Corné van Zeijl Koopjes in biotech Huizenmarkt - Iex

Corné van Zeijl Koopjes in biotech Huizenmarkt - Iex

Corné van Zeijl Koopjes in biotech Huizenmarkt - Iex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

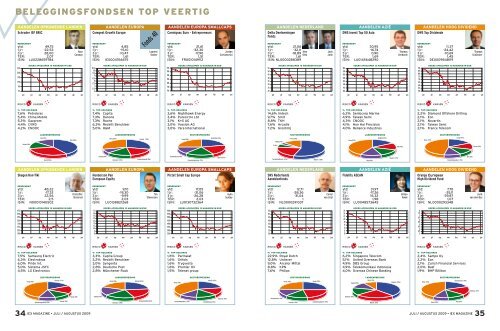

BELEGGINGSFONDSEN TOP VEERTIG<br />

AANDELEN OPKOMENDE LANDEN<br />

Schroder ISF BRIC<br />

RENDEMENT<br />

ytd: 49,75<br />

1 jr: -22,53<br />

3 jr: 28,00<br />

TER: 2,07<br />

ISIN: LU0228659784<br />

Alan<br />

Conway<br />

AANDELEN EUROPA<br />

Comgest Growth Europe<br />

RENDEMENT<br />

ytd: 4,85<br />

1 jr: -15,10<br />

3 jr: -10,47<br />

TER: 1,61<br />

ISIN: IE0004766675<br />

Fonds 40<br />

Laurent<br />

Dobler<br />

AANDELEN EUROPA SMALLCAPS<br />

Carmignac Euro - Entrepreneurs<br />

RENDEMENT<br />

ytd: 21,61<br />

1 jr: -32,30<br />

3 jr: -17,90<br />

TER: 1,51<br />

ISIN: FR0010149112<br />

Jordan<br />

Cvetanovski<br />

AANDELEN NEDERLAND<br />

Delta Deelnem<strong>in</strong>gen<br />

Fonds<br />

RENDEMENT<br />

ytd: 21,06<br />

1 jr: -32,11<br />

Alex<br />

3 jr: -18,89<br />

Otto<br />

TER: 1,61<br />

ISIN: NL0000288389<br />

Jack<br />

Jonk<br />

DWS Invest Top 50 Asia<br />

AANDELEN AZIË<br />

RENDEMENT<br />

ytd: 30,95<br />

1 jr: -16,74<br />

3 jr: 0,90<br />

TER: 1,69<br />

ISIN: LU0145648290<br />

Thomas<br />

Gerhardt<br />

AANDELEN HOOG DIVIDEND<br />

DWS Top Dividende<br />

RENDEMENT<br />

ytd: 11,37<br />

1 jr: -24,42<br />

3 jr: -10,69<br />

TER: 1,45<br />

ISIN: DE0009848119<br />

Thomas<br />

Schüssler<br />

270<br />

230<br />

190<br />

150<br />

110<br />

70<br />

KOERS AFGELOPEN 12 MAANDEN IN USD<br />

jun jul sep nov jan feb apr jun<br />

10,5<br />

10<br />

9,5<br />

9<br />

8,5<br />

8<br />

7,5<br />

7<br />

6,5<br />

6<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov dec feb apr jun<br />

210<br />

190<br />

170<br />

150<br />

130<br />

110<br />

90<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

55<br />

50<br />

45<br />

40<br />

35<br />

30<br />

25<br />

20<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

185<br />

170<br />

155<br />

140<br />

125<br />

110<br />

95<br />

80<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

90<br />

85<br />

80<br />

75<br />

70<br />

65<br />

60<br />

55<br />

50<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

% TOP-HOLDINGS<br />

7,6% Petrobras<br />

5,4% Ch<strong>in</strong>a Mobile<br />

5,2% Gazprom<br />

4,4% CVRD<br />

4,2% CNOOC<br />

% TOP-HOLDINGS<br />

7,4% Capita<br />

7,3% Danone<br />

7,3% Roche<br />

6,3% Reckitt Benckiser<br />

5,0% H&M<br />

% TOP-HOLDINGS<br />

3,6% Nighthawk Energy<br />

3,4% Purecircle Ltd<br />

3,1% K+S AG<br />

3,0% Vossloh AG<br />

3,0% Yara International<br />

% TOP-HOLDINGS<br />

14,6% Imtech<br />

9,7% Smit<br />

8,8% TKH<br />

7,6% Arcadis<br />

7.2% Grontmij<br />

% TOP-HOLDINGS<br />

6,2% Sembcorp Mar<strong>in</strong>e<br />

4,9% Taiwan Semi<br />

4,3% CNOOC<br />

4,1% Hon Hai Precision<br />

4,0% Reliance Industries<br />

% TOP-HOLDINGS<br />

2,2% Diamond Offshore Drill<strong>in</strong>g<br />

2,1% Eon<br />

2,1% Novartis<br />

2,1% Taiwan Semi<br />

2,1% France Telecom<br />

Rusland (14%)<br />

LANDENSPREIDING<br />

India (13%)<br />

Ch<strong>in</strong>a (40%)<br />

LANDENSPREIDING<br />

SECTORSPREIDING<br />

SECTORSPREIDING<br />

LANDENSPREIDING<br />

Overig (29%) Frankrijk (29%)<br />

Overig (25%)<br />

Grondstoffen (21%)<br />

Overig (13%)<br />

Hongkong (16%)<br />

Overig (42%)<br />

Voed<strong>in</strong>g (4%)<br />

IT (6%)<br />

India (14%)<br />

Overig (47%)<br />

SECTORSPREIDING<br />

Energie (17%)<br />

Telecom (13%)<br />

Brazilië (32%)<br />

Duitsland (8%)<br />

Zwitserland (16%)<br />

Verenigd Kon<strong>in</strong>krijk (18%)<br />

Gezondheidszorg (14%)<br />

Consumentengoederen (19%)<br />

Industrie (21%)<br />

Consumentendiensten (22%)<br />

Industrie (55%)<br />

Ch<strong>in</strong>a (14%)<br />

S<strong>in</strong>gapore (14%)<br />

Consumentengoederen (11%)<br />

Nuts (12%)<br />

AANDELEN OPKOMENDE LANDEN<br />

Skagen Kon-Tiki<br />

Henderson Pan<br />

European Equity<br />

AANDELEN EUROPA<br />

AANDELEN EUROPA SMALLCAPS<br />

Pictet Small Cap Europe<br />

AANDELEN NEDERLAND<br />

SNS Nederlands<br />

Aandelenfonds<br />

Fidelity ASEAN<br />

AANDELEN AZIË<br />

AANDELEN HOOG DIVIDEND<br />

Orange European<br />

High Dividend Fund<br />

RENDEMENT<br />

ytd: 48,22<br />

1 jr: -17,32<br />

3 jr: 22,56<br />

TER: 2,5<br />

ISIN: NO0010140502<br />

Kristoffer<br />

Stensrud<br />

RENDEMENT<br />

ytd: 9,10<br />

1 jr: -19,30<br />

3 jr: -9,99<br />

TER: 2,03<br />

ISIN: LU0138821268<br />

Tim<br />

Stevenson<br />

RENDEMENT<br />

ytd: 17,05<br />

1 jr: -31,06<br />

3 jr: -26,28<br />

TER: 2,03<br />

ISIN: LU0130732364<br />

Ayl<strong>in</strong><br />

Suntay<br />

RENDEMENT<br />

ytd: 12,71<br />

1 jr: -38,36<br />

3 jr: -31,04<br />

TER: 1<br />

ISIN: NL0000291037<br />

Corné<br />

<strong>van</strong> <strong>Zeijl</strong><br />

RENDEMENT<br />

ytd: 31,97<br />

1 jr: -17,26<br />

3 jr: 16,32<br />

TER: 1,98<br />

ISIN: LU0048573645<br />

Gillian<br />

Kwek<br />

RENDEMENT<br />

ytd: 7,70<br />

1 jr: -35,11<br />

3 jr: -39,87<br />

TER: 1,07<br />

ISIN: NL0000293348<br />

Jorik<br />

<strong>van</strong> den Bos<br />

470<br />

430<br />

390<br />

350<br />

310<br />

270<br />

230<br />

190<br />

KOERS AFGELOPEN 12 MAANDEN IN NOK<br />

jun jul sep nov jan feb apr jun<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

KOERS AFGELOPEN 12 MAANDEN IN USD<br />

15<br />

16<br />

17 600<br />

55<br />

26<br />

550<br />

50<br />

24<br />

22<br />

14<br />

500<br />

45<br />

20<br />

13<br />

450<br />

40<br />

18<br />

12<br />

10 11<br />

400<br />

35<br />

16<br />

350<br />

30<br />

14<br />

9<br />

300<br />

25<br />

12<br />

8<br />

250<br />

20<br />

10<br />

jun jul sep nov jan feb apr jun<br />

jun jul sep nov jan feb apr jun<br />

jun jul sep nov jan feb apr jun<br />

jun jul sep nov jan feb apr jun<br />

7,5 8<br />

6,5 7<br />

5,5 6<br />

4,5 5<br />

3,5 4<br />

3<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov dec feb apr jun<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

RISICOR KANSENr<br />

% TOP-HOLDINGS<br />

7,5% Samsung Electric<br />

6,3% Electrobras<br />

6,0% Pride Int.<br />

5,0% Sistema JSFC<br />

4,5% LG Electronics<br />

% TOP-HOLDINGS<br />

3,3% Capita Group<br />

3,2% Reckitt Benckiser<br />

3,0% Syngenta<br />

2,8% Deutsche Post<br />

2,8% Münchener Ruck<br />

% TOP-HOLDINGS<br />

1,6% Parmalat<br />

1,6% Grifols<br />

1,6% Trygvesta<br />

1,6% Premier Oil<br />

1,5% Telenet group<br />

% TOP-HOLDINGS<br />

22,9% Royal Dutch<br />

12,8% Unilever<br />

9,0% Arcelor Mittal<br />

8,8% KPN<br />

7,6% Philips<br />

% TOP-HOLDINGS<br />

6,2% S<strong>in</strong>gapore Telecom<br />

5,1% United Overseas Bank<br />

4,9% DBS Group<br />

4,9% Telekomunikasi Indonesia<br />

4,0% Oversea Ch<strong>in</strong>ese Bank<strong>in</strong>g<br />

% TOP-HOLDINGS<br />

2,4% Sampo Oy<br />

2,2% Eon<br />

2,1% Zurich F<strong>in</strong>ancial Services<br />

2,0% Basf<br />

1,9% BHP Billiton<br />

SECTORSPREIDING<br />

LANDENSPREIDING<br />

SECTORSPREIDING<br />

SECTORSPREIDING<br />

F<strong>in</strong>ancials (17%)<br />

Overig (44%) Overig (19%)<br />

Duitsland (23%)<br />

Industrie (22%)<br />

Overig (24%)<br />

Energie (25%)<br />

Overig (37%)<br />

Thailand (12%)<br />

LANDENPREIDING<br />

Overig (9%)<br />

S<strong>in</strong>gapore (38%)<br />

Overig (42%)<br />

SECTORSPREIDING<br />

Basismaterialen (19%)<br />

F<strong>in</strong>ancials (17%)<br />

Consumentengoederen (11%)<br />

Telecom (12%)<br />

Energie (16%)<br />

Frankrijk (17%)<br />

Zwitserland (20%)<br />

Verenigd Kon<strong>in</strong>krijk (21%)<br />

Consumentengoederen (12%)<br />

Gezondheidszorg (14%)<br />

F<strong>in</strong>ancials (15%)<br />

Basismaterialen (14%)<br />

F<strong>in</strong>ancials (15%)<br />

Consumentengoederen (22%)<br />

Indonesië (15%)<br />

Maleisië (26%)<br />

Energie (10%)<br />

Nuts (12%)<br />

34 IEX MAGAZINE • JULI / AUGUSTUS 2009 JULI / AUGUSTUS 2009 • IEX MAGAZINE 35