Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

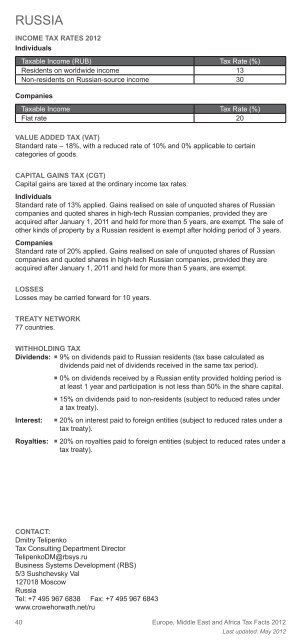

RUSSIA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

40<br />

<strong>Tax</strong>able Income (RUB) <strong>Tax</strong> Rate (%)<br />

Residents on worldwide income 13<br />

Non-residents on Russian-source income 30<br />

Companies<br />

<strong>Tax</strong>able Income <strong>Tax</strong> Rate (%)<br />

Flat rate 20<br />

VALUE ADDED TAX (VAT)<br />

St<strong>and</strong>ard rate – 18%, with a reduced rate of 10% <strong>and</strong> 0% applicable to certain<br />

categories of goods.<br />

CAPITAL GAINS TAX (CGT)<br />

Capital gains are taxed at the ordinary income tax rates.<br />

Individuals<br />

St<strong>and</strong>ard rate of 13% applied. Gains realised on sale of unquoted shares of Russian<br />

companies <strong>and</strong> quoted shares in high-tech Russian companies, provided they are<br />

acquired after January 1, 2011 <strong>and</strong> held for more than 5 years, are exempt. The sale of<br />

other kinds of property by a Russian resident is exempt after holding period of 3 years.<br />

Companies<br />

St<strong>and</strong>ard rate of 20% applied. Gains realised on sale of unquoted shares of Russian<br />

companies <strong>and</strong> quoted shares in high-tech Russian companies, provided they are<br />

acquired after January 1, 2011 <strong>and</strong> held for more than 5 years, are exempt.<br />

LOSSES<br />

Losses may be carried forward for 10 years.<br />

TREATY NETWORK<br />

77 countries.<br />

WITHHOLDING TAX<br />

Dividends: � 9% on dividends paid to Russian residents (tax base calculated as<br />

dividends paid net of dividends received in the same tax period).<br />

� 0% on dividends received by a Russian entity provided holding period is<br />

at least 1 year <strong>and</strong> participation is not less than 50% in the share capital.<br />

� 15% on dividends paid to non-residents (subject to reduced rates under<br />

a tax treaty).<br />

Interest: � 20% on interest paid to foreign entities (subject to reduced rates under a<br />

tax treaty).<br />

Royalties: � 20% on royalties paid to foreign entities (subject to reduced rates under a<br />

tax treaty).<br />

CONTACT:<br />

Dmitry Telipenko<br />

<strong>Tax</strong> Consulting Department Director<br />

TelipenkoDM@rbsys.ru<br />

Business Systems Development (RBS)<br />

5/3 Sushchevsky Val<br />

127018 Moscow<br />

Russia<br />

Tel: +7 495 967 6838 Fax: +7 495 967 6843<br />

www.crowehorwath.net/ru<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>