Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

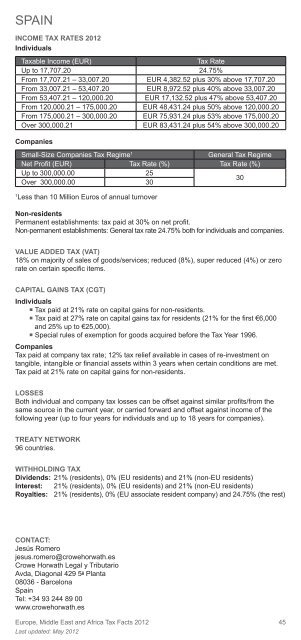

SPAIN<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate<br />

Up to 17,707.20 24.75%<br />

From 17,707.21 – 33,007.20 EUR 4,382.52 plus 30% above 17,707.20<br />

From 33,007.21 – 53,407.20 EUR 8,972.52 plus 40% above 33,007.20<br />

From 53,407.21 – 120,000.20 EUR 17,132.52 plus 47% above 53,407.20<br />

From 120,000.21 – 175,000.20 EUR 48,431.24 plus 50% above 120,000.20<br />

From 175,000.21 – 300,000.20 EUR 75,931.24 plus 53% above 175,000.20<br />

Over 300,000.21 EUR 83,431.24 plus 54% above 300,000.20<br />

Companies<br />

Small-Size Companies <strong>Tax</strong> Regime1 General <strong>Tax</strong> Regime<br />

Net Profi t (EUR) <strong>Tax</strong> Rate (%) <strong>Tax</strong> Rate (%)<br />

Up to 300,000.00<br />

Over 300,000.00<br />

25<br />

30<br />

30<br />

1 Less than 10 Million Euros of annual turnover<br />

Non-residents<br />

Permanent establishments: tax paid at 30% on net profi t.<br />

Non-permanent establishments: General tax rate 24.75% both for individuals <strong>and</strong> companies.<br />

VALUE ADDED TAX (VAT)<br />

18% on majority of sales of goods/services; reduced (8%), super reduced (4%) or zero<br />

rate on certain specifi c items.<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

� <strong>Tax</strong> paid at 21% rate on capital gains for non-residents.<br />

� <strong>Tax</strong> paid at 27% rate on capital gains tax for residents (21% for the fi rst €6,000<br />

<strong>and</strong> 25% up to €25,000).<br />

� Special rules of exemption for goods acquired before the <strong>Tax</strong> Year 1996.<br />

Companies<br />

<strong>Tax</strong> paid at company tax rate; 12% tax relief available in cases of re-investment on<br />

tangible, intangible or fi nancial assets within 3 years when certain conditions are met.<br />

<strong>Tax</strong> paid at 21% rate on capital gains for non-residents.<br />

LOSSES<br />

Both individual <strong>and</strong> company tax losses can be offset against similar profi ts/from the<br />

same source in the current year, or carried forward <strong>and</strong> offset against income of the<br />

following year (up to four years for individuals <strong>and</strong> up to 18 years for companies).<br />

TREATY NETWORK<br />

96 countries.<br />

WITHHOLDING TAX<br />

Dividends: 21% (residents), 0% (EU residents) <strong>and</strong> 21% (non-EU residents)<br />

Interest: 21% (residents), 0% (EU residents) <strong>and</strong> 21% (non-EU residents)<br />

Royalties: 21% (residents), 0% (EU associate resident company) <strong>and</strong> 24.75% (the rest)<br />

CONTACT:<br />

Jesús Romero<br />

jesus.romero@crowehorwath.es<br />

<strong>Crowe</strong> <strong>Horwath</strong> Legal y Tributario<br />

Avda, Diagonal 429 5 a Planta<br />

08036 - Barcelona<br />

Spain<br />

Tel: +34 93 244 89 00<br />

www.crowehorwath.es<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong> 45<br />

Last updated: May <strong>2012</strong>