Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

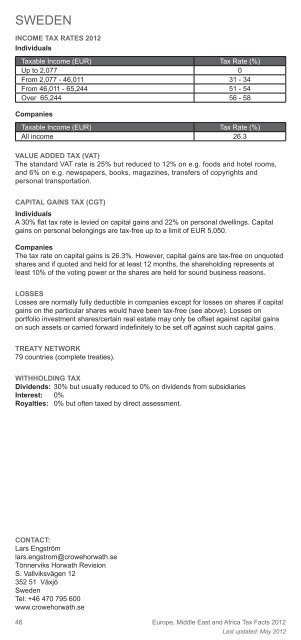

SWEDEN<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

46<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

Up to 2,077 0<br />

From 2,077 - 46,011 31 - 34<br />

From 46,011 - 65,244 51 - 54<br />

Over 65,244 56 - 58<br />

Companies<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

All income 26.3<br />

VALUE ADDED TAX (VAT)<br />

The st<strong>and</strong>ard VAT rate is 25% but reduced to 12% on e.g. foods <strong>and</strong> hotel rooms,<br />

<strong>and</strong> 6% on e.g. newspapers, books, magazines, transfers of copyrights <strong>and</strong><br />

personal transportation.<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

A 30% fl at tax rate is levied on capital gains <strong>and</strong> 22% on personal dwellings. Capital<br />

gains on personal belongings are tax-free up to a limit of EUR 5,050.<br />

Companies<br />

The tax rate on capital gains is 26.3%. However, capital gains are tax-free on unquoted<br />

shares <strong>and</strong> if quoted <strong>and</strong> held for at least 12 months, the shareholding represents at<br />

least 10% of the voting power or the shares are held for sound business reasons.<br />

LOSSES<br />

Losses are normally fully deductible in companies except for losses on shares if capital<br />

gains on the particular shares would have been tax-free (see above). Losses on<br />

portfolio investment shares/certain real estate may only be offset against capital gains<br />

on such assets or carried forward indefi nitely to be set off against such capital gains.<br />

TREATY NETWORK<br />

79 countries (complete treaties).<br />

WITHHOLDING TAX<br />

Dividends: 30% but usually reduced to 0% on dividends from subsidiaries<br />

Interest: 0%<br />

Royalties: 0% but often taxed by direct assessment.<br />

CONTACT:<br />

Lars Engström<br />

lars.engstrom@crowehorwath.se<br />

Tönnerviks <strong>Horwath</strong> Revision<br />

S. Vallviksvägen 12<br />

352 51 Växjö<br />

Sweden<br />

Tel: +46 470 795 600<br />

www.crowehorwath.se<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>