Corné van Zeijl Koopjes in biotech Huizenmarkt - Iex

Corné van Zeijl Koopjes in biotech Huizenmarkt - Iex

Corné van Zeijl Koopjes in biotech Huizenmarkt - Iex

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

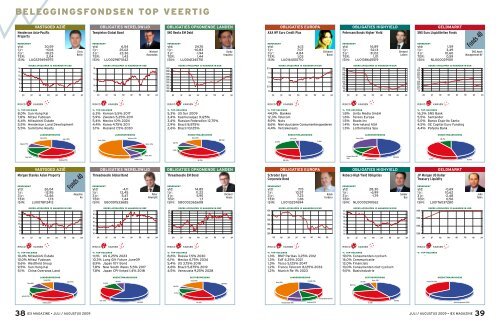

BELEGGINGSFONDSEN TOP VEERTIG<br />

Henderson Asia-Pacific<br />

Property<br />

VASTGOED AZIË<br />

RENDEMENT<br />

ytd: 30,59<br />

1 jr: -10,16<br />

3 jr: -19,23<br />

TER: 2,04<br />

ISIN: LU0229494975<br />

Chris<br />

Reilly<br />

OBLIGATIES WERELDWIJD<br />

Templeton Global Bond<br />

RENDEMENT<br />

ytd: 6,54<br />

1 jr: 25,02<br />

3 jr: 23,36<br />

TER: 1,43<br />

ISIN: LU0029871042<br />

Michael<br />

Hasenstab<br />

OBLIGATIES OPKOMENDE LANDEN<br />

ING Renta EM Debt<br />

RENDEMENT<br />

ytd: 24,76<br />

1 jr: -10,83<br />

3 jr: -1,94<br />

TER: 1,44<br />

ISIN: LU0041345751<br />

Gorky<br />

Urquieta<br />

OBLIGATIES EUROPA<br />

AXA WF Euro Credit Plus<br />

RENDEMENT<br />

ytd: 6,13<br />

1 jr: 7,07<br />

3 jr: 4,84<br />

TER: 1,03<br />

ISIN: LU0164100710<br />

Eléonore<br />

Bunel<br />

OBLIGATIES HIGHYIELD<br />

Petercam Bonds Higher Yield<br />

RENDEMENT<br />

ytd: 16,89<br />

1 jr: -32,13<br />

3 jr: -31,02<br />

TER: 1,01<br />

ISIN: LU0138645519<br />

Bernard<br />

Laliere<br />

GELDMARKT<br />

SNS Euro Liquiditeiten Fonds<br />

RENDEMENT<br />

ytd: 1,59<br />

1 jr: 3,49<br />

3 jr: 10,60<br />

TER: 0,59<br />

ISIN: NL0000291011<br />

Fonds 40<br />

SNS Asset<br />

Management BV<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

KOERS AFGELOPEN 12 MAANDEN IN USD<br />

jun jul sep nov jan feb apr jun<br />

18<br />

17<br />

16<br />

15<br />

14<br />

KOERS AFGELOPEN 12 MAANDEN IN USD<br />

jun jul sep nov jan feb apr jun<br />

3100<br />

2900<br />

2700<br />

2500<br />

2300<br />

2100<br />

1900<br />

1700<br />

1500<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

12,5<br />

12<br />

11,5<br />

11<br />

10,5<br />

10<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

180<br />

170<br />

160<br />

150<br />

140<br />

130<br />

120<br />

110<br />

100<br />

90<br />

80<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

23,8<br />

24<br />

23,6<br />

23,4<br />

23,2<br />

23<br />

22,8<br />

22,6<br />

22,4<br />

22,2<br />

22<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

RISICOS KANSENr<br />

RISICOQ KANSENq<br />

RISICOR KANSENq<br />

RISICOQ KANSENq<br />

RISICOR KANSENr<br />

RISICOO KANSENo<br />

% TOP-HOLDINGS<br />

8,0% Sun Hung Kai<br />

7,8% Mitsui Fudosan<br />

6,4% Mitsubishi Estate<br />

5,5% Henderson Land Development<br />

5,5% Sumitomo Realty<br />

% TOP-HOLDINGS<br />

6,3% Korean 5,5% 2017<br />

5,9% Zweden 5,25% 2011<br />

5,4% Mexico 10% 2024<br />

4,4% Korea 4,75% 2011<br />

3,1% Rusland 7,5% 2030<br />

% TOP-HOLDINGS<br />

5,3% US 5yr 2009<br />

3,4% Kazmunaigaz 9,125%<br />

3,4% Russian Federation 12,75%<br />

2,9% Brazil 8,875%<br />

2,6% Brazil 10,125%<br />

% TOP-HOLDINGS<br />

44,9% Banken<br />

12,3% Telecom<br />

8,9% Nuts<br />

8,6% Niet-duurzame Consumentengoederen<br />

4,4% Verzekeraars<br />

% TOP-HOLDINGS<br />

1,8% Unity Media GmbH<br />

1,6% Tereos Europe<br />

1,5% Boats Inv<br />

1,4% Kverneland ASA<br />

1,3% Lottomatica Spa<br />

% TOP-HOLDINGS<br />

16,3% SNS Bank<br />

5,5% Santander<br />

5,0% Banco Espirito Santo<br />

4,5% GE Capital Euro Fund<strong>in</strong>g<br />

4,4% Pohjola Bank<br />

S<strong>in</strong>gapore (9%)<br />

LANDENSPREIDING<br />

Overig (16%)<br />

Japan (30%)<br />

Overig (55%)<br />

LANDENSPREIDING<br />

Zuid-Korea (17%)<br />

Mexico (10%)<br />

AAA (9%)<br />

KREDIETWAARDIGHEID<br />

Overig (14%)<br />

BBB (37%)<br />

AA (24%)<br />

KREDIETWAARDIGHEID<br />

Overig (3%)<br />

A (49%)<br />

Overig (29%)<br />

LANDENSPREIDING<br />

KREDIETWAARDIGHEID<br />

AAA (9%)<br />

B (9%)<br />

Ch<strong>in</strong>a (15%)<br />

Hongkong (29%)<br />

Indonesië (9%)<br />

Zweden (9%)<br />

BB (31%)<br />

BBB (24%)<br />

Europese Unie ex EMU<br />

(11%)<br />

Noord-Amerika (12%)<br />

EMU (48%)<br />

A (45%)<br />

AA (46%)<br />

VASTGOED AZIË<br />

Morgan Stanley Asian Property<br />

RENDEMENT<br />

ytd: 26,04<br />

1 jr: -12,95<br />

3 jr: -12,66<br />

TER: 1,73<br />

ISIN: LU0078112413<br />

Fonds 40<br />

Angel<strong>in</strong>e<br />

Ho<br />

OBLIGATIES WERELDWIJD<br />

Threadneedle Global Bond<br />

RENDEMENT<br />

ytd: -4,11<br />

1 jr: 12,45<br />

3 jr: 5,47<br />

TER: 1,44<br />

ISIN: GB0001533685<br />

Peter<br />

Allwright<br />

OBLIGATIES OPKOMENDE LANDEN<br />

Threadneedle EM Bond<br />

RENDEMENT<br />

ytd: 14,85<br />

1 jr: 11,22<br />

3 jr: 5,95<br />

TER: 1,7<br />

ISIN: GB0002365608<br />

Richard<br />

House<br />

Schroder Euro<br />

Corporate Bond<br />

OBLIGATIES EUROPA<br />

RENDEMENT<br />

ytd: 7,15<br />

1 jr: 10,57<br />

3 jr: 7,23<br />

TER: 1,28<br />

ISIN: LU0113257694<br />

Adam<br />

Cordery<br />

OBLIGATIES HIGHYIELD<br />

Robeco High Yield Obligaties<br />

RENDEMENT<br />

ytd: 28,30<br />

1 jr: -6,99<br />

3 jr: -1,79<br />

TER:<br />

ISIN: NL0000290062<br />

Sander<br />

Bus<br />

JP Morgan US Dollar<br />

Treasury Liquidity<br />

GELDMARKT<br />

RENDEMENT<br />

ytd: -0,69<br />

1 jr: 10,62<br />

3 jr: -2,48<br />

TER: 0,56<br />

ISIN: LU0176037280<br />

John<br />

Tob<strong>in</strong><br />

18<br />

16<br />

14<br />

12<br />

10<br />

8<br />

6<br />

4<br />

KOERS AFGELOPEN 12 MAANDEN IN USD<br />

jun jul sep nov jan feb apr jun<br />

70<br />

65<br />

60<br />

55<br />

50<br />

45<br />

40<br />

KOERS AFGELOPEN 12 MAANDEN IN GBP<br />

jun jul sep nov jan feb apr jun<br />

60<br />

56<br />

58<br />

54<br />

50<br />

52<br />

46<br />

48<br />

44<br />

40<br />

42<br />

KOERS AFGELOPEN 12 MAANDEN IN GBP<br />

jun jul sep nov jan feb apr jun<br />

450<br />

400<br />

350<br />

300<br />

250<br />

200<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

feb apr jun jul sep okt dec feb<br />

24<br />

22<br />

20<br />

18<br />

16<br />

14<br />

12<br />

10<br />

KOERS AFGELOPEN 12 MAANDEN IN EUR<br />

jun jul sep nov jan feb apr jun<br />

11450<br />

11400<br />

11350<br />

11300<br />

KOERS AFGELOPEN 12 MAANDEN IN USD<br />

jun jul sep nov dec feb apr jun<br />

RISICOS KANSENr<br />

RISICOQ KANSENq<br />

RISICOR KANSENq<br />

RISICOP KANSENq<br />

RISICOR KANSENr<br />

RISICOO KANSENo<br />

% TOP-HOLDINGS<br />

10,4% Mitsubishi Estate<br />

10,0% Mitsui Fudosan<br />

9,6% Westfield Group<br />

9,5% Sun Hung Kai<br />

5,1% Ch<strong>in</strong>a Overseas Land<br />

% TOP-HOLDINGS<br />

11,1% US 6,25% 2023<br />

10,3% Long Gilt Future June09<br />

8,9% Japan 10Y Bond<br />

7,8% New South Wales 5,5% 2017<br />

7,8% Japan CPI-l<strong>in</strong>ked 1,4% 2018<br />

% TOP-HOLDINGS<br />

8,6% Russia 7,5% 2030<br />

6,1% Mexico 6,75% 2034<br />

5,4% US 3,75% 2018<br />

4,8% Brazil 5,875% 2019<br />

4,5% Venezuela 9,25% 2028<br />

% TOP-HOLDINGS<br />

1,3% BNP Paribas 3,25% 2012<br />

1,3% EdF 6,25% 2021<br />

1,3% Tesco 5,125% 2047<br />

1,2% France Telecom 8,125% 2033<br />

1,2% Munich Re 1% 2023<br />

% TOP-HOLDINGS<br />

19,0% Consumenten cyclisch<br />

16,0% Communicatie<br />

12,0% F<strong>in</strong>ancials<br />

10,0% Consumenten niet-cyclisch<br />

9,0% Basis<strong>in</strong>dustrie<br />

% TOP-HOLDINGS<br />

-<br />

Ch<strong>in</strong>a (10%)<br />

LANDENSPREIDING<br />

Overig (10%)<br />

Japan (34%)<br />

AA (12%)<br />

KREDIETWAARDIGHEID<br />

BBB (6%)<br />

AAA (5%)<br />

SECTORSPREIDING<br />

Overig (18%)<br />

BBB (42%)<br />

Overig (42%)<br />

LANDENSPREIDING<br />

Frankrijk (21%)<br />

BBB (17%)<br />

CCC (6%)<br />

SECTORSPREIDING<br />

Overig (5%)<br />

Treasury bills (34%)<br />

KREDIETWAARDIGHEID<br />

B (11%)<br />

Australië (13%)<br />

Hongkong (33%)<br />

Cash (22%)<br />

AAA (60%)<br />

BB (24%)<br />

Verenigde Staten (10%)<br />

Nederland (12%)<br />

Verenigd Kon<strong>in</strong>krijk (15%)<br />

B (31%)<br />

BB (41%)<br />

Repurchase agreements (66%)<br />

38 IEX MAGAZINE • JULI / AUGUSTUS 2009<br />

JULI / AUGUSTUS 2009 • IEX MAGAZINE<br />

39