Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

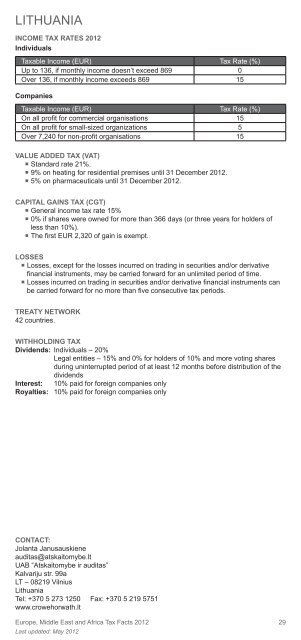

LITHUANIA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

Up to 136, if monthly income doesn’t exceed 869 0<br />

Over 136, if monthly income exceeds 869 15<br />

Companies<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

On all profi t for commercial organisations 15<br />

On all profi t for small-sized organizations 5<br />

Over 7,240 for non-profi t organisations 15<br />

VALUE ADDED TAX (VAT)<br />

� St<strong>and</strong>ard rate 21%.<br />

� 9% on heating for residential premises until 31 December <strong>2012</strong>.<br />

� 5% on pharmaceuticals until 31 December <strong>2012</strong>.<br />

CAPITAL GAINS TAX (CGT)<br />

� General income tax rate 15%<br />

� 0% if shares were owned for more than 366 days (or three years for holders of<br />

less than 10%).<br />

� The fi rst EUR 2,320 of gain is exempt.<br />

LOSSES<br />

� Losses, except for the losses incurred on trading in securities <strong>and</strong>/or derivative<br />

fi nancial instruments, may be carried forward for an unlimited period of time.<br />

� Losses incurred on trading in securities <strong>and</strong>/or derivative fi nancial instruments can<br />

be carried forward for no more than fi ve consecutive tax periods.<br />

TREATY NETWORK<br />

42 countries.<br />

WITHHOLDING TAX<br />

Dividends: Individuals – 20%<br />

Legal entities – 15% <strong>and</strong> 0% for holders of 10% <strong>and</strong> more voting shares<br />

during uninterrupted period of at least 12 months before distribution of the<br />

dividends<br />

Interest: 10% paid for foreign companies only<br />

Royalties: 10% paid for foreign companies only<br />

CONTACT:<br />

Jolanta Janusauskiene<br />

auditas@atskaitomybe.lt<br />

UAB “Atskaitomybe ir auditas”<br />

Kalvariju str. 99a<br />

LT – 08219 Vilnius<br />

Lithuania<br />

Tel: +370 5 273 1250 Fax: +370 5 219 5751<br />

www.crowehorwath.lt<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong> 29<br />

Last updated: May <strong>2012</strong>