Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

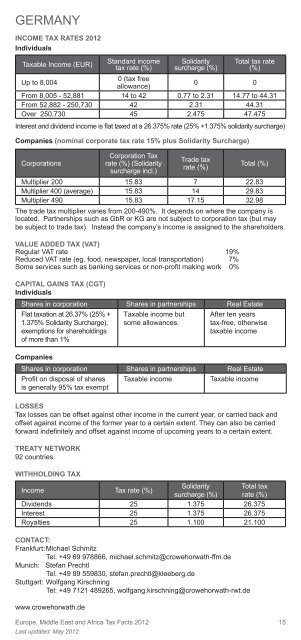

GERMANY<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

<strong>Tax</strong>able Income (EUR)<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong> 15<br />

Last updated: May <strong>2012</strong><br />

St<strong>and</strong>ard income<br />

tax rate (%)<br />

Solidarity<br />

surcharge (%)<br />

Total tax rate<br />

(%)<br />

Up to 8,004<br />

0 (tax free<br />

allowance)<br />

0 0<br />

From 8,005 - 52,881 14 to 42 0.77 to 2.31 14.77 to 44.31<br />

From 52,882 - 250,730 42 2.31 44.31<br />

Over 250,730 45 2.475 47.475<br />

Interest <strong>and</strong> dividend income is fl at taxed at a 26.375% rate (25% +1.375% solidarity surcharge)<br />

Companies (nominal corporate tax rate 15% plus Solidarity Surcharge)<br />

Corporations<br />

Corporation <strong>Tax</strong><br />

rate (%) (Solidarity<br />

surcharge incl.)<br />

Trade tax<br />

rate (%)<br />

Total (%)<br />

Multiplier 200 15.83 7 22.83<br />

Multiplier 400 (average) 15.83 14 29.83<br />

Multiplier 490 15.83 17.15 32.98<br />

The trade tax multiplier varies from 200-490%. It depends on where the company is<br />

located. Partnerships such as GbR or KG are not subject to corporation tax (but may<br />

be subject to trade tax). Instead the company’s income is assigned to the shareholders.<br />

VALUE ADDED TAX (VAT)<br />

Regular VAT rate 19%<br />

Reduced VAT rate (eg. food, newspaper, local transportation) 7%<br />

Some services such as banking services or non-profi t making work 0%<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

Shares in corporation Shares in partnerships Real Estate<br />

Flat taxation at 26.37% (25% +<br />

1.375% Solidarity Surcharge),<br />

exemptions for shareholdings<br />

of more than 1%<br />

Companies<br />

<strong>Tax</strong>able income but<br />

some allowances.<br />

After ten years<br />

tax-free, otherwise<br />

taxable income<br />

Shares in corporation Shares in partnerships Real Estate<br />

Profi t on disposal of shares<br />

is generally 95% tax exempt<br />

<strong>Tax</strong>able income <strong>Tax</strong>able income<br />

LOSSES<br />

<strong>Tax</strong> losses can be offset against other income in the current year, or carried back <strong>and</strong><br />

offset against income of the former year to a certain extent. They can also be carried<br />

forward indefi nitely <strong>and</strong> offset against income of upcoming years to a certain extent.<br />

TREATY NETWORK<br />

92 countries.<br />

WITHHOLDING TAX<br />

Income <strong>Tax</strong> rate (%)<br />

Solidarity<br />

surcharge (%)<br />

Total tax<br />

rate (%)<br />

Dividends 25 1.375 26.375<br />

Interest 25 1.375 26.375<br />

Royalties 25 1.100 21.100<br />

CONTACT:<br />

Frankfurt: Michael Schmitz<br />

Tel. +49 69 978866, michael.schmitz@crowehorwath-ffm.de<br />

Munich: Stefan Prechtl<br />

Tel. +49 89 559830, stefan.prechtl@kleeberg.de<br />

Stuttgart: Wolfgang Kirschning<br />

Tel: +49 7121 489265, wolfgang.kirschning@crowehorwath-rwt.de<br />

www.crowehorwath.de