Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

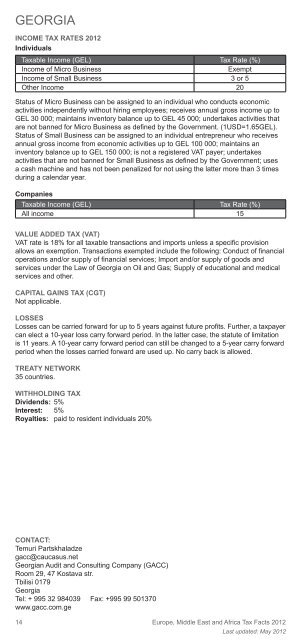

GEORGIA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

<strong>Tax</strong>able Income (GEL) <strong>Tax</strong> Rate (%)<br />

Income of Micro Business Exempt<br />

Income of Small Business 3 or 5<br />

Other Income 20<br />

Status of Micro Business can be assigned to an individual who conducts economic<br />

activities independently without hiring employees; receives annual gross income up to<br />

GEL 30 000; maintains inventory balance up to GEL 45 000; undertakes activities that<br />

are not banned for Micro Business as defi ned by the Government. (1USD=1.65GEL).<br />

Status of Small Business can be assigned to an individual entrepreneur who receives<br />

annual gross income from economic activities up to GEL 100 000; maintains an<br />

inventory balance up to GEL 150 000; is not a registered VAT payer; undertakes<br />

activities that are not banned for Small Business as defi ned by the Government; uses<br />

a cash machine <strong>and</strong> has not been penalized for not using the latter more than 3 times<br />

during a calendar year.<br />

Companies<br />

<strong>Tax</strong>able Income (GEL) <strong>Tax</strong> Rate (%)<br />

All income 15<br />

VALUE ADDED TAX (VAT)<br />

VAT rate is 18% for all taxable transactions <strong>and</strong> imports unless a specifi c provision<br />

allows an exemption. Transactions exempted include the following: Conduct of fi nancial<br />

operations <strong>and</strong>/or supply of fi nancial services; Import <strong>and</strong>/or supply of goods <strong>and</strong><br />

services under the Law of Georgia on Oil <strong>and</strong> Gas; Supply of educational <strong>and</strong> medical<br />

services <strong>and</strong> other.<br />

CAPITAL GAINS TAX (CGT)<br />

Not applicable.<br />

LOSSES<br />

Losses can be carried forward for up to 5 years against future profi ts. Further, a taxpayer<br />

can elect a 10-year loss carry forward period. In the latter case, the statute of limitation<br />

is 11 years. A 10-year carry forward period can still be changed to a 5-year carry forward<br />

period when the losses carried forward are used up. No carry back is allowed.<br />

TREATY NETWORK<br />

35 countries.<br />

WITHHOLDING TAX<br />

Dividends: 5%<br />

Interest: 5%<br />

Royalties: paid to resident individuals 20%<br />

CONTACT:<br />

Temuri Partskhaladze<br />

gacc@caucasus.net<br />

Georgian Audit <strong>and</strong> Consulting Company (GACC)<br />

Room 29, 47 Kostava str.<br />

Tbilisi 0179<br />

Georgia<br />

Tel: + 995 32 984039 Fax: +995 99 501370<br />

www.gacc.com.ge<br />

14<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>