Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

Europe, Middle East and Africa Tax Facts 2012 - Crowe Horwath ...

- TAGS

- crowe

- horwath

- www.kleeberg.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

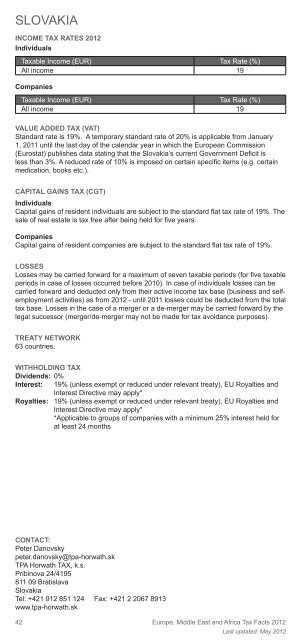

SLOVAKIA<br />

INCOME TAX RATES <strong>2012</strong><br />

Individuals<br />

42<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

All income 19<br />

Companies<br />

<strong>Tax</strong>able Income (EUR) <strong>Tax</strong> Rate (%)<br />

All income 19<br />

VALUE ADDED TAX (VAT)<br />

St<strong>and</strong>ard rate is 19%. A temporary st<strong>and</strong>ard rate of 20% is applicable from January<br />

1, 2011 until the last day of the calendar year in which the <strong>Europe</strong>an Commission<br />

(Eurostat) publishes data stating that the Slovakia’s current Government Defi cit is<br />

less than 3%. A reduced rate of 10% is imposed on certain specifi c items (e.g. certain<br />

medication, books etc.).<br />

CAPITAL GAINS TAX (CGT)<br />

Individuals<br />

Capital gains of resident individuals are subject to the st<strong>and</strong>ard fl at tax rate of 19%. The<br />

sale of real estate is tax free after being held for fi ve years.<br />

Companies<br />

Capital gains of resident companies are subject to the st<strong>and</strong>ard fl at tax rate of 19%.<br />

LOSSES<br />

Losses may be carried forward for a maximum of seven taxable periods (for fi ve taxable<br />

periods in case of losses occurred before 2010). In case of individuals losses can be<br />

carried forward <strong>and</strong> deducted only from their active income tax base (business <strong>and</strong> selfemployment<br />

activities) as from <strong>2012</strong> - until 2011 losses could be deducted from the total<br />

tax base. Losses in the case of a merger or a de-merger may be carried forward by the<br />

legal successor (merger/de-merger may not be made for tax avoidance purposes).<br />

TREATY NETWORK<br />

63 countries.<br />

WITHHOLDING TAX<br />

Dividends: 0%<br />

Interest: 19% (unless exempt or reduced under relevant treaty), EU Royalties <strong>and</strong><br />

Interest Directive may apply*<br />

Royalties: 19% (unless exempt or reduced under relevant treaty), EU Royalties <strong>and</strong><br />

Interest Directive may apply*<br />

*Applicable to groups of companies with a minimum 25% interest held for<br />

at least 24 months<br />

CONTACT:<br />

Peter Danovsky<br />

peter.danovsky@tpa-horwath.sk<br />

TPA <strong>Horwath</strong> TAX, k.s.<br />

Pribinova 24/4195<br />

811 09 Bratislava<br />

Slovakia<br />

Tel: +421 912 851 124 Fax: +421 2 2067 8913<br />

www.tpa-horwath.sk<br />

<strong>Europe</strong>, <strong>Middle</strong> <strong>East</strong> <strong>and</strong> <strong>Africa</strong> <strong>Tax</strong> <strong>Facts</strong> <strong>2012</strong><br />

Last updated: May <strong>2012</strong>