Reforma fiscal y bienestar en la economía de México

Reforma fiscal y bienestar en la economía de México

Reforma fiscal y bienestar en la economía de México

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

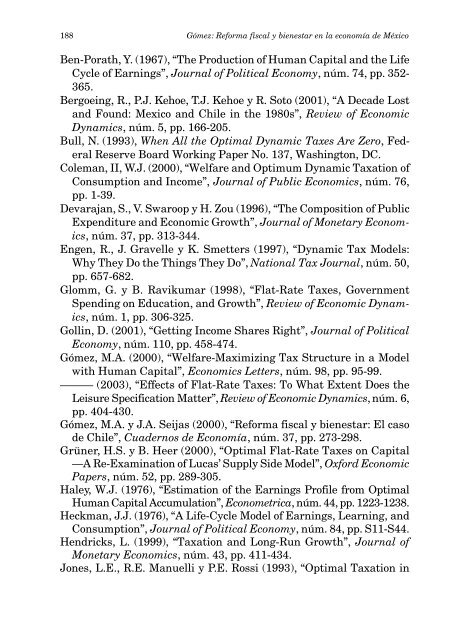

188 Gómez: <strong>Reforma</strong> <strong>fiscal</strong> y <strong>bi<strong>en</strong>estar</strong> <strong>en</strong> <strong>la</strong> <strong>economía</strong> <strong>de</strong> <strong>México</strong>B<strong>en</strong>-Porath, Y. (1967), “The Production of Human Capital and the LifeCycle of Earnings”, Journal of Political Economy, núm. 74, pp. 352-365.Bergoeing, R., P.J. Kehoe, T.J. Kehoe y R. Soto (2001), “A Deca<strong>de</strong> Lostand Found: Mexico and Chile in the 1980s”, Review of EconomicDynamics, núm. 5, pp. 166-205.Bull, N. (1993), Wh<strong>en</strong> All the Optimal Dynamic Taxes Are Zero, Fe<strong>de</strong>ralReserve Board Working Paper No. 137, Washington, DC.Coleman, II, W.J. (2000), “Welfare and Optimum Dynamic Taxation ofConsumption and Income”, Journal of Public Economics, núm. 76,pp. 1-39.Devarajan, S., V. Swaroop y H. Zou (1996), “The Composition of PublicExp<strong>en</strong>diture and Economic Growth”, Journal of Monetary Economics,núm. 37, pp. 313-344.Eng<strong>en</strong>, R., J. Gravelle y K. Smetters (1997), “Dynamic Tax Mo<strong>de</strong>ls:Why They Do the Things They Do”, National Tax Journal, núm. 50,pp. 657-682.Glomm, G. y B. Ravikumar (1998), “F<strong>la</strong>t-Rate Taxes, Governm<strong>en</strong>tSp<strong>en</strong>ding on Education, and Growth”, Review of Economic Dynamics,núm. 1, pp. 306-325.Gollin, D. (2001), “Getting Income Shares Right”, Journal of PoliticalEconomy, núm. 110, pp. 458-474.Gómez, M.A. (2000), “Welfare-Maximizing Tax Structure in a Mo<strong>de</strong>lwith Human Capital”, Economics Letters, núm. 98, pp. 95-99.——— (2003), “Effects of F<strong>la</strong>t-Rate Taxes: To What Ext<strong>en</strong>t Does theLeisure Specification Matter”, Review of Economic Dynamics, núm. 6,pp. 404-430.Gómez, M.A. y J.A. Seijas (2000), “<strong>Reforma</strong> <strong>fiscal</strong> y <strong>bi<strong>en</strong>estar</strong>: El caso<strong>de</strong> Chile”, Cua<strong>de</strong>rnos <strong>de</strong> Economía, núm. 37, pp. 273-298.Grüner, H.S. y B. Heer (2000), “Optimal F<strong>la</strong>t-Rate Taxes on Capital—A Re-Examination of Lucas’ Supply Si<strong>de</strong> Mo<strong>de</strong>l”, Oxford EconomicPapers, núm. 52, pp. 289-305.Haley, W.J. (1976), “Estimation of the Earnings Profile from OptimalHuman Capital Accumu<strong>la</strong>tion”, Econometrica, núm. 44, pp. 1223-1238.Heckman, J.J. (1976), “A Life-Cycle Mo<strong>de</strong>l of Earnings, Learning, andConsumption”, Journal of Political Economy, núm. 84, pp. S11-S44.H<strong>en</strong>dricks, L. (1999), “Taxation and Long-Run Growth”, Journal ofMonetary Economics, núm. 43, pp. 411-434.Jones, L.E., R.E. Manuelli y P.E. Rossi (1993), “Optimal Taxation in