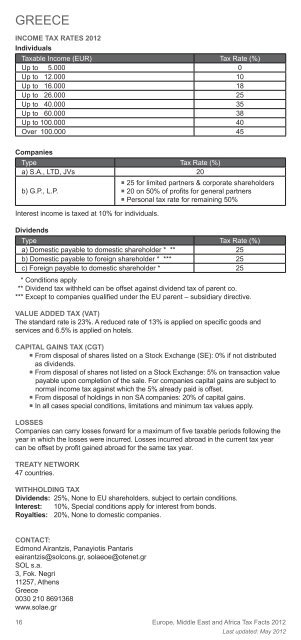

GREECE<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

16<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

Up to 5.000 0<br />

Up to 12.000 10<br />

Up to 16.000 18<br />

Up to 26.000 25<br />

Up to 40.000 35<br />

Up to 60.000 38<br />

Up to 100.000 40<br />

Over 100.000 45<br />

Companies<br />

Type <strong>Tax</strong> Rate (%)<br />

a) S.A., LTD, JVs 20<br />

� 25 for limited partners & corporate shareholders<br />

b) G.P., L.P.<br />

� 20 on 50% of profi ts for general partners<br />

� Personal tax rate for remaining 50%<br />

Interest income is taxed at 10% for individuals.<br />

Dividends<br />

Type <strong>Tax</strong> Rate (%)<br />

a) Domestic payable to domestic shareholder * ** 25<br />

b) Domestic payable to foreign shareholder * *** 25<br />

c) Foreign payable to domestic shareholder * 25<br />

* Conditions apply<br />

** Dividend tax withheld can be offset against dividend tax of parent co.<br />

*** Except to companies qualifi ed under the EU parent – subsidiary directive.<br />

VALUE ADDED TAX (VAT)<br />

The st<strong>and</strong>ard rate is 23%. A reduced rate of 13% is applied on specifi c goods <strong>and</strong><br />

services <strong>and</strong> 6.5% is applied on hotels.<br />

CAPITAL GAINS TAX (CGT)<br />

� From disposal of shares listed on a Stock Exchange (SE): 0% if not distributed<br />

as dividends.<br />

� From disposal of shares not listed on a Stock Exchange: 5% on transaction value<br />

payable upon completion of the sale. For companies capital gains are subject to<br />

normal income tax against which the 5% already paid is offset.<br />

� From disposal of holdings in non SA companies: 20% of capital gains.<br />

� In all cases special conditions, limitations <strong>and</strong> minimum tax values apply.<br />

LOSSES<br />

Companies can carry losses forward for a maximum of fi ve taxable periods following the<br />

year in which the losses were incurred. Losses incurred abroad in the current tax year<br />

can be offset by profi t gained abroad for the same tax year.<br />

TREATY NETWORK<br />

47 countries.<br />

WITHHOLDING TAX<br />

Dividends: 25%, None to EU shareholders, subject to certain conditions.<br />

Interest: 10%, Special conditions apply for interest from bonds.<br />

Royalties: 20%, None to domestic companies.<br />

CONTACT:<br />

Edmond Airantzis, Panayiotis Pantaris<br />

eairantzis@solcons.gr, solaeoe@otenet.gr<br />

SOL s.a.<br />

3, Fok. Negri<br />

11257, Athens<br />

Greece<br />

0030 210 8691368<br />

www.solae.gr<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>